Small Caps Live Weekly Summary

CAM CKT RFX TIDE

Another quiet week for the sort of UK small caps we follow.

Camelia (CAM.L) - Trading Update

More bad news from this conglomerate. They are facing challenges with both volume and pricing in tea across all their regions. This shows the problem of being a commodity producer when pricing goes against you. Things are not going well in other areas, too. The Bardsley closure costs could be worse, but perhaps are higher than guided - in FY2023, they took an £8.9m hit for impairments and shutting down half of operations, and in the annual report said:

Redundancy costs estimated at £0.6 million will be reflected in the 2024 results, as will further gains or costs associated with the early termination of leases and any gains or losses realised on asset disposals.

Now we have:

We expect to report a reduced loss for the year from Bardsley in the range of £3.5-4.5 million (2023: Loss £15.6 million). This includes the trading loss as well as the estimated cost of exiting leases, impairments, closure costs and the results of asset disposals.

The overall outcome excluding Bardsley is:

However, the outlook for the adjusted loss before tax for continuing operations has worsened from our previous guidance and is now at between £10-12 million (2023: £2.5 million loss).

But probably the most disappointing news is about the £100m BF&M sale:

While we are still confident the sale of our stake will go ahead, further delays in the regulatory approval process mean we now expect completion in the latter part of 2024.

Most recently, this was to be completed in Q2 and is destined for share buybacks.

That the share price didn’t react negatively to these events shows the asset backing and that this is the sort of stock that is only held by the kind of deep value investor whose patience is virtually unlimited.

Checkit (CKT.L)/Crimson Tide (TIDE.L) - Possible Offer

Although this is described as a offer but is really an all share merger. It is structured as Checkit buying Crimson Tide for a 12% premium, but this quickly disappeared when the market priced the announcement. Crimson Tide shareholders would end up with 30% of the combined business.

So this looks like it would be a sensible merger of two companies doing similar things. But:

the Checkit Board notes that the Crimson Tide Board has on multiple occasions refused to engage in constructive discussions regarding the Possible Offer.

This is not surprising since to accept it would be a massive admission of defeat given the recent share price performance:

Crimson Tide shareholders may feel a little aggrieved that it looked like they were finally forecast to break into owning a profitable business, and now they would back with a loss-making one if the merger completes.

In response, Crimson Tide pushed back at the suggestion that they haven’t properly engaged:

The Board has engaged with all serious and considered proposals and objects strongly to the suggestion that they have refused to do so.

Having met some of the Crimson Tide board in previous ventures, Leo is not so sure.

With Checkit's share price down, the preliminary approach is now worth just 169p, now a discount to Crimson Tide up 10% to 179p. So this looks dead in the water despite the obvious logic of a tie-up.

Ramsdens (RFX.L) - Interim Results

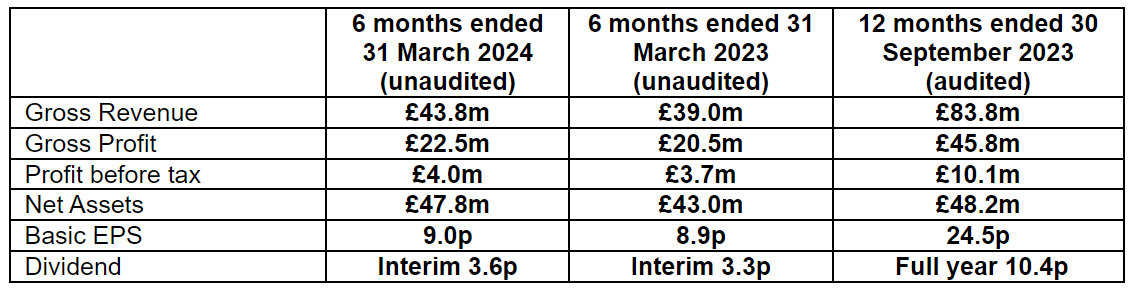

Here’s the summary table:

Note that this is much shorter than many companies these days, mainly because the word “adjusted” doesn’t appear in these results. However, not all is hunky dory. The 12% revenue rise looks good, but this is not all LFL, and it looks less good as you go down the income statement. So we can see why the market was a little bit meh towards these results.

The first issue is that costs are rising almost as fast as revenue. However, we are encouraged that the factors driving cost increases are likely to grow much more slowly in the future. The living wage is unlikely to increase at the same rate, and the Labour government aren’t likely to increase corporation tax much above the current rate.

The second issue is the tax charge. This has been consistently high, which can be a symptom of conservative accounting (i.e. according to the tax man, the profits were higher than reported), but it reached 28.6% in the period, which is getting silly. We believe the high tax charge is caused by deferred tax and the H1 / H2 split of profits and management expects the tax rate for the year to be lower.

In terms of outlook, they say:

H2 FY24 trading to date is in line with the Board's expectations, with continued positive performances across the Group's diversified income streams.

House broker, Liberum say:

We leave numbers unchanged for now but H1 PBT growth of 8% versus our estimate of 4% for the full year could leave scope for outperformance.

We increase our FY 24 net cash estimate from £5.2m to £6.2m given the lower-than-expected inventory build.

So in the short-term, there’s the chance of a beat. In the medium term, there are several reasons to think it can continue to grow revenue faster than inflation, from a maturing new store estate to online initiatives.

We don’t think this is ever going to grow at rates to justify a P/E of 20-30 but the current “no growth” multiple of 7-8 still looks too low for a well-run cash-generative business.

That’s it for this week. Have a great weekend!