Budget anticipation continues to be the elephant in the room. Here is the latest that The Guardian reports:

Starmer has indicated that CGT on the sale of shares and other assets, currently set at up to 20%, will increase. The tax is expected to rise by several percentage points.

However, ministers are expected to leave CGT on the sale of property untouched because of concerns that increasing it would cost money by slowing down sales. The Conservatives cut the top rate of CGT for property from 28% to 24% in the last budget.

Reeves is also looking at tightening the rules for inheritance and gift tax. Only about one in 20 UK estates now attract inheritance tax.

So it looks like CGT rates will go up on shares, but perhaps not a huge jump; otherwise, it would be far out of line with property and, most importantly, still at a discount to income tax rates. Expect investors to keep taking profits before next Wednesday though, in case the changes come in immediately.

The changes to IHT are more vague. The big impact will be if AIM shares lose their exemption. Any softer changes may be bullish for small caps. There is also no mention of changing SIPP rules, which may be a positive.

Here’s this week’s company news:

Brand Architects (BAR.L) - Final Results

If you read all the brand highlights, you’d expect they were growing rapidly:

· Super Facialist grew by 17%, fuelled by distribution gains, notably Holland & Barrett.

· Skinny Tan ' s Body Glow launched into Boots, Superdrug, Asda and Tesco. Body Glow is now the fastest growing value sku in the UK tanning category (Circana latest 12 weeks ending 8 July 24).

· Dirty Works launched in 750 Watsons stores in 9 countries, with encouraging sell out results. FY25 brand refresh will focus on all year-round gifting and a sub range called Mood Magic.

· T he Solution's net sales were up 43%. The Solution Menopause range launched on its own website in June 2024 and rolled out to Amazon in July 24. The Solution Haircare range is planned to launch in Q3 FY25.

· Net sales of Root Perfect grew +14%, driven by strong UK demand for affordable hair colourants and a pan European distribution expansion across Normal stores.

In reality, they only chose to mention the brands growing rapidly. Sales are down 15%:

· Sales for FY24 were £17.0m (down 15% on 2023: £20.1m) due to a planned brand rationalisation programme, as well as challenging trading conditions in the UK caused by a cost-of-living crisis and an unseasonably wet spring and early summer.

This means they are still loss-making, and there is a cash balance reduction:

There’s about £6m of Net Current Assets on top of the £7m cash, but we have to include a pension deficit that isn’t on the balance sheet. So, a £7m market cap may well undervalue them, depending on one’s estimate of the NPV of the ongoing pension contributions and if they could stem the losses. What they need is scale so they can turn a small profit out of their mostly average brands. Perhaps shareholders will finally be willing to throw in the towel and accept a modest premium offer rather than see the value continually eroded by ongoing losses.

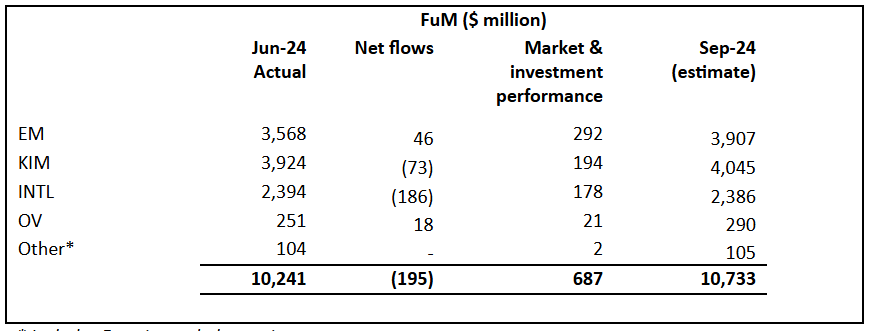

City of London Investment Group (CLIG.L) - Q3 Trading Update

A rare combination of strong performance and inflows from their original emerging market business:

International Equity follows the more normal pattern of strong performance, leading to lower client weightings as institutions rebalance their portfolios. KIM/Karpus/Cash Management has been disappointed due to one-off factors. The held dividend is looking increasingly safe. This means that, despite strong performance year-to-date, this looks like it has further to go. As is frequently the case, the main concern is a potential US market crash (this time in megacaps).

Empresaria (EMR.L) - Trading Update

Things are tough in recruitment:

However, despite this relatively good performance in the third quarter, we now expect results in the fourth quarter to be worse than previously forecast with market conditions in Germany particularly challenging, at what is normally a peak time for our operations there, along with a continued deterioration of markets in APAC which in some cases had been relatively resilient.

They are still profitable:

As a result, full year adjusted profit before tax is now expected to be no less than £2.0m.

But not so much that they don’t have to ask their banks to waive covenants:

Our bank has relaxed the interest cover covenant to 3x (normally 4x) for December 2024 testing, ensuring that we expect to remain compliant. As at 30 September, adjusted net debt was £13.6m and available headroom was £6.5m (excluding invoice financing).

No end in sight, either:

We expect these adverse trading conditions to continue through the first half of 2025.

This shows why sensible players in this highly cyclical industry run balance sheets with large cash balances, not large debts. Speaking of which…

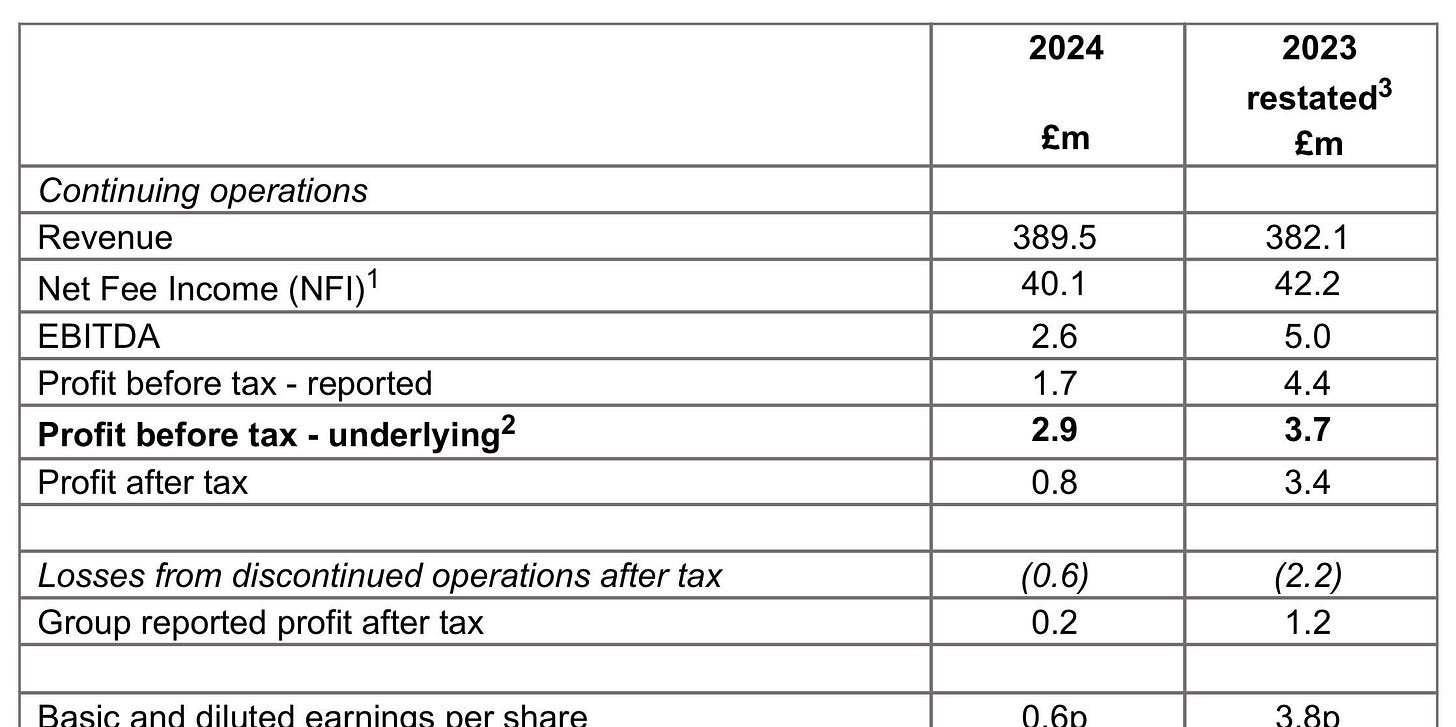

Gattaca (GATC.L) - Final Results

without any commentary, you would say that these were poor:

Poor enough that they had to use the R-word:

Resilient performance with underlying PBT slightly ahead of market expectations

So this is ahead, but it shows how poor the results were expected to be. This was an investor favourite a while back when a bullish Equity analyst Developed a model, which had them growing EPS rapidly, that never came to pass. They should make a film with the analyst, played by Ethan Hawke, fantasising about the share price going into outer space, but the company remains grounded due to being an inherently cyclical people business.

Still, they are profitable and cash-rich, which is something many recruiters are failing to be at the moment. And unlike Empresaria, they are now at Tangible Book Value. The vast majority of which is cash/working capital. So, this could be one of the better sector plays if you think the employment cycle is about to turn.

Gear4Music (G4M.L) - HY Trading Update

This trading update raises as many questions as it answers:

Net debt further reduced by £3.6m to £14.5m at 30 September 2024 (FY24 H1: £18.1m, FY23 H1: £21.8m), reflecting the normal seasonal build of inventory ahead of peak trading

Most companies suck in cash and risk liquidity issues as they grow. While a few have a negative working capital model and blow up if they shrink. We have never before come across a company where an inventory build frees up cash! Does their inventory have a negative value, as if it is a form of toxic waste? We’re guessing they meant to say, "...despite the normal seasonal build..."

Reported Loss Before Tax expected to improve by £0.7m to £1.2m compared with FY24 H1

Assuming an improvement means fewer losses, how have they reduced debt while increasing inventory?

On top of this, we have gross margin slippage. It's not great, given that it's the improvement in margin which has re-established confidence that management knows what they are doing here. Also, the international revenue figure is still a worry given that it is -9% on a weak comparative. And this sounds like the sort of own goal they don't need:

Early-stage challenges with the implementation of a new outsourced AI-based marketing system, which impacted own-brand revenues, European revenues, and overall marketing efficiency, have now been resolved

Did they sack the person responsible, or was this screw-up the first action of the new guy?

New experienced Marketing Director appointed, and started in September 2024

Perhaps instead, they fed in recent sales data into the AI model, and it concluded that they would never make money, so it turned itself off, along with all of their marketing, and fired the marketing director!

Hunting (HTG.L) - Q3 Trading Update

It's disappointing to see a minor profit warning here after recent strength and the momentum of recent upgrades:

Ongoing subdued US onshore market and low natural gas pricing have led to trading within the Hunting Titan operating segment (Perforating Systems product group) being at break-even during the quarter. Cost cutting initiatives are being planned to further right-size the Titan business to prevailing market conditions.

No surprise that it’s Titan that is the weak area, though:

With the recent decline in the oil price and renewed falls in US natural gas pricing, sentiment has reduced in recent weeks in areas of the sector, which will likely lead to lower client activity within certain product groups throughout the remainder of the year, most notably within the short-cycle Perforating Systems product group, as highlighted above.

Helpfully, they quantify the impact:

While Hunting's other product groups continue to perform well, based on this short-term market outlook, 2024 full-year Group-level EBITDA guidance is being prudently reduced to between c.$123-$126 million, a reduction of c.8% on previous guidance issued in July 2024.

The positive is that they are back into a decent net cash position:

Year-end cash and bank / (borrowings) is, however, likely to increase significantly, and is now anticipated to be c.$60-$70 million. This improvement is driven by the acceleration of receivables in respect of the KOC contracts, which are currently underway within the Group's Asia Pacific operating segment.

In light of this, the share price being down almost 20% looks like an overreaction, perhaps representing the scale of disappointment, with many expecting the momentum to continue rather than reverse, rather than the actual change in earnings.

Luceco (LUCE.L) - Q3 Trading Update

· The Group achieved 3.0% year-on-year revenue growth in Q3 2024, and year-to-date growth of 6.4%.

· Gross margin has remained in line with expectations for this quarter at just below 40%.

This isn’t all organic, though:

On a like-for-like basis Q3 2024 revenue was down 3.6%. However, strong fourth quarter order book supports like-for-like revenue growth expectations for the second half.

While all companies claim they outperform the market, it is clearly a tough environment. As such, they are reliant on Q4 to pick up:

· Healthy order book underpins our expectations for like-for-like revenue growth in the second half, and for full year total revenue growth to exceed 10%.

Given their history, they probably deserve the benefit of the doubt on this one, given that they are a quality operator:

The Group's profit expectations remain in line with full year consensus.

And those headwinds look like they may be about to become tailwinds:

· Recent growth in UK residential property transactions suggests improving residential RMI sentiment, giving us cause for optimism for 2025 and beyond.

They also report that container costs are back to historical norms, which could have a positive read-across to other companies with significant manufacturing in China.

They don’t seem to be slowing down on the acquisition front:

· Luceco continues to review a healthy pipeline of M&A opportunities.

· In order to facilitate further investment in growth, the Group has recently exercised its option for its £40m accordion facility to provide a total bank debt facility of £120m.

· Strong balance sheet and cash flow generation provides optionality for further organic and M&A opportunities consistent with the Group's stated capital allocation objective.

The market hasn’t liked the debt here in the past, even if it is used for earnings-enhancing acquisitions. They also mention that synergies make acquisitions a better deal than the headline numbers. However, this is something to keep an eye on:

· Bank Net Debt at the third quarter end of £67.4m, giving a Bank Net Debt : EBITDA leverage ratio of 1.8x, comfortably within our target leverage range of 1-2x. Given the Group's excellent track record of strong cash generation, we expect to be towards the middle of this range by the end of 2025.

Sell-offs on debt or market worries often prove to be good entry points into this quality compounded.

Shoezone (SHOE.L) - Trading Update

As Zeus reveals, this is another profit warning, although a slight one.

· Group revenue reduced by 2.7% to £161.3m (FY 2023: £165.7m)

· Store numbers, in line with plan, reduced to 297 (FY 2023: 323)

· Product margin increased to c.62.8% (FY 2023: 62.1%)

· Adjusted profit before tax expected to be not less than £9.5m[1] (FY 2023: £16.5m)

· Net cash of £3.7m (FY 2023: £16.4m)

PBT was 5% lower than forecast, and net cash was lower as well. The known headwinds also impact future years.

Similar to Card Factory, the main price action recently appears to be short-term momentum traders getting excited:

Many simply expect this company to always beat, and they have now had two misses. In light of this, the price action so far looks light, not necessarily compared to the size of the miss this time, but compared to how much this has risen on no news after the last profit warning.

Zeus argues that this is on a cash-adjusted P/E of about 10, which seems reasonable until you realise that there is very little growth, the headwinds are not going away, and similar companies are on cash-adjusted P/Es of 6 in the current market, so this actually looks expensive.

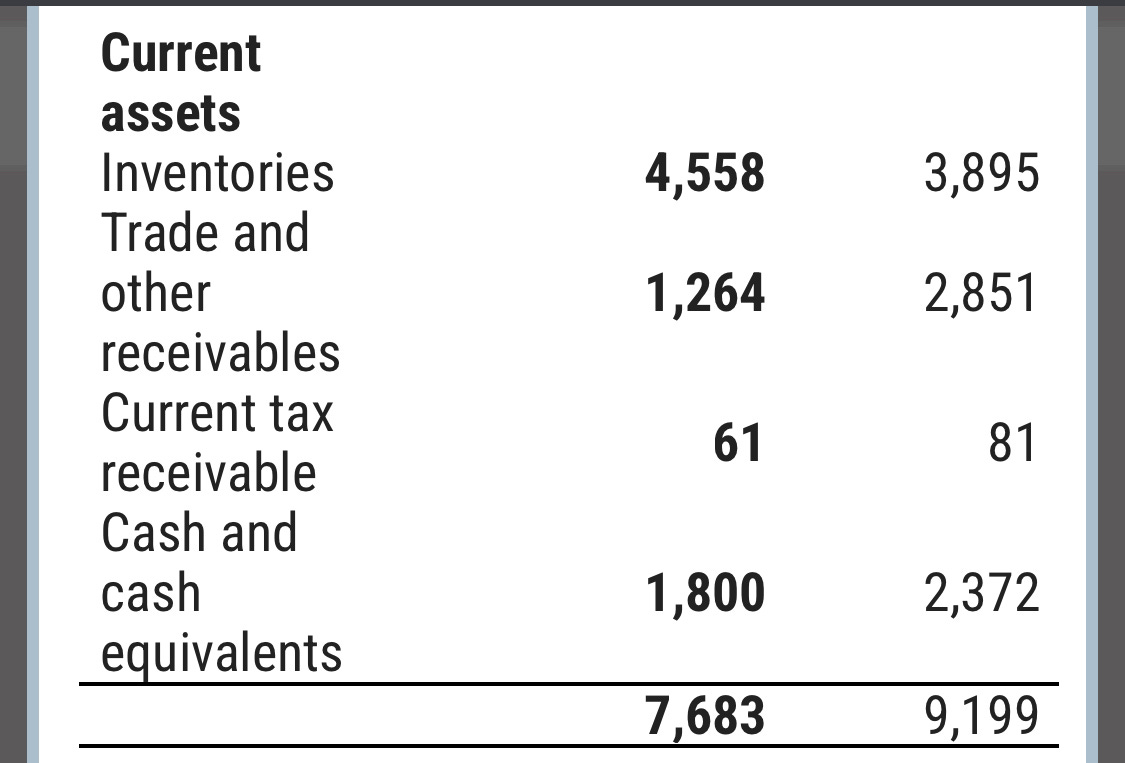

Thruvision (THRU.L) - Interim Results

Having warned a few weeks ago and faced a big off, here is the key part of the balance sheet we wanted to see:

It seems they potentially have the inventory built to deliver c.£6m of revenue in H2. GM is 50%, so £4.5m could easily deliver that. Plus, payables are significantly down. This doesn't look quite as bad as it did in the trading update.

However, as the going concern statement reveals, there is now little leeway. Delivering the expectations surely is just breaking even on a cash flow basis, and they will need similar, if not more, inventory to deliver any growth.

In addition, most of their overdraft facility expires in January, and presumably, if they could have extended it ahead of the interims, they would have. In our opinion, it is clear they need to raise more cash, but it would be a gamble to delay in the hope of a better outlook or higher share price. However, a lack of a CEO probably doesn’t help with bank negotiations, careful cost management or raising fresh equity.

That’s it for this week. Have a great weekend, and eyes down for the budget announcement next week.