Mello London

There was little in the way of substantive discussion on Small Caps Live this week. Many active participants were preparing for and then attending the Mello investing conference in London. It was another great event, made possible by the hard work of David Stredder and team, and the quality of individual investor attendees. Sadly, the number of companies willing to come out in person to meet their current and prospective shareholders seemed at an all-time low. While many will no doubt argue they do online presentations, this is a poor substitute for being able to quiz a management team face-to-face.

For the first time, some Italian companies joined the event. While Italian Wine Brands and Gibus may not be widely known, they were profitable, cash-generative companies that are market leaders in their areas and on modest ratings. While we are not going to suddenly branch out into covering Italian-listed equities, it is worth noting that if these companies can jump on a flight to London to meet investors, UK companies should be able to make the effort.

Hargreaves Lansdown (HL.L) - Possible Offer

The highlight of the show was undoubtedly Leon Boros presenting Hargreaves Lansdown as an investment idea, and while he was speaking, it was announced that the company had received a possible takeover offer:

The Consortium confirms that it is considering a possible offer for HL, most recently having approached the Board of HL at 985 pence per HL share on 26 April 2024.

It seems this was quickly rebuffed:

The Board of HL rejected this proposal.

However, the most interesting part is that many funds were short the stock. Some of these appear to be systematic funds, which, while unlikely to be squeezed in the same way, will be natural buyers as the stock rises in order to maintain the nominal size of their position. Any funds trading momentum are more likely to close their positions as the stock becomes a winner rather than a loser. Hence, the stock rose above the price of the rejected offer this week. Despite this, some significant short positions remain:

Given that disclosure, and hence trackers stop reporting short when positions go below 0.5%, the real short positions are likely to be north of the reported figure. So, while the P/E of around 14 doesn’t look obviously good value anymore, it may be worth hanging on for an offer at a level management feel they could recommend or a further short squeeze.

Rockwood Strategic (RWS.L)

Meeting Richard Staveley from Rockwood Strategic was another highlight, as his investment strategy is very similar to many on SCL - value-focused, limited number of holdings with the potential to 2-3x in the next couple of years. Where a fund manager differs from an individual investor, though is that they have to take positions when the liquidity is available, which typically means they buy after bad news. The risk is that the shares release further bad news, as has happened with several of Rockwood’s holdings this year. Where an active fund manager can add value and an individual can’t is in forcing change within the business itself, and Richard’s presentation focussed on this aspect. One challenge can be that businesses take longer and need more capital to turn around than investors expect. This was the downfall of the Downing Strategic Microcap fund. So far, Rockwood are off to a much better start, and we will certainly be following all of their holdings closely.

Braemar (BMS.L) - Final Results

You always have to worry when the house broker uses the word “resilient” in their note title. Even more so when the results lead with a Partridge-esque title:

Strong trading performance building resilience and sustainable returns for shareholders, with a platform for future growth

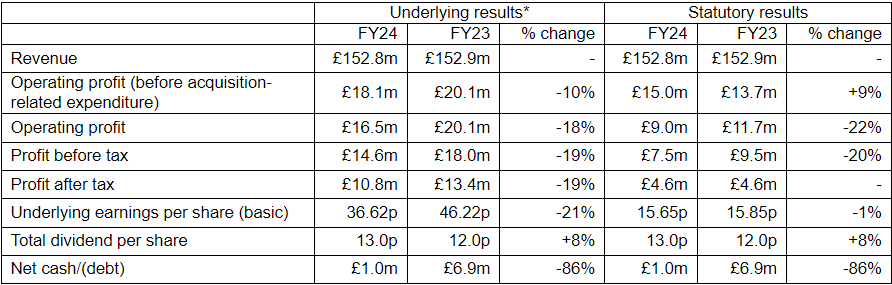

Scrolling down to find the summary table, it turns out to be flat revenue leading to a c.20% drop in underlying profits:

However, this appears to be in line with expectations.

On the surface, a P/E of 9 may look like good value, but we are reminded that this is a people business that is not really forecast to grow EPS, so 9 is probably about right. In addition, the balance sheet equity is almost entirely goodwill and intangibles.

Calnex (CLX.L) - Final Results

We are not sure why the share price here was so strong into this update. These look terrible:

This suggests there is no quick fix:

Challenges across the wider telecoms market are expected to remain for the duration of the year but the fundamental long-term need for telecoms testing solutions remains unchanged.

The review of sales channels doesn’t seem to have produced any concrete near-term solutions to their current woe:

Post-period end review of sales channels and channel partner arrangements has identified opportunities to strengthen existing customer engagements and to reach new customers. To provide the Company with the ability to optimise the channel partner arrangements, the Board has elected to terminate its reseller agreement with Spirent and initiated the process of implementing the company's new sales channel strategy.

Spirent is being taken over and may have other priorities. However, it seems a strange move to end a reseller agreement early with a much larger company with greater customer reach. Spirent reselling was over 70% of their sales in 2020, which suggests this may be a bigger deal than they are making out. It could certainly add to the short-term woes.

There has been no change to Cavendish's forecasts, and they haven't taken the opportunity to add a 2026 forecast. This suggests that neither the company nor the broker has any idea of when a recovery might come, just not in the short term. As such, any investment here would appear to be a faith position rather than an evidence-based one.

Kinovo (KINO.L) - Trading Update

Given their last trading update was only on the 2nd of May, it seems a little bit strange to issue a further one for the year that ended 2 months ago. We can only guess that this is the scheduled one.

Although the title is ahead of expectations, this appears to just add “colour” to the previous beat:

As reported on 2 May 2024, subject to audit, the Group expects to report a full year performance ahead of prior expectations.

And in the management commentary:

Following our recent announcement that we have produced a full year performance ahead of expectations, I am delighted to provide more colour on what has been a critical year of strategic progress for Kinovo.

With this sort of announcement, we half expect a “but” or “however” halfway down, reversing everything previously said, but one didn’t appear here. DCB in line with the previous statement.:

The anticipated financial liabilities for DCB currently remain in line with those disclosed on 8 March 2024.

The market liked this update though. It may a logical response to the further re-assurance on DCB. However, we couldn’t rule out shareholders (or even bots!) being confused by the “ahead” title and thinking this is a further beat. We are not convinced it is.

Likewise (LIKE.L) - Final Results

On current trading:

The Group has again made significant progress in 2023, which has continued into the first four months of 2024, with Group Sales to the end of April increasing by 8.7% and Sales in Likewise Branded businesses increasing by 15.3% compared with the prior year. The Group continues to trade in line with current market expectations.

This will be a worry for shareholders in Headlam, as Likewise seem to be achieving their mission of eating their lunch. Here’s the outlook:

With a continued focus on investment in Sales Resource and Point of Sale combined with the additional capacity in the Logistics Infrastructure, the Board is confident of achieving its ambitions in the coming years. Notwithstanding some cost inflation, Sales progression in the near future will be delivered at a lower than historic percentage cost resulting in Operational Gearing and the Return on Sales meeting the aspirations of the Group.

Also:

Whilst the Group will continue to invest, particularly in Sales Resource, the significant infrastructure costs are largely complete in this phase of our development.

So, the lunch eating doesn’t appear to be slowing down anytime soon.

Looking at the accounts, the current trade and other payables have shot up, but this is mostly about a movement from non-current. Higher trade payables than receivables are an advantage to a growing company, but they will cause a cash outflow if growth reverses. However, this should be covered by the substantial inventories. The balance sheet looks pretty solid for this type of business.

The forward P/E of 15 is expensive compared to other opportunities in UK small caps but not that far above where they should be, given the outlook. Perhaps the real investing takeaway from these results is to be careful in expecting a quick rebound in performance at Headlam.

That’s it for this week. Have a great weekend!