Weakness in trading by many companies and flows out of the UK markets due to worries over the upcoming budget mean this has been a fairly torrid week for most UK small caps. In times like this, it can be hard to get the motivation to look at company news, even though we know that such weak markets often provide the best opportunities. Here is what we looked at:

Eco Animal Health (EAH.L) - Trading Update

We’d previously commented that this company looked materially overvalued and that the promised growth that holders must be expecting far in the future beyond the broker forecast horizon better arrive. And it better start soon in the shape of beating expectations. Unfortunately, things are going the other way here:

…revenue for the full year will be materially below market expectations.

Broker equity development interprets this as:

At this stage we have adjusted our FY25 outlook accordingly. Our FY25 revenue estimate is reduced by 7%, and (adj.) EBITDA by 10%.

Materially below normally means much more than 7%, so this is is a bit strange. Also on the topic of material but not material - there is a material cash balance, but with a good chunk of this in China and subject to at least some capital controls, it would be wise only to include that held outside China in any valuation. In light of this, it may be tempting to think that a 27% drop in the share price is an overreaction. Until you realise it is still on a forward P/E of 66!

Luceco (LUCE.L) - Acquistion of CMD

This is a material acquisition here:

…market-leading manufacturer of wiring accessories for the workplace, through the acquisition of its ultimate parent company, Baltic Topco Limited, from Rubicon Partners and management for cash consideration of £30.0m on a cash and debt-free basis.

7.5x EBITDA isn't immediately a bargain, although it is earnings-enhancing and likely will have a better 2024 than 2023:

For the audited 12-month period ended 31 December 2023 CMD reported revenue of £23.1m and earnings before interest, tax, depreciation and amortisation ("EBITDA") of £4.0m. The Acquisition is expected to be earnings enhancing in its first full year of ownership.

The market has been a bit wary of the debt levels here, so it may not like the move to 1.7xEBITDA, even though it is within their target range and will no doubt be paid down rapidly.

It will be interesting to see how much synergy they obtain from the combined operations. It is not immediately obvious where CMD’s manufacturing is and, hence, whether this helps with Luceco’s strategy of trying to diversify manufacturing locations.

Luceco’s management have a long history of doing this sort of acquisition and seeing it deliver incremental EPS growth, and we don’t see why this would be any different.

Mpac (MPAC.L) - Acquisition of CSi Palletting

Far from being a bolt-on, this is a massive acquisition, with them paying €56m versus MPAC's market cap of £90m. As such they need to tap the equity markets. £29m is being raised from shareholders via a placing, plus there are €5m of new shares going directly to the sellers, so they are taking full advantage of what we consider a pretty high valuation when you (un)adjust earnings for highly recurring exceptionals.

While they are also taking on debt, this deal might actually reduce risk as it diversifies their cashflows, which have proven rather lumpy recently and leaves them with significantly greater undrawn borrowing facilities. In any debt levels are conservative, especially beyond the very short term:

Net debt/EBITDA is expected to be less than 2.0x on Completion and the Group is expecting rapid deleveraging to less than 1.0x by the end of FY25 due to high levels of cash generation by the enlarged Group.

Outer packaging and end-of-line automation, in general, is an area they have highlighted for growth before, as it tends to be the last thing to automate, but with increasing labour costs, it is increasingly problematic to do manually. So, there is good reason to believe this is a well-chosen strategic acquisition rather than just growth for growth's sake.

Liberum’s forecasts are now for 35.6p this year, then 45.6p and 54.1p. Pension costs and recovery payments will be a lower proportion of cash flows, which is good, but these figures also exclude amortisation of acquired intangibles and likely restructuring costs. The forecast cash flow looks to be around £12m a year, which gives some guidance on the likely level of the latter. One thing to be slightly wary of is what Liberum call "CSI's negative working capital model".

The current enterprise value is likely to be around £155m post-acquisition, so it looks like a reasonable value on cash flow. Liberum have EV/EBITDA at the current share price of 3.5x in FY 2026, which may make them look cheap depending on the (un)adjustments that need to be made. With those caveats, we agree that this deal is genuinely transformational.

Brighton Pier (PIER.L) - Interim Results

They consider the £1 pier admission fee for non-residents to be a success, which is something, but overall, it is another profits warning here:

if trading continues in line with the last few months, full year sales and earnings will be lower than previously expected for 2024 .

There is a possible transformation story here as bars are closed, the pier and golf stagnate, but Lightwater Valley grows and then moves into profitability. However, the latter has gone backwards in the last 12 weeks:

Lightwater Valley traded broadly in line with 2023, where a stronger performance during key weeks in August was not sufficient to offset shortfalls during key weeks in July and September. Total sales were £2.6 million, down £0.1 million versus 2023 (2023: £2.7 million).

Although net debt is similar, cash has fallen significantly over the last 12 months:

Proportionately, receivables have also fallen more than payables, but in pound terms, there was a working capital outflow YoY. Payables remain significantly in excess of receivables, so any further deterioration in trading may see further working capital outflows:

Something shareholders will need to be wary of.

Surface Transforms (SCE.L) - Interim Results

Here is the key line:

Expected Q3 revenues of £2.7m improved over Q2 but significantly behind plan

The company has been continuously behind plan for several years, so this did not come as a surprise to SCLers.

Here's the carrot for the next fundraise:

our run rate in recent weeks is broadly achieving Q3 average target

But of course, there are always new problems:

new consequential downstream process losses

Even though Q3 improved towards the end (although maybe that was only yields and not net volumes), Q4 is expected to be 40% down. The level of Q3/4 weighting goes some way to explain the full-year effect, but this is still an incredible miss with only three months to go:

Expected revenues for the full year of approximately £11m (with no engineering revenues prudently assumed) will be significantly behind current market guidance of £17.5m

Broker Zeus say:

We note Surface Transforms’ interim report and outlook statement published today. We suspend our estimates pending discussions with management.

Unsurprising really, when, as well as ongoing production hell, they are also failing to deliver on their customer development contracts:

No engineering revenue (estimated value £1.7m) has been recognised to date, due to ongoing performance obligation assessments under IFRS 15.

Surely customers must be close to giving up on them and cancelling contracts? But the greatest immediate concern is cash, for which they refuse to provide a recent figure:

Cash at June 30, 2024, stood at £5.0m however current levels at the end of Q3 are significantly reduced.

However, it sounds like they are close to collapse:

The impact of delays to the pace of growth has led to operational inefficiencies and cash constraints. We continue to manage cash flows carefully and are reviewing all available funding options to enhance our cash flow going forward.

Surface Transforms has been a great client for Cavendish and Zeus, but it looks to us like the game is up with both suspending forecasts. Surely a sign that they are unwilling to risk their reputations any further by proposing this to clients.

Spectra Systems (SPSY.L) - Interim Results

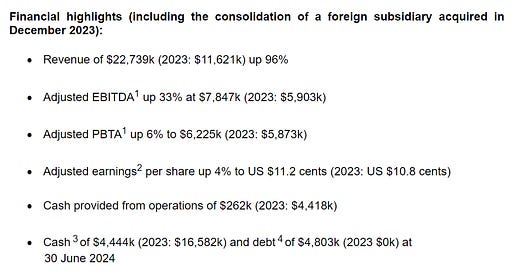

Any initial optimism seems to disappear the further down the income statement we go:

It's partly acquisition-related, which is lower margin and adds admin expenses, but it would be nice for the company to break out the details.

That sort of drop in cash would normally be worrying, but in this case it is inventory build for a sensor contract with a North American Central Bank. This contract will see earnings soar to 38c in 2025, which makes it look cheap even after recent rises. However, this drops back down to 24c in 2026. This makes it a difficult company to value using earnings multiples.

Wynnstay (WYN.L) - Trading Update

It is a profits warning here: "materially lower". Potentially the extended absence of a permanent CEO contributed to what sounds like poor execution:

decreased poultry feed volumes as this activity transitions away from manufacturing poultry feed at Twyford; these lower volumes are currently expected to persist for a further period.

If this is indeed not a company that is so wonderful that an idiot can run it, then we'd better hope the new CEO is good. One of the historical advantages of Wynnstay as an investment is that when feed does badly, fertiliser tends to do well. But the feed issues are mostly not market related and fertiliser isn't doing well:

margins have been significantly impacted as market prices have fallen during the later summer and autumn months. This has been further compounded by reduced volumes in the last two months as farmers have taken a cautious approach to product purchases, pending harvest and planting outcomes, which like last year, are being impacted by heavy rains.

The third leg is hardly strong either:

The Specialist Merchanting Division has continued to see constrained farmer spending although it has modestly outperformed the prior year to date.

Shore deliver a 35% cut to full year forecasts. To report such a large miss with one month to go in a relatively stable sector like this suggests that there was simply nobody looking at the numbers during the CEO’s leave of absence.

There is also evidence that the company were simply not talking to the house broker:

As a result, we reduce our FY24F adj. PBT (largely reflecting the Agri division) by c.35% to £7.5m (implies a c.19% downgrade to consensus)

Next year's forecasts have also been massively cut, with no recovery in sight.

Given the scale of the miss, shareholders escaped lightly here with just single-digit percentage fall in share price. This is presumably being supported by the discount to TBV and an assumption that this is a cyclical downturn. We think a significant majority of the non-current assets should be written off in any conservative asset-based valuation, either due to being intangibles or having extremely low returns on capital. But even if you write them all off this has full tangible asset support right now.

However, the issue is that the current valuation now makes no sense on current or projected earnings (if you believe Shore have now been guided correctly now) and it has been significantly cheaper in the past when there was trusted and established management in place and when equity markets generally were more highly valued.

That’s it for this week. have a great weekend!