A briefer look at some of the companies reporting this week - holidays combined with the number of companies reporting means that we’ve had to be concise in places!

D4T4 Solutions (D4T4.L) - Final Results

This is yet another year where the company generates cash due to upfront license payments but fails to really grow adjusted EPS:

Diluted adjusted EPS of 7.74p (FY22: 7.11p) and diluted basic EPS of 5.18p (FY22: 4.14p)

The outlook statement has a long-term slant to it, but with little concrete near-term certainty:

We started the new financial year with a strong pipeline, and a leadership team structured clearly on the delivery of new customer wins, increased revenues and customer satisfaction. The Group has a healthy cash balance to fund necessary investments into growth and I'm delighted to report that the Board is highly confident in the Group's strategy and our ability to deliver growth and create significant shareholder value in the coming years.

Broker finnCap hadn't previously updated forecasts for higher corporation tax, so they have cut EPS forecasts. However, the sums don't quite add up:

Forecasts for FY24 are unchanged, but for amending the tax rate in FY24, reducing adj dil. EPS to 9.8p (from 11p).

11/0.8 = 13.75p EPS pre tax 20% tax, 10.3p post tax. Of course, tax rates usually vary from the nominal rates due to accelerated capital allowances etc.

But the big news is the introduction of 2025 and 2026 forecasts. 2026 looks more like a model based on a set of assumptions than a forecast, but still, it is for 14p adjusted EPS. However, it is still not looking particularly cheap on 2026 figures, so presumably, the market is now looking forward to 2027 when, if everything goes well, they may be on a single-digit P/E.

But this is a company where things never seem to go well. First, it was the shift to SaaS meant to be delaying revenue recognition, but at least five years into this transition, the EPS is below 2017 levels:

The story of the last trading update, and the reason for 2023 EPS forecast downgrades, was contracts being delayed into 2024:

Yet here we are in FY24, and instead of an upgrade due to the revenue of the delayed contracts, we have a downgrade due to tax rates, which surely shouldn’t have been a surprise to the broker. Despite having a decent software offering, this has become a stock for Only Fools and Horses. Next year Rodney, next year…

Eco Animal Health (EAH.L) - Final Results

First time we’ve taken a look at this, and what a great trading share this has been!

ECO Animal Health Group plc is a leader in the development, registration and marketing of pharmaceutical products for global animal health markets.

And who wouldn't want this little guy to be healthy?

Their biggest market is China & Japan, with 35% of sales, then the US with 20%. Latin America is close behind, Then the rest of Asia. Other markets are pretty small, with UK only at 2%, despite presumably some advantages of being a home market.

By far their biggest product, at 89%, is:

Aivlosin®, our patented antimicrobial which is used under veterinary prescription for the treatment of economically important respiratory and gastrointestinal diseases in pigs and poultry

International pork markets and their proponents struggled in 2022, so the outlook statement will be key. First markets:

Trading momentum from the second half of FY2023 has continued into the first half of the current financial year. In China, the Group has seen improved trading and the Asian and Latin American markets continue the trend of delivering strong growth.

That's good, but forecasts confirm that FY March 2021 was an outlier, and we're looking at gentle growth from here. Then they make some operational comments:

Production and operational efficiencies are being driven by the leadership team and this is expected to support margins going forward.

From the last annual report:

production stoppage over the summer of 2022 when production is switched to the new factory in China.

It looks like they use a mixture of owned, JV and contract manufacturing. Presumably, as medicines enter the human food chain, regulation is tight. On that diversification:

The R&D programme continues to provide considerable excitement and game-changing future product flow is confidently expected.

However, the sales concentration of their largest product increased slightly YoY in H1. Of course, there are always evolving risks:

Despite the challenges from continuing, sporadic African swine fever outbreaks and commodity price pressures...

But the conclusion is neural to positive:

the Board is cautiously optimistic for the remainder of this financial year and views the future with confidence.

On valuation, we can immediately see there is some support from the balance sheet, with the price to book at 0.79x. Clearly, their patents and approvals have significant intangible value. These are amortised and only reviewed for impairment, so they could easily be held below true value. Less so the goodwill.

It really isn't fair to look at tangible book value, but there's still some support with the company trading at only 1.4x. Including the "drug registrations, patents and license costs" but excluding the goodwill, assets come it at 114p / share, so trading at 0.86x.

Valuation in earnings terms is far less obvious. Indeed it appears to be bonkers to be paying a 26.5x multiple for something where revenue has barely managed to keep up with inflation over the last few years. EPS is down from 16.6p in 2017 to 3.7p forecast in 2024.

R&D expenses of £6m seem to have been taken directly through the P&L - if you reverse this out, then after-tax profit is up by £4.4m. But there is a non-controlling interest. It is unclear how much of the R&D is borne by non-controlling interests, and hence it is difficult to work out what their adjusted profit is.

Here is the note from the last AR:

Zhejiang ECO Biok Animal Health Products Limited (Zhejiang ECO Biok) and Shanghai ECO Biok Veterinary Drug Sale Company Limited (Shanghai ECO Biok), both 51% owned subsidiaries of the Group, have material non-controlling interests (NCI).

As these minority interests account for the majority of the consolidated profits, I think the implication is that R&D costs are borne centrally:

You'd expect profits for the 51% of Zhejiang ECO Biok Animal Health Products Limited (Zhejiang ECO Biok) and Shanghai ECO Biok Veterinary Drug Sale Company Limited (Shanghai ECO Biok) owned by the listed entity to be £2,168k, meaning the rest of the business lost £1,160k. Central admin costs such as R&D would seem to be the best explanation.

Although they seem to be getting cash out of China, we personally would only count the cash that has been repatriated:

The consolidated cash position in the Group has increased to £21.7m at 31 March 2023 from £14.3m at 31 March 2022. The consolidated cash position held outside of China decreased to £4.1m at 31 March 2023 from £6.2m at 31 March 2022. A portion of the China cash is repatriated once per annum by dividend declaration; the Group's share of the cash distribution from ECO Biok in China received in the UK is 51%. During the year the dividend received from ECO Biok was £1.8m - related to the China profitability in the year ended 31 December 2021 (2022: £2.2m - related to year ended 31 December 2020). In addition, the Group received a first dividend of £4.0m during the year from its wholly owned entity in China.

The plc bearing all the major costs but the dividends from the subsidiaries going half and half to the company and minority interests are one way that shareholders may be disadvantaged. We have no evidence that this is occurring in this case, but if it was going to happen, then that would be the way it would be achieved, given the JV structure.

finnCap (FCAP.L) - Final Results

finnCap reports a 0.9p loss for the year. The unadjusted loss was 3.3p, and they say:

There will be further restructuring costs in FY24 as we bring Cenkos and finnCap together following completion of the merger. Although we have undertaken significant integration planning, we cannot yet quantify these costs and commensurate benefits.

So it is fair to say that there is a good deal of uncertainty about what the combined business will look like in terms of profitability or even net assets, given the costs of restructuring.

In terms of trading, ECM was better than we expected, but M&A was worse. As they say:

FY23 was challenging in particular in ECM where market conditions limited corporate activity and investor appetite.

But looking at the numbers, ECM was down 32% YoY, whereas M&A was down 44%. The reason for this was the single bright spot:

Total fees from retainer agreements increased to £7.0m (FY22: £6.6m), driven primarily by RPI adjustments.

They did very well only to lose one net client given the conditions. Fixed administrative costs remained high but are on a downward path. We suspect there is scope for efficiency gains using AI and other technology - a good starting point would be for the finance department to decommission their fax machine:

Looking forward, however, revenue for Q1 exceeds our expectations:

FY24 has started well with Q1 revenue of £8.7m up 32% on Q1 FY23 (£6.6m)

So could this be the first green shoots? The market has effectively priced finnCap as if AIM IPO’s or significant equity raises are never coming back. This seems far too pessimistic. These may be highly challenging markets, but are they really that different to other small cap bear markets we’ve seen over the last few decades?

Through-cycle nominal EPS at finnCap is likely to be around of 2p and for Cenkos around 4p. Making them both look very cheap if they can survive the lean years in good shape, which we believe they can.

Hostelworld (HSW.L) - Trading Update

Leading with the following has all the hallmarks of a loss-making company

Largest H1 on record

This is what they do reveal:

H1 '23 adjusted EBITDA €5.1m

D&A alone in 2022 was €11.6m for the full year, so yes, it looks like a loss. They also have a high and increasing interest bill. From the full-year results:

On 19 February 2021 the Group signed a €30m five-year term loan facility with certain investment funds and accounts of HPS Investment Partners LLC (or subsidiaries or affiliates thereof). The facility is single drawdown and bears interest at a margin of 9.0% per annum over EURIBOR

12-month EURIBOR is around 4.2%, so presumably, they are paying over 13% interest on this loan. They recently repaid some of the loans, but the interest accrues, so is compounding at this rate:

…is pleased to announce a voluntary early repayment of €10 million of its €30 million term loan facility…Following this early repayment, the current outstanding debt to HPS is €24.4 million, which includes PIK interest of €4.4 million.

So that’s still €3.2m interest each year, or a third of their annualised H1 EBITDA. Profits for the full year continue to be forecast, although it is not clear whether they are trading ahead or behind, and there is no accessible brokers note. Getting on for €15m of interest, depreciation and amortisation leaves a lot to do.

And as a reminder, this absolutely not an accommodation agency:

Hostelworld Group Plc is a ground-breaking social network powered OTA focused on the hostelling category, with a clear mission to help travellers find people to hang out with.

Shoezone (SHOE.L) - Trading Update

Yet another upgrade here, from £10.5m adjusted PBT to at least £13.5m. This is now well ahead of last year's result, which most had thought was exceptional. Everything is moving their way:

strong demand with volumes up double digit on last year

lower container rates

favourable foreign exchange rates

LeoInvestorUK — Yesterday at 07:41

Broker Zeus have stuck the figures into their model for us and come out with 21.8p EPS giving a PE of 10.8x on yesterday's close. They have also been guided to increase 2024 forecasts again:

We assume some of the margin improvement flows through into FY24E, driving a 14.3% increase in forecast adjusted PBT to £12.5m and a 14.3% increase in FY24E EPS and dividend per share.

One word of warning is that ShoeZone does not operate a progressive dividend policy. Accordingly, the dividend is forecast to fall for FY 2024 in line with earnings.

Unlike in Next's recent update, there is no commentary or speculation about why sales demand is so strong. We strongly suspect the one-off bonus paid to approximately 1m NHS workers at the end of June may be a factor.

The market liked this update, with the share price up another 10%. There is an underlying growth/rollout story behind the short (now medium) term strong trading, but the PE is pushing 14x for FY 2024, which is pretty rich in today's market for a shoe retailer. We also don’t see what management are doing to sell more cheap shoes. We’ve not seen any advertising, for example. So while they execute well, they are largely a commodity supplier. What they do well is manage market expectations. So they always meet or beat expectations

System 1 (SYS1.L) - Q1 Trading Update

Data revenue was up 36% on Q1 last year, which doesn’t seem too shabby:

Until you realise that all three categories of revenue are down in Q1 this year compared with Q4 last year. This doesn’t seem like a company that should have excessive seasonality, so this is a poor quarter.

We don’t have results for FY23, so a lot of guesswork is required on what their costs will be, and hence if they are profitable or not. Simplistically, £6.2m revenue is probably £5m gross profit. Adding 10% inflation to H1 last year's operating costs would be £4.9m. making this another marginally profitable year, but with a wide range of outcomes depending on any growth in data revenue or costs.

Canaccord have adjusted PBT FY24 estimates of £0.8m. If the Data side of the business can scale and they can control costs, there is operational gearing. However, this is two big “ifs”, and the EV here is £16m, so there is already a lot of hope built into the price compared to current profitability. The recent business performance doesn’t exactly give much cause for hope.

Totally (TLY.L) - Preliminary Results

Let’s start with this:

Gross cash as at 31 March 2023 of £6.5 million (31 March 2022: £15.3 million).

Only quoting gross cash, so any debt will be stable, right?

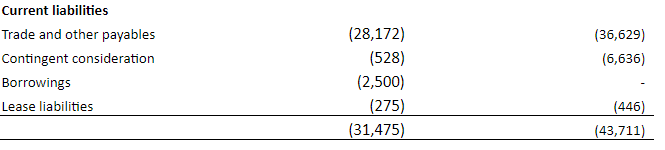

Oh dear. £2.5m of debt has also appeared. So that's almost £11m of cash outflow over the year. Although, £6.6m was due to paying contingent consideration for acquisitions. Which makes this distinctly unimpressive:

Underlying EBITDA increased 11% to £6.9 million (2022: £6.2 million), excluding £0.6 million in exceptional items.

The only mention of like-for-like is this relatively minor part of the business, that just happens to be doing well:

Revenue from EFP totalled £1.7 million (2022: £0.3 million for the period 15 December 2021 to 31 March 2022), up 40% on a like for like basis as demand exceeded pre-pandemic levels

This still isn't what we would want to see from a balance sheet of an investable company:

Stockopedia had 2.08p EPS forecast, so 0.94p Basic EPS is a big miss. Although we'd expect there to be some adjustments in there. SP down 24% suggests that others agree this is a miss too. This looks totally….

Tharisa (THS.L) - Q3 Production Results

Strong results here despite slightly lower chrome production. Helped by chrome prices staying strong:

Processing capacity maintained

‒ PGM output increased to 37.0 koz (Q2 FY2023: 34.3 koz) with yield maintained and recoveries improving

‒ Chrome output marginally lower at 378.8 kt (Q2 FY2023: 404.8 kt) on steady grades, yield, and recoveries

‒ Mining volumes remain constrained

‒ Metallurgical grade chrome concentrate prices up 7.8% quarter on quarter averaging US$290/t (Q2 FY2023: US$269/t)

This has led to a $40m increase in net cash for the quarter despite Karo spend. This is very impressive, given the challenges of load shedding and lower PGM prices they have faced in the quarter.

Brokers are starting to upgrade after a long period of downgrades:

When the company is on a forward P/E of 3, this starts to look very cheap, despite the obvious SA/Zim risks.

That’s it for this week. Have a great weekend!