Here is a selection of things we discussed this week:

Beeks Financial Cloud (BKS.L) - Interim Results

As usual, there is a huge gap between statutory and adjusted figures:

· Underlying profit before tax** up 37% to £1.89m (H1 2024: £1.38m)

· Statutory profit before tax up 188% to £0.46m (H1 2024: £0.16m)

Helpfully, the winners in this game are made abundantly clear:

The largest reconciling item is the consistent add back of the non-cash share-based payment charge.

The treatment of SBP can cause problems for investors looking to value a company when they are lumpy. However, as they note, these have been fairly consistent year on year, which means there is no need to adjust them out, and we can be fairly safe in assuming the statutory figures most closely reflect the economic reality for equity holders.

Brokers make moderate cuts to forecasts. We are not sure the reasons given by Progressive were obvious from the results themselves:

Forecast changes de-risk the new sales model. Beeks is migrating from long-term contracts to a revenue-sharing model for Exchange Cloud. The economics are attractive but as rev/rec is based on usage, it is harder to forecast.

It seems that previously, customers were paying for some of the hardware up front (thus funding it), and now they won't be. We thought the revenue share model was a new offering rather than a replacement. A revenue share doesn't provide a good match for the depreciation liabilities well, which makes it harder to gear up and separate the low-return hardware element from the high-return software. As with the change in business model around the time of the IPO, it also makes valuation even harder.

This means whatever the return on capital for their software is, henceforth, it will be more diluted by hardware. And given the instability of their revenues, we can't see them getting cheap finance or it being appropriate to gear up. As we understand it, they can't share hardware between different customers like a traditional Cloud company due to security, latency and a lack of sufficient diversity in customers: They could have idle servers earning nothing but still have to buy new ones for another customer.

IWRC's depreciation policy shifted from 4 to 5 years a while back. Fully depreciated IT equipment in a dust-free environment will generally keep doing the job it was bought for, but if you're paying the energy bill, there comes a point when it is cheaper to replace it. IIRC, some of the hyperscalers extended their depreciation policy a few years ago, but Beeks' 5 years hardly seems conservative.

No mention of NASDAQ in these results, you’d have thought they’d take the opportunity to at least comment on the recent press, even to just say it’s not them. This makes us think it’s not currently them but that they don’t know if they will be affected by a similar action. They do say:

Several of the world's leading exchanges in final stages of conversations and multiple other opportunities in the sales funnel

Experience suggests that "final stages" means "a couple of years away", but that they will win these exchanges. That justifies a high multiple for the shares, even if these wins are going to require yet more capex. However, the current 215x annualised statutory earnings still looks bonkers.

Crimson Tide (TIDE.L)/Checkit (CKT.L) - Takeover/Merger Rejected

Crimson Tide’s shareholders reject what seemed to be very sensible merger proposal:

At the Court Meeting, as more particularly described below, the requisite majority of Crimson Tide Scheme Shareholders did not vote in favour of the resolution to approve the Scheme.

It clearly didn’t have much love for it as the share price of both companies rose on the announcement.

Crimson Tide continues to make nuclear submarines independently, in their usual unprofitable manner, if their broker, Cavendish, is to be believed.

DigitalBox (DBOX.L) - Acquisition of Assets

…is pleased to announce it has exchanged contracts (the "Exchange") to acquire the digital assets of The Life Network from Media Chain Group Limited for a total consideration of £200,000 (the "Consideration", together the "Acquisition"). The Acquisition is subject to completion of satisfactory testing by Digitalbox, as set out below, and is expected to be earnings enhancing on completion.

These are social media sites from Steven Bartlett’s former company, with the marketing agency sold to Brave Bison for £7.7m. Social Chain AG continues as an e-commerce company, so these appear to be non-core for them.

The most important part is that DigitalBox only pay £20k upfront and the rest is dependent on the business case panning out and being earnings enhancing. Of course, this isn’t that high a bar compared to 5% or so in interest on cash, but it means more than it does during the ZIRP times.

Fintel (FNTL.L) - FY Results

Things must be tough in the Finnish telecoms sector as doing the maths suggests that organic revenue is down 5%.

Core1 revenue increased to £68.9m (FY23: 56.6m), up 22%, supported by revenue of £15.0m (FY23: £1.5m) from our acquired portfolio.

On top of that:

Adjusted EBITDA margin 28.3% 31.5% (320 bps)

So they are a declining business without acquisitions. They made four in the last year, but they want shareholders to ignore all the costs associated with buying and integrating businesses as non-core:

Only the £3.2m of amortisation of intangible assets is reasonable to exclude, but even here, the size of the capitalised development costs show that EBITDA is a completely inappropriate metric to use for this company:

So, realistically, the true economic value is represented by statutory EPS:

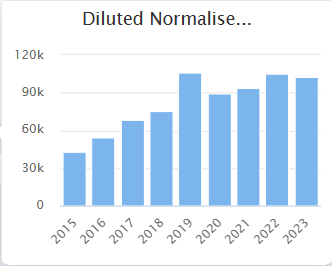

In the current market, companies that are struggling with organic growth are given P/E ratios of around 5. That would be 28.5p per share versus a current share price of £2.48, almost 10x higher. Even if we are willing to suspend disbelief and take them at their adjusted figures, this business hasn't grown EPS since 2019 despite repeated acquisitions, so who on earth is buying this at 20x heavily adjusted EPS?

MTI Wireless (MWE.L) - Final Results

We don’t really get the current love-in amongst investors with this company. Growth is always mediocre at best, despite their continued claims of being in growth sectors:

· Revenues held up well at US$45.6m (2023: US$45.6m) in a very challenging environment

· Profit from operations decreased 3% to US$4.51m (2023: US$4.65m)

· Profit before tax similar to last year at US$4.81m (2023: US$4.84m)

Everything has its price, and Mark has owned shares in this company in the past when it was super cheap despite its many risk factors. But why pay 20x earnings for a risky plodder in small cap markets which have some of the bargains of a lifetime?

Nexteq (NXQ.L) - Final Results

The Chair says:

the robustness of the underlying business meant the Group delivered total revenues of $86.7m, albeit 24% down on a strong comparative year

The implication of which is that the current level of trading represents the new normal. However, the CEO disagrees:

our trading performance was not at the high standard that we set ourselves. Notwithstanding external factors, there are a number of operational and organisational factors within our control that I, together with the newly appointed Senior Leadership Team, have identified to change in order to become leaders of markets again

They appear to be admitting what Leo had deduced a while back

2023 and 2024 were both years where our innovation process and R&D initiatives stalled slightly as we focussed on retention and the conversion to Intel as a graphics provider in the Gaming sector.

We think one of their platforms was specifically designed for Aruze. They hoped to sell it elsewhere, but Leo found it bordering on the obsolete. The downturn has done them no favours:

Management does not expect to fully recover the net book value of $2.6m and considered a provision against the raw materials of $2.2m was required as at 31 December 2024.

We can’t see any statement on current trading either, but on the IMC call said that there was "solid order book generation in the first few months of the year".

Net cash is up to $29.1m, which is almost 60% of the current market cap. This makes it pretty cheap, at least if you believe the forecasts for later years (e.g. 9p EPS for FY27). However, the talk has shifted away from buybacks to M&A due to the need to diversify and not have so much dependence upon a handful of key customers. So the execution risk increases as well.

Plexus (POS.L) - Placing

Here’s the expected placing. The company directors put in £2m. There is a book build for £1m and a retail offer of £0.5m. All at 6.5p. This is only a 3% discount, so presumably, they had some informal indication that institutions will support it at 6.5p, but £1m is a very small amount overall, hence why the directors need to back most of it. It would seem daft for many to take up the retail offer with such a small discount, though.

It looks like the 20% CLNs are being converted as well:

The Company has been notified by the Noteholder Majority of their intention to convert both the principal and the interest accrued of the Outstanding Convertible Loan Notes into new Ordinary Shares in the Company at the Conversion Price. The total number of Conversion Shares is 13,461,692, comprising:

· OFM Investment Limited: 8,333,442 Conversion Shares

· Ben van Bilderbeek: 4,166,712 Conversion Shares

· Jeffrey Thrall: 961,538 Conversion Shares

So that’s 67.3m additional shares vs 103.6m current shares in issue. A huge dilution overall.

Victoria Carpets (VCP.L) - CFO Transition

We’ve often thought that only a Pratt would be willing to take responsibility for the financials of this company, and this week, we have been proven right:

…today announces the planned appointment of Alec Pratt to the Group board as Chief Financial Officer Designate

Let’s hope he’s a smart Alec.

That’s it for this week. Have a great weekend!

Thanks Mark and Leon. Penetrating and considered analysis here with observations not made elsewhere.