Lots of news this week, but it is also a time when many contributors are making the most of cheaper flights to get away to warmer climes, so forgive us if the discussions summarised here are a little less detailed than usual.

Argentex (AGFX.L) - Interim Results

Prior to these results, we predicted that they were going to lead with a couple of pages of narrative about the size of the opportunity when they develop a platform business and bury the financial results as low as possible. The worst case was that they would have to resort to using the word “Resilient” in the title!

They escaped the dreaded R-word, but we were right about the rest. Several pages of scrolling revealed an EPS loss. This is quite some fall from their peak trading. There is little chance of any improvement soon as the outlook statement confirms:

The improvement in trading which we saw during Q2 has continued and revenues for the eight months to 31 August were broadly flat year on year, compared to the 4% decline experienced in the first half.

We continue to expect FY24 revenues to be in the mid £40 millions, with an EBITDA margin in the low single digits as we invest in growth and the repositioning of the business, and we remain confident in our long-term prospects.

At this stage, any remaining investors will be bought into the idea that they can develop into a better quality platform business and are willing to take the short-term pain associated with it. However, we note that complex IT projects tend to take a lot longer and cost a lot more than originally anticipated, and several competitors that have made or attempted the transition have highlighted how hard this is.

Billington Holdings (BILN.L) - Interim Results

As expected, management were holding something in the tank here:

FY24 profits are now expected to be ahead of current market expectations

They had previously stated that last year’s performance was exceptional and that we should not expect a repeat this year. However, these interims are broadly in line with last year. And now they say:

• Increased macroeconomic confidence, combined with price stability of construction materials, resulting in deferred projects restarting

• Record order book at 30 June 2024 spanning multiple market sectors and a positive pipeline of opportunities provides confidence for FY24 and 2025

• It is anticipated that due to the timing of deliveries on certain significant contracts the Group's revenue will be stronger in the second half of the year

Cash is in line with the year-end despite higher investment in capex:

The Group is now in year four of its planned five year capital investment and modernisation programme and will continue to actively invest in appropriate areas, whilst being mindful of the returns achievable from capital investment. It is expected that capital expenditure will be approximately £3.5 million in both 2024 and 2025, with £2.0 million of this year's expenditure being invested in the first half.

About £4m has gone out on a dividend, but the cash balance is still a significant part of the market cap. They also say:

In addition to the Group's cash resources, the Group has entered into an agreement with HSBC, the Company's bankers, for a £6.0 million Revolving Credit Facility (RCF) for three years to provide enhanced flexibility to capitalise on acquisition opportunities should suitable and appropriate prospects be identified.

This suggests that they may have something more concrete in the acquisition pipeline than in the recent past.

Their broker Cavendish turn this into a 9.4% EPS upgrade. Again, it is hard to see this not being upgraded further if things continue to go as planned in H2. Although the precise timing of project milestones may impact this, and we can see why management want to keep something in the tank. A 9.4% increase also means that they haven’t misled the market (and major holder Gutenga, who sold a chunk of shares recently) by not timely reporting a 10% beat!

Strangely, the market didn’t react to this news. Perhaps many were expecting this beat. But if so, it is difficult to believe this from the numbers which have the company on a P/E of 9 with a quarter of the market cap in cash, and a chance of further upgrades to come.

Fintel (FNTL.L) - Interim Results

In a low interest rate environment, companies have gotten used to be able to buy pretty much anything and pay daft multiples and get to claim an earnings-enhancing acquisition, which the market then bids up the shares to reflect. Fintel appear to have found out to their cost that what you pay matters. These results show that their acquisitions have proven to be earnings dilutive after interest costs. Perhaps this will come good as they grow (and interest rates fall), but not within any reasonable forecasting horizon.

In response to this, broker Zeus took 7% out of their forecast. This means that EPS has failed to grow for several years despite the company being on an acquisition spree. This begs the question: How on earth are people paying 20x earnings for this serial underperformer?

Franchise Brands (FRAN.L) - Interim Results

Despite containing the words “in line”, this instinctively feels like a small downgrade:

in line with the current range of market expectations

And indeed, Dowgate say:

The group guides to EBITDA within the £35.7m-£37.2m range and to reflect the more challenging macro outlook we trim our top-end EBITDA estimate by -3% to £36.0m.

However, the real damage is further down the P&L:

We adjust for higher depreciation and interest charges to arrive at PBT/EPS of £22.0m/8.4p (was £25.3m/9.8p) for FY24 and £29.5m/11.3p (£32.5m/12.4p) in 2025

That's -14% in the current year and -9% next. We understand that the company don’t feel that they have particularly high macro sensitivity and that lower utilisation means lower maintenance or repairs. Unfortunately, while this applies to customer's equipment, the amortisation of Franchise Brand's software continues at the same rate even though it is being used less than expected. Indeed, it appears that they have had to revisit initial assumptions over the amortisation rate of Pirtek's software as broker Allenby have also increased D&A in their model.

Ingenta (ING.L) - Half-Year Results

These results have suffered from a drop in both sales and gross margin, particularly in the Commercial segment:

· Commercial revenue decreased by 20% to £3.4m (2023: £4.3m) as a result of delayed project work and exit of legacy customer business

This has led to the risk of a warning for the full year:

Timing of new business wins versus expected reduction in legacy business has resulted in lower than expected revenues in H1 and provides some risk to the achievement of current year end expectations; year end EBITDA outcome now expected to be £1.8m-£2.0m. · Group expects project work to increase in the second half of the year and has already secured significant new business and the Board remains optimistic about the remainder of the year

It seems to be largely timing related, but investors will not be pleased to find out that H1 revenue was below expectations three months after the period end. Especially when there was the option to announce these in a trading update or an AGM update over the preceding months.

Cavendish goes for the bottom of the EBITDA range, which takes 13% off the EPS forecast. Not particularly bad and potentially beatable if this is finally conservative. However, the market didn’t like this, taking the shares down by up to 25% at some point on the day. This may just be illiquidity, or it may be a loss of faith in the management after waiting three months to reveal poor results.

Net cash is up and now stands at £3m. However, this is another company that wants to make acquisitions but can’t find the right deals. You could say the cash-adjusted P/E of around 6 more than makes up for this risk. One thing is clear, though: this won’t re-rate anywhere near Cavendish’s £2.60 price target until they can show some sustained growth.

Maintel (MAI.L) - Interim Results

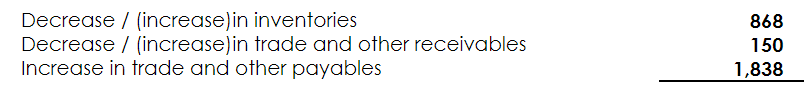

Net debt is down from £18.1m at the year-end to £15.6m now, but a glance at the cash flow statement reveals that all and more is due to working capital flows:

Given the largely static debt but increased cash balance, this suggests quite a bit of window dressing here. With payables exceeding receivables by around £21m, this adds further to the suspicion.

Looking further into the accounting gimmicks, their preferred measure of adjusted profit seem a completely inappropriate way to measure the performance of this business, as the adjustments exclude the amortisation of intangibles but capitalise a similar amount of intangibles each year.

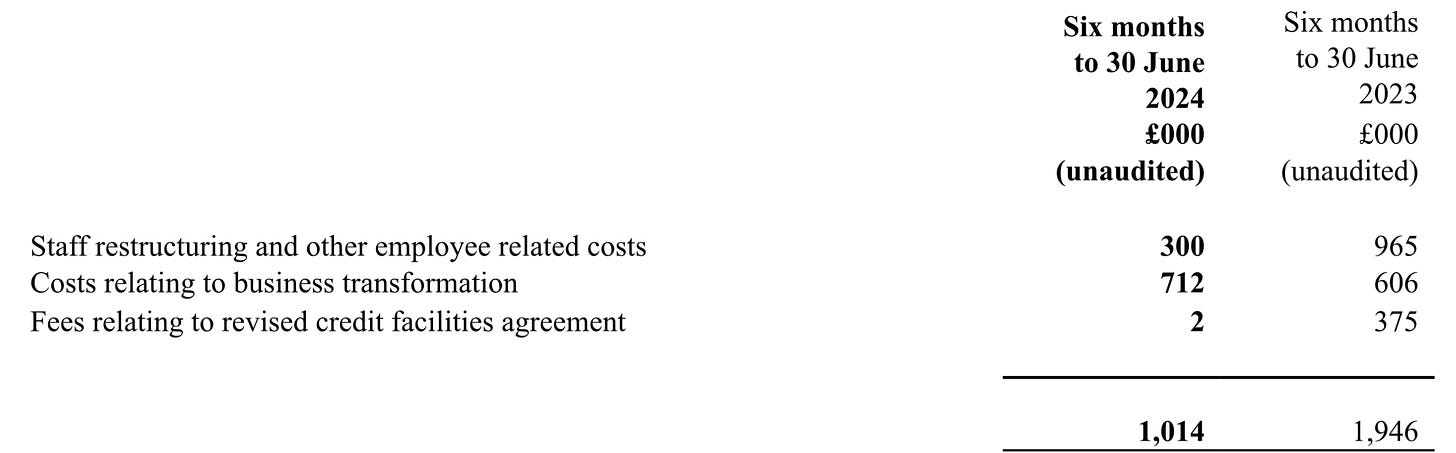

And as note 8 reveals, the exceptionals are anything but:

At least they have been reduced compared to last year. So, the reality is that this remains a loss-making, heavily indebted business. Perhaps not all is lost, though, as they say:

significant deals referenced above were closed later in the first half than initially anticipated, leading to an expected H2 2024 weighted revenue and EBITDA performance.

So H2 should be better and may even be profitable. However, with what appears to be aggressive window-dressing for net debt and adjusted EBITDA being completely meaningless for this business, who knows what the real economics are?

Portmeirion (PMP.L) - Interim Results

This looks like a challenge with these results:

We expect FY24 profit to be up on prior year with improving operating margins, in line with FY market expectations.

A lot of the loss is down to South Korea, but they are going to have to find a lot of adjustments in H2 to get to the full-year EPS forecasts.

The good news is that there were no pension contributions in the period. Perhaps this means the 2023 triennial was concluded after all? Cash initially looks like a concern, and we suspect the lower-than-expected H1 dividend is partly about managing cash (the reason given makes little sense), but an H1 outflow is normal here as inventories climb from "very high" to "crazy high".

Broker Singer make some "modest balance sheet tweaks". We note their year-end debt (excluding leases) forecast moves from £4.3m to £5.0m. This is a serial recent disappointer, and having conceded a small cash miss, the probability of another profit warning appears to have risen further. There is only so much you can cover up with adjustments.

Tandem (TND.L) - Interim Results

How are these results still so bad? They are still loss-making and net debt is increasing with little sign of any turnaround, despite efforts being made. This is not just due to accounting either with a LBITDA suggesting that it’s not just the depreciation on the over-sized warehouse that is the problem.

Clearly cycling demand has a lot to do with it but you only have to go to any touristy place to see hoardes of over 50’s on e-bikes. This is a brilliant trend that gets people cycling who wouldn’t otherwise, but it seems Tandem aren’t able to capitalise on it.

In their note, Cavendish calls these results “robust”; we guess that this is one better than the rock bottom “Resilient”.

Clearly, the reason for losses is that the overheads are too large for their revenues: there's no problem with gross margins, which, if anything, seem high for a distributor with only one direct retail outlet. The lack of scale might be a problem they could dig themselves out of with acquisitions. The issue is that they have spent all their money on the warehouse, and with ongoing losses, any acquisition would need to be equity funded, presumably at a big discount. They trade at a decent discount to assets, so the logical solution would be to put themselves up for sale to another distributor who needs the space. The price of any offer may not please shareholders, though.

That’s it for this week. Have a great weekend!

I look forward to reading your fair commentary on shares. Well done!