It will be a quiet week next week on SCL as the vast majority of regular contributors will be making their way to the Mello investing conference in London. Mark will be doing a talk called “Can you time the market?”. It is not too late to join us. SCL subscribers can still take advantage of our discount code Simpson50 which gives 50% off tickets.

https://melloevents.com/mello2023tickets/

Leo has also created a Mello Preview by reviewing all of the companies presenting.

Here is the usual summary of this week’s news:

Aferian (AFRN.L) - Final Results

Here is the key line from these results:

Taking account of these matters, the Directors have concluded that the circumstances set forth above indicates the existence of material uncertainty that may cast significant doubt on the Group's ability to continue as a going concern.

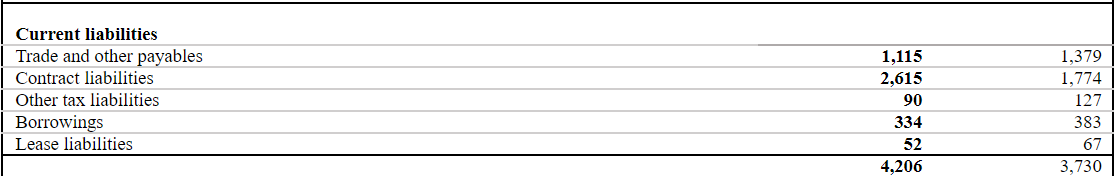

On the surface, it seems strange that a company with net cash of $4m would not be a going concern. However, trade payables have soared:

On flat to declining revenue. This suggests either a large amount of window dressing or delays in paying suppliers compared to their normal payment timeline. They have a $50m facility, of which only $7.5m is drawn down, so the issue is not headroom but covenants. As they say:

We are currently in active discussions with the Group's existing loan facility providers to seek solutions in order to increase the safety headroom based on the current covenant definitions. Should those not be successful we may need to seek additional funding through a placement of shares or other sources of funding which have not yet been secured. The Group has a history of successfully negotiating covenant revision, and raising financing.

Covenants are 2.5xEBITDA, so there is potentially some room for re-negotiation:

As part of the amended covenant definition, the amount of available facility is subject to a cap of 2.5 times the amount of 12 month rolling Adjusted Lender EBITDA, tested on a monthly basis.

Tellingly, paid-for research provider Progressive aren’t even willing to make any forecast, so we have no idea what future trading will be:

They just say:

Guidance was reaffirmed for FY23 group revenue and EBITDA significantly below FY22 levels, albeit with positive and material EBITDA.

If they could return to anywhere near the previous EPS, then the shares are cheap, but it is a massively risky investment with the material uncertainty as a going concern hanging over them.

Angling Direct (ANG.L) - Final Results & Board Changes

We knew these results were going to be poor. A combination of lower gross margins and higher costs has offset any sales growth:

However, we were expecting the outlook to be weather-impacted too, so this is stronger than many would be expecting:

Current trading and outlook

● Despite the turbulent consumer environment and sustained cost pressures, management remains focused on delivering profitable growth and market share gains in the UK and Europe over the medium to long term

● Total Q1 FY24 sales growth of 11.0%, with growth across all channels, including accelerated growth in Europe

● Whilst management is pleased with this early sales performance it remains vigilant to the ongoing inflationary cost pressures being experienced by consumers

● However, given the fundamental strengths of the business, management believes there is a significant opportunity to gain market share in a weakening competitor landscape

Growth accelerating in Europe from last year's 32%, although off a small base, bodes well for their expansion there. Although European sales last year were some way short of £3.5m full-year figure mentioned in September, so some of that is catch-up.

The most interesting part is perhaps what they choose to highlight as part of the CFO appointment. Do we sense a desire for the founders to sell out to Private Equity:

…the appointment of Sam Copeman as Group Chief Financial Officer... most recently led the trade sale of Esportif...Prior to this, Sam held senior finance roles across a variety of industries within private equity and privately owned businesses and has a track record of creating shareholder value through the development and execution of ambitious strategic plans, delivering growth and leading successful shareholder exits.

(our emphasis)

Founders have a blocking but not controlling stake:

So the risk of an unfavourable exit is low. Gresham House are the largest holder and have been adding. Presumably, because they want to protect their interests in any takeover (or perhaps they just see good value.) Martyn Page is already reducing the scope of his role:

Martyn Page, will step down from his role as Non-executive Chairman and will remain on the Board as a Non-executive Director.

Given the large cash balance and the ability to keep rolling out cash-generative stores, we can see this being attractive to private equity. The stumbling block may be the price. The share price is currently a long way below the 100p+ it traded post-IPO. If Mr Page wants to get anywhere close to that figure, he may well need to wait for a recovery in trading, not just appoint a CFO who knows how to get a deal done.

Mpac (MPAC.L) - AGM Report

Given that we have been critical of the company’s recent performance, we thought it only fair we include a couple of snippets about these issues that Leo gleaned from attending the AGM:

On the deterioration in the forecast 31st December cash that occurred between early September and January's update: two things went wrong: orders didn't complete and become invoicable AND deposits for new orders didn't come in.

On cash in Q2, whether ED's "cash positive in H1" or whether their RNS "cash positive at the end of H1" was more accurate: they said there would be ups and downs, but the trajectory was upwards, and it wouldn't rely on window dressing.

On revenue recognition, how did they know machinery without chips worked? They said their policy has always been to recognise work done, and they couldn't really change it arbitrarily on a one-off basis even if they wanted to. Also that these were relatively low-risk items, not something entirely new. Obviously, this kind of revenue recognition could only be done if the customer had an obligation to pay. How could that be true if they'd missed delivery dates? The answer is that contracts have penalty clauses that cover this kind of thing, not a cut-off where the contracts become invalid and in any case, many clients were happy to wait, and they had not accrued such costs.

On supply chain: not only is the chip supply improving, but also some assembly suppliers have/are redesigned/ing to use modern chips and some customers approved alternative products, thus solving the underlying problem. Also that they were very happy with the access they had to suppliers and prioritisation.

Make of that what you will.

Mycelx (MYX.L) - Final Results

This first came to our attention as a net net with interesting technology. The sale of their previous HQ gave them significant cash resources. But not anymore, as, unfortunately, SG&A here looks completely out of control:

There seems to be no way they can fund these ongoing losses

No mention of the current cash position that we can see. This is worrying as they could well have burnt through the cash and be in a net debt position by now. The outlook is simply:

Following the strong start we have made in 2023, we look forward to updating the market on further developments over the coming months.

With £8m annualised total operating expenses, unless that strong start involves annualised revenue in excess of $18m, then it looks like they run out of cash and will need another equity raise. They do have a large positive net working capital position that could unwind, and revenue is forecast to be some $16m, which would be a rapid growth rate but not enough to see them cash break even.

They did have a debt facility, but it was secured on the property they sold, and as far as we can see, there are no other agreed borrowings. So this is very much squeaky bum time. The story is probably strong enough to see Canaccord raise for them, even in these markets, but that is another dilution coming, potentially at a large discount to the current price. Given these risks, there is no point in considering investing until the raise is out of the way.

Parity (PTY.L) - Final Results

These are terrible, with revenue down, an increased loss and increased net debt:

If you exclude intangibles, deferred tax assets and a retirement benefit "asset" (an asset that is costing them £330k a year in recovery payments), then tangible asset value is around zero here.

Small recruiters such as this tend to trade at a discount to TBV, but as it is impossible for share prices to go negative, we will be kind and round our fair value for the equity in this company up to zero.

ShoeZone (SHOE.L) - Interim Results

• Adjusted profit before tax of £2.5m (2022 H1: £3.1m)*

• Earnings per share of 3.1p (2022 H1: 5.7p)

They say these are ahead of expectations, but 3.1p adjusted for the HY (excluding their FX hedge losses) vs 13.5p FY forecasts for a forward P/E of 18 looks a bit ahead of itself here. This always used to be on a P/E of sub-10

Full year results in line with market expectations.

So H1 ahead, FY in line means H2 behind right? Or they think they can upgrade in the future. It seems shareholders were expecting better, and the shares sold off this week. However, the company holds a reasonable amount of cash and doesn’t seem shy about using it to support the price via buybacks. So management must see some value even at a high P/E.

SmartSpace Software (SMRT.L) - Final Results

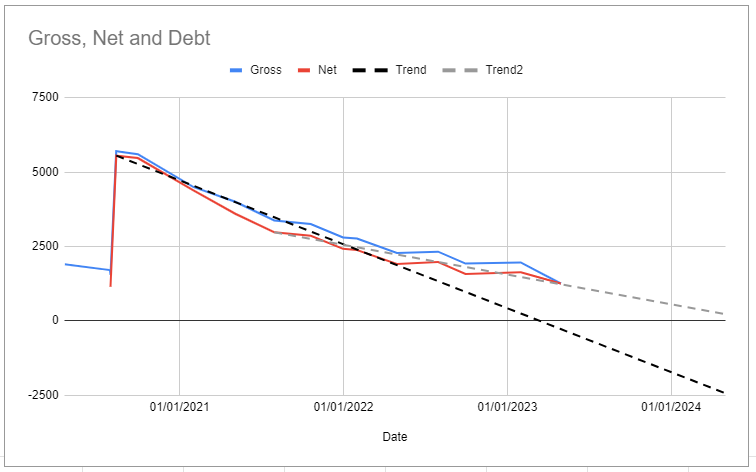

As those who have read our commentary on this company previously will know, the first thing we look at here is the cash:

So the rate of decline has slowed but not stopped. And this is partly due to increases in contract liabilities:

This may just be licensing costs paid upfront. However, if this includes payment for customisation or customer support, then this could mean the cash balance faces further pressure.

The other big change is that A+K is now classed as a discontinued operation and they are actively engaged in finding new owners for the business. So how much might A+K be worth, including property?

A+K recorded revenue of £2.09m (FY22: £1.73m), EBITDA loss of £0.11m (FY22: £0.12m loss) and ARR of £0.13m

Intangible assets relating to A+K consisting of £1.14m of goodwill and £0.11m of acquired intangible assets were transferred to assets held for sale. An impairment charge of £0.56m was recorded against the goodwill associated with A+K, valuing the assets held for sale at their fair value less costs of disposal.

If we understand that correctly, that means goodwill has been written down 50%, leaving around £0.6m. So A+K should sell for between £0.6m and £1.2m. This will help avoid a cash crunch in 2024.

So how is current trading:

Despite adding £0.19m of net new ARR in the quarter to 30 April 2023, a strengthened pound sterling held back ARR to £5.62m* (30 April 2022: £4.77m or £4.69m on a constant currency basis). When measured on a constant currency basis ARR is up 20% year-on-year and 3% since the beginning of the financial year.

12.6% annualised growth is clearly a slowdown on the 24.5% in the year to 31st January. As previously discussed, much of their growth comes from ARPU, and they imply this will resume growing shortly:

Our new fully integrated single workplace platform is nearing completion and will launch in the current financial year. There are also a number of other new revenue generating features due to be released in the coming months, which add to our confidence that we can maintain our growth trajectory.

Our concern here is that customers/locations have a history of only growing at best linearly, requiring significant ARPU growth to result in the exponential growth we expect, and indeed that is required in the long term to stay ahead of costs. It is evident that in their year to January 2023, underlying APRU growth from upselling and new features stalled, with reported numbers being propped up by catch-up/one-off pricing increases applied at renewal. As this has rolled off, ARPU has grown more slowly over the last three months. Revenue growth, of course, lags, and so 48% growth is more about what happened 18 months ago.

Forecasts from Canaccord generally seem to be reasonable. For example, 2024 revenue is in line with Leo’s estimate of +20%, and ARPU is expected to be 13% ahead, in line with annualised Q1 growth. 2025 revenue growth is accordingly forecasted to only be 10% higher. This is all refreshingly sensible for a house broker, but then they go and spoil it all with their price target:

Given strategic progress, this looks too low against a backdrop of ongoing consolidation in the workspace management software sector with recent transactions suggesting deals are being done at 7-10x ARR. We maintain our BUY rating and 125p target price at which SmartSpace would trade on 5.5x/4.8x ARR for FY24E/25E.

Which kind of undermines the rest of their analysis.

WANdisco (WAN.L) - Exploring Funding Options

Who puts fresh capital in when there is still a material uncertainty over whether they have a business that can book any significant real revenues?

Given the quantum of the Proposed Fundraise, and uncertainty of the issue price, it is possible that the Company may not currently have sufficient shareholder authorities to issue the required number of Ordinary Shares to successfully deliver the Proposed Fundraise (the "New Ordinary Shares"), therefore a General Meeting will be required for Shareholders to authorise the allotment of New Ordinary Shares on a non-pre-emptive basis.

Given the standard 10% pre-emption rights waiver, this suggests a valuation of any equity injection below a $300m valuation. Again anywhere close to this figure seems bonkers, given recent history, so the real valuation could be much lower. Here's the real sting, however:

As of 30 April 2023, the Company had a net cash balance of $8.1 million with no debt facilities. The Board believes this provides the Company with sufficient working capital until the middle of July 2023.

This puts them in a very tricky position since:

…the Board cannot realistically launch the Proposed Fundraise until it is confident that the suspension in the Company's shares will be lifted at the point in time the New Ordinary Shares are issued, or shortly thereafter. Following consultation with AIM Regulation it is the Company's view that the suspension will only be lifted following the publication of the Company's annual report and audited accounts for the year ended 31 December 2022. The Company does not expect that the audit will be completed until the end of June 2023. Thus, launching the Proposed Fundraise followed by a general meeting to approve the allotment of New Ordinary Shares could result in the cash runway ending before the Company receives the net proceeds of the Proposed Fundraise (the "Net Proceeds").

So they run out of cash in Mid-July but currently expect to complete their audit by the end of June, giving them two weeks to publish the accounts, lift the suspension and raise the $30m. Shareholders will have already waived pre-emption rights, so institutions can already name their price to shaft existing holders. But institutions won't make firm commitments since another audit delay of a week or so puts the company into admin.

It is unlikely they could rely on a loan either, as their fixed assets are largely leasehold property, so there is little tangible value that any loan can be secured on. They had $500k of computers in the FY21 annual report. The rest was ROU assets and leasehold improvements. So if they borrowed against or sold all their computers, they may be able to make payroll for another seven days at current cash burn levels.

Then if it all goes smoothly, then they will be back to the market again for fresh capital in under a year, even with reduced overheads:

The Company has announced a reduction of its global headcount by approximately 30% and reduced the Group's annualised cost base from $41 million to circa $25 million. These actions are across all areas of the Company's operational and geographic footprint.

Zytronic (ZYT.L) - Interim Results

This is another set of poor results flagged in advance, although only suspiciously recently. A lot of this is down to the end customer of one of their customers going into Chapter 11 in the US. It seemed orders were still coming in until very recently. This explains the weak overall outlook, but perhaps not why this half-year was so weak:

· Group revenue of £4.7m (2022: £5.9m)

· Loss before tax of £0.9m (2022: profit of £0.4m)

· Basic loss per share of 7.5p (2022: earnings per share of 3.0p)

· Cash used in operations £0.4m (2022: generated from operations £0.1m)

They do still hold significant cash balances, however:

· Net cash of £5.4m (30 September 2022: £6.4m)

As well as property. Freehold property value is £2.2m, including £0.8m of depreciation. There is a further £1.5m of long leasehold property after £1.0m of depreciation. Plus £0.2m of land. The plant and machinery part is only on the books for £1.2m. We’re not sure of the length of the leasehold property, but to be clear it is fully paid - no rent, and is definitely an asset. Here is the depreciation policy:

From this, we infer that the leasehold for much of the property was over 50 years at the outset and a minimum of 30 years. So another valuation of PP&E might be £3.2m for the freeholds (i.e. adding back in the depreciation), £1.5m for the leasehold (i.e. book) and zero for the rest. Overall that's 90% of the book value. This means that the break-up value of the group could well be in excess of the current share price. However, we may be waiting a long time for those assets to become productive again.

That’s all for this week. Have a great weekend!

That was a negative week!!