Small Caps Live Weekly Summary

DBOX IGR TPX VRS

Here’s a selection of what was of interest this week. (Remember this is a summary of many opinions, and isn’t the view of any one commentator; check out the actual discussion on Discord if you want the nuance of the different opinions.)

DigitalBox (DBOX.L) - Trading Update

We love a significantly ahead of expectations:

The Company expects EBITDA for the 12 months to 31 December 2025 to be significantly ahead of market expectations

The reality of Momentum is that winners tend to keep on winning, and management often hold something in reserve, meaning that further ahead statements often follow. When combined with a jump in the share price, as we saw here this week, significant share price rises often follow.

Not everything is rosy, though:

…revenue to be broadly in line with the market expectations.

In interviews, management are keen to point out that their c.6% revenue growth is still significantly ahead of the market, where similar companies are reporting high single-digit declines in revenue.

The other problem is that the brokers are not updating forecasts, so we don’t know whether significantly ahead in percentage terms is actually fairly immaterial in monetary terms. We take some heart from this appearing to be an unscheduled trading update - we had one pencilled in for January.

The market pricing recently appeared to be sliding down a wall of worry, fearful of a potential miss, in what are very difficult market conditions in the UK. So in that sense, it is also good news, whatever the actual monetary beat. And this bit is interesting:

we remain alive to consolidation and acquisition opportunities that can maximise shareholder value

Our understanding is that larger holders still like the investment opportunity here, but they (rightly) view it as subscale to be listed, and would be keen to roll it up into something else if the right fit could be found. The problem is that the natural buyers in this space are so large that buying DigitalBox wouldn’t move the needle for them. Management may be keen to scale up, using their cash balance to add further assets, to drive a re-rating, before considering an exit.

IG Design (IGR.L) - Interim Results

Finally get to see a balance sheet with DG Americas. Our first thought is that this could have been worse, we have £93.9m NTAV:

This is versus a £45.2m market cap, so it shows the company still trades on a big discount to NTAV. However, this problem remains:

The Board reaffirms its full-year guidance of $270-280 million revenue and adjusted operating margin of 3-4%.

Paid-for research provider Progressive calculates that this is a forward P/E of 19. It takes them to FY28 to get the P/E down to 12 if everything goes well. Which still seems high for a producer of Christmas tat. Those assets just aren’t productive in their current form, nor does there appear to be a route they can be make them productive.

These results show a small amount of net cash, but we know this is not representative of the average during the year, and year-end is picked to be the most favourable date for working capital.

TPX Impact Holdings (TPX.L) - Interim Results

They get their revenue excuses in early, with the first “highlight”:

As the Group nears the end of its three year plan, we are delighted that our key focus on cash generation and materially improved profitability can be clearly seen in the metrics below

And you can see why:

Revenue of £36.2m (H125: £37.8m), a year on year decrease of 4.3%

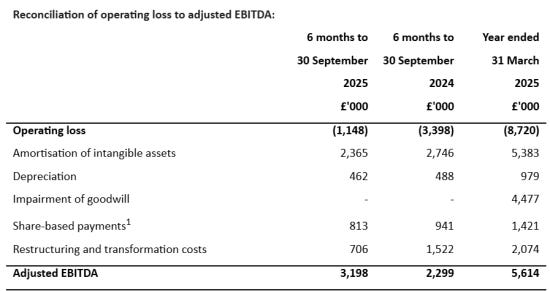

What really matters seems to be going in the right direction, though:

Adjusted EBITDA2 up 39% to £3.2m (H125: £2.3m; H124: £2.0m). On track to meet our full year adjusted EBITDA guidance of £6-7m

And the bottom line is heading up, too, if you believe those adjustments:

Adjusted diluted earnings per share2 up strongly to 1.7p (H125: 1.2p; H124: 0.5p) Reported diluted loss per share improved to (1.6)p (H125: (3.6)p; H124: (10.2)p)

These are what they want us to forget about:

Restructuring costs don’t seem to be very “one-off”, but at least they are reducing. SBP continue to be material, and at the very least we should be taking fully-diluted adj. EPS. However, overall, this is not catastrophic.

Debt has been a potential issue here in the past, but it looks to be under control:

Management expects net debt to reduce further. The Board updates year-end net debt guidance to below £6m (previously £7-8m), and updates year-end leverage target to less than 1.0x net debt to adjusted EBITDA (previously 1.0x - 1.5x)

We get an initiation note from Cavendish following their recent appointment, with lots of business details. However, it is the forward metrics that made this look exceptionally cheap, even for a not particularly high-quality business. EV/EBIT of around 4 in the Cavendish note looked out of place even for a very cheap UK small-cap market.

However, this isn’t exactly new news; FY26 estimates from Cavendish appear to be lower than their previous broker, Dowgate’s, both for revenue and EPS, so in some ways this is a downgrade. However, having this outlook confirmed by a new broker, who tend to be more keen to avoid overly optimistic forecasting, may make these more achievable and avoid a broker consensus trend that looks like this in the future:

The market certainly seems to have taken this view, with the shares responding surprisingly positively to these results, rising 60% this week. If the shares were still 15p, I think most of us would say this is too cheap. However, the case is more nuanced now that the share price has risen to 24p, putting them on a forward 6x EV/EBIT. There is still much to deliver for this year, and some may now argue the share price has got ahead of itself in the short term.

Versarien (VRS.L) - Intention to Appoint Administrators

Goodbye, Versarien. You won’t be missed:

Although creditors continue to be supportive, the Board has regrettably resolved to serve a notice of intention to appoint (”NOIA”) Leonard Curtis as administrators.

Turns out Versarien’s free shareholder golf days were the most expensive rounds of golf ever.

That’s it for this week. Have a great weekend!

"Turns out Versarien’s free shareholder golf days were the most expensive rounds of golf ever." - He He !