Acquis Exchange (AQX.L) - Interim Results

This is a bit of a weird one. All of their operational highlights appear to be positive:

Strategic delivery across all divisions:

- Aquis Technologies: strong growth in contract pipeline; more than half are for national exchanges or central banks, demonstrating the evolution of the division's client profile.

- Aquis Markets: market share up to 5.20% (FY23: 4.85%), as the benefits of the change to the proprietary trading rule continue to flow through and members adapt to the change.

- Aquis Data: increase in revenue, driven by new data fees for members which came into effect in the second quarter, with further positive impact expected as the year progresses.

- Aquis Stock Exchange: strong growth in trading, with volumes up 44% on the prior year and £87m of funds raised, against a challenging market backdrop.

But then their financial results look like this:

There has been no further profit warning in the last two weeks, though. After largely stalling since 2021, their current P/E of 20 seems hard to justify.

The idea of the Acquis Exchange sounds good and is positive for the wider UK markets. Just not so great for those who’ve provided the equity capital for them to do this.

Heiq (HEIQ.L) - Trading Update

A detailed update here, but when it comes down to it, revenue and losses continue at roughly the same rate:

Having reported losses from operations for the first 12 months in 2023 of US$11.6 million (US$6.9 million excluding depreciation & amortization charges), the loss from operations for the 6 months to 30 June 2024 is expected to be US$6 million (US$3.5 million excluding depreciation & amortization charges).

They are trying to raise money, hoping to do it at the subsidiary level rather than issue more shares:

As previously announced on 16th July 2024, the Group has therefore initiated a process to raise capital for HeiQ AeoniQ™ at the subsidiary level by the H1 2025, to fund required investment into the HeiQ AeoniQ™ plant in Portugal. As part of the raise, HeiQ has engaged the investment bank Banco Santander, to lead the fundraise.

It’s clear that this will be coming (or worse) if they fail to get the subsidiary funding:

The Board is reviewing strategic options for individual units (including mergers, sales or carve-outs) to improve the balance sheet and financial position of the Group as required.

The market didn’t like this update. However, we are not sure what was so surprising about this update that could justify a 40% fall in the share price - we already knew they were in dire straits. This doesn’t mean we now think it is cheap, though.

Itaconix (ITX.L) - Half-Year Results

It seems strange of them to call these highlights:

· First half revenues of $2.8 million were 30% lower than in the first half of 2023 ($4.0 million).

· Gross profits were $1.1 million, consistent with the first half of 2023.

· Adjusted EBITDA1 was a loss of $1.0 million, compared to a loss of $0.4 million for the first half of 2023 and a loss of $0.5 million for the second half of 2023, due to increased investment spending on major new revenue generating opportunities and further development of our operating capabilities.

It is tempting to think that designed-in chemical revenues could be sticky recurring revenue with very little overhead required, but then a major customer proved not to be sticky. The CEO has been involved with the business since at least 2008, so if this was ever going to be a viable business, he surely should have been able to show it by now. Instead, we get $6 million of low gross margin revenue, and investors are giving this a £20m market cap. Go figure!

Luceco (LUCE.L) - Interim Results

Revenue is up 8%, and adjusted EPS is up 14% for H1, showing some reasonable operational gearing. This means that revenue is a little behind, and EPS is ahead of the rates they need to hit FY expectations. However, the underlying figures are less impressive:

Our like-for-like revenue growth of 3.6% in the first half of 2024 is put into context when we compare ourselves to the wider construction market, with data from the Construction Products Association ("CPA") indicating that output of our addressable markets is forecast to reduce c.3% in 2024.

This is still a c6% outperformance compared to the industry. We are always a little sceptical when companies quote industry comparisons, as invariably, these are unverifiable. For example, they may have cherry-picked the source (CPA) and scope (whether just electricals, all second fixes, all interior, or total construction materials) for comparison. However, these are undoubtedly tough end markets, and for the company to perform well in these shows what a quality business this is.

Hostmore (MORE.L) - Business Update

RNS titled Business Update are rarely good news, and this is no exception as they announce that the acquisition of the US Brand Owner is terminated as they no longer own the brand!

Then we have:

The present indications from the leading bids are that the consideration for the store sale will be lower than the par value of the borrowings currently secured by the Group's trading subsidiary, Thursdays (UK) Limited ("Thursdays"). Accordingly, it is unlikely that the equity owner of Thursdays, being the Company, will recover any meaningful value for its ownership.

And this means:

It is the Board's present expectation that the Company (Hostmore plc), being the listed non-trading holding company of Thursdays, will be wound up and delisted contemporaneous with the conclusion of the sale process, as TGI Fridays in the UK will continue its operations under new ownership.

Basically they have told the market that this is a zero, and the price fell around 95% this week. Normally, things like this get suspended, but we actually think it’s good that they don’t. The shorts can close more easily, and anyone who longs can get a chance to escape with a little bit by selling to them. The downside is that unscrupulous actors can try to promote the shares to the unwary. For example, uninformed and short-term momentum traders may get lured into a dead cat bounce. However, there are so many opportunities to naively lose money in the markets that trying to protect such people is probably counterproductive.

Mpac (MPAC.L) - Half-Year Results

The headline figures are pretty good:

But, diving into the details, a couple of things need to be watched closely. For example:

The timing of individual orders and project billing milestones has an impact on working capital and we closed H1 with elevated levels of unbilled revenue associated with projects expected to complete in H2 2024 and net debt of £4.9m.

Leo raised concerns about revenue recognition before, and while it apparently came good in the end last time, this requires careful watching. In addition, they rightly express caution over battery production equipment:

Mpac continues to take a conservative view of individual Clean Energy opportunities, noting that there remains no certainty around the timing or quantum of future production line orders.

FREYR looks like a dead duck:

(Two years ago, their share price was $6 on the above scale)

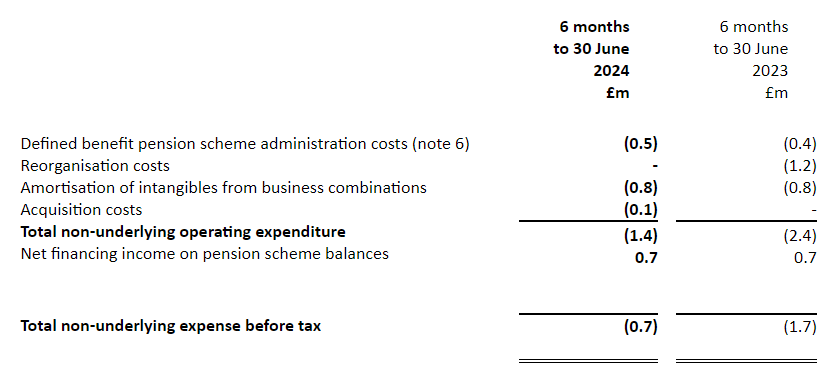

On the plus side, the gap between adjusted and statutory profit is no longer as significant as previous periods at £0.7m vs £1.7m last year:

We should probably add back in the £0.5m of pension costs that aren't going away, as well as £1.2m of recovery payments. So, the "real underlying" PBT should be more like £2.3m vs. £4m reported. These figures are getting less important as the underlying business grows. They are still very significant, though, and blow a hole in the idea that this is a cheaply rated stock.

Even taking their figures at face value, there's a big H2 weighting in EPS forecasts, if not in revenue, and their actual order book numbers don’t support this:

30/6/2022 £62.6m

31/12/2022 £67.2m

30/6/2023 £77.5m

31/12/2023 £72.5m

30/6/2024 £71.4m

So, yes, the order book isn't much worse than at FY 2023, but it is far worse than a year earlier. There is a lot to like here but a lot to dislike, too.

Renold (RNO.L) - Trading Update & Acquisition

The trading update is in-line. Forecasts were for a small drop in organic revenue and EPS. However, a debt-funded acquisition announced at the same time is earnings enhancing. These are the financial details:

The total consideration for the Acquisition of US$31.4 million represents an acquisition multiple of c.7.5x twelve months to June 2024 EBITDA. Realising the initially identified hard synergies will result in the multiple reducing to 6.9x, in the initial year of ownership, reducing to well below 6.0x in subsequent years.

This is a lot more expensive than Renold itself on a headline 4xEV/EBITDA, but just a bit more expensive after synergies and the 1.4xEBITDA Renold pension deficit is included in the valuation. So, this could be taken either way - it either highlights that this is not a great deal, or that the original Renold business is cheap. The lack of organic growth makes it hard to make the case for the latter, though.

Sylvania Platinum (SLP.L) - Final Results

These results should come as no surprise to any investor capable of adding up the numbers of the detailed quarterly results. Production guidance is probably the only new news:

Annual production target of 73,000 to 76,000 4E PGM ounces for FY2025.

So flat versus last year. At current PGM levels, this will be marginally profitable.

The market appears to have taken fright at the increased level of capex that had been told to brokers. And Simon Thompson appears to have been scared off too, giving a sell recommendation in the Investors Chronicle. This is despite calling it a buy on the same results six weeks ago. It continues to amaze us how many of their portfolio decisions some investors delegate to someone who writes a column in a newspaper. However, from a purely selfish point of view, the more uninformed the average market participant is, the better.

That’s it for this week. Have a great weekend!