UK share discussions this week were dominated by the budget announced on Wednesday. While it was undoubtedly bad news for investors, in many ways, it was much better than expected. Those who had large capital gains in stocks seemed to do the right thing by selling ahead of the budget, as the headline rates were brought in line with property gains at 18/24%. The rise for higher-rate taxpayers was relatively light, though. The biggest news was that 100% of AIM IHT relief was removed, but it was retained at 50%, meaning an effective tax rate of 20%. Given this is better than nothing, this means that the reason for IHT relief managed-accounts remains in place and removes a very large overhang for AIM shares. ISAs and SIPPs were untouched apart from bringing pensions inside estates for IHT.

The removal of the possible overhang and the amount of money now available for re-investment means there was a bit of a relief rally. Some of this may be logical and happened in the stocks that would have been most affected by IHT fund overhangs. However, the really big moves appeared to be in simply the most popular stocks with individual investors. This suggests that there is a massive amount of crowding in certain stocks, usually the previous year’s big winners. While momentum can be a powerful indication of changing fundamentals within a business, mean reversion is the leading force over the longer term. We fear that this sort of behaviour is far more likely to lead to big losses rather than further gains for those jumping on the bandwagon.

Bioventix (BVXP.L) - FY Results

These look decidedly pedestrian for a company on a P/E of over 20:

· Revenue up 6% to £13.6 million (2023: £12.82 million)

· Profit before tax up 5% to £10.6 million (2023: £10.13 million)

Many investors will point to the very high gross margins and returns on capital here. However, there is only one reason to pay a high multiple for a company: you believe it will grow earnings rapidly in the future. High returns on capital may point towards a company that can achieve this growth without diluting shareholders or while still paying a dividend, but it is the growth itself that adds value, not a historical accounting ratio.

There is little sign of that growth arriving soon, either. Indeed, there is a mild profits warning for FY25 included with these results due to Troponin sales:

After correctly allocating the revenue to each of the years 2023/24 and 2022/23 our total troponin antibody royalty revenue from Siemens Healthineers and another separate technology sub-license increased by 3% during the year from £1.41 million to £1.45 million. The level of these royalties and their growth are below our previous expectations based on downstream assumptions.

This makes at least five years where sales and profits have largely tracked inflation and not grown in real terms. It is also worth noting that, despite the very high gross margins, there is little sign of operational gearing here. Given the ratings the UK small cap market currently gives to stocks that appear to be ex-growth, at least half of the company's value is based on future products yet to generate meaningful revenue. Here, the outlook is better:

We remain very encouraged by the very early signs of success for our Tau/Alzheimer's antibodies and we look forward to more progress into the future.

Whatever the industry, future product adoption tends to be slower and more measured than management and investors expect. Hence, with so much of the value here dependent on those products, investors would be wise to do some cautious modelling of future prospects rather than simply trusting that this sort of valuation can be grown into.

James Cropper (CRPR.L) - CEO Succession

This packaging specialist has two divisions. A highly profitable advanced materials part:

And a legacy paper and packaging division that loses pretty much all the money that the other division makes:

What the company really needs is someone to come in and take the tough decisions to rationalise the cost base in the loss-making part. Unfortunately, this is something the controlling shareholders appear resistant to, and hence, the new CEO is David Stirling, formerly of Zotefoams. When he resigned there, we noted that:

Given that the company has not generated a return above their cost of capital for almost all of his tenure, David has certainly not made an enormous contribution to shareholder value. Indeed, he appears to have consistently destroyed it.

The kindest interpretation is that he was taking care of other stakeholders, such as employees, by not shutting down the unproductive parts of their business. Another reality may be that the productive and unproductive parts simply can't be separated, and they are hoping the loss-making "growth" parts eventually deliver sufficient returns to make the other parts worth keeping going. However, if this is happening anytime soon, why would the CEO leave now?

You can see why the controlling shareholders think he is the right man for the job. However, as well as getting someone who appears to be a very poor asset allocator - spending a fortune involving debt and dilution to create capacity that wasn't required - Cropper is getting someone who appears to be good at selling the story to easily impressed shareholders. He may be able to do the same here, but without radical changes, the underlying business is likely to continue to generate the mediocre earnings that David’s tenure at Zotefoams enjoyed.

Diales (DIAL.L) - Trading Update

Given that broker Singer titles their accompanying note:

Strategic actions drive increased profitability in 2024

Then you’d assume they’d made some great progress. But instead:

The Group expects to report revenue from continuing operations in FY24 of £43.0m (FY23: £42.6m). The Group expects to deliver an increased underlying* operating profit, from continuing operations, in FY24 of not less than £1.1m (FY23: £1.0m).

This is hardly groundbreaking, and a forward P/E of 17 shows there is still much work to do to improve the business's profitability. However, this is better news:

The Group continues to have a robust balance sheet with a strong cash position with an improvement in the September 2024 year end cash position to £4.3m (March 2024: £3.6m).

Cash collection has always been a problem here, and they have also spent £200k on buybacks, so this is better than it appears. Unfortunately, that buyback is now 71% complete and not going to support the price for long. The original intention of buying back £1m worth became £250k plus £750k to spend on Golden Hellos to try to persuade new employees to join. The rest of the cash seems to be being retained in order to balance the big working capital flows they have and isn’t available for other uses. Assuming the cash figure is clean, this rise in cash may give them the capacity to extend the buyback when the results are announced, or up their Golden Hello budget!

IG Design (IGR.L) - Trading Update

Effectively in line with the warning last month:

In line with the expectations set out in last month's pre-AGM trading update, Group revenue has declined 11% in the period, driven by DG Americas, which resulted in a 62% decline in adjusted profit in H1 compared to the prior year period. However, as stated last month, we anticipate profit improvement in H2.

We don’t think the previous trading update revealed that an 11% drop in revenue would lead to a 62% drop in adjusted profits, though. And this is a company that likes their adjustments. You can be sure they’ve pulled out all the stops to get it even as high as that. So it is a huge drop in H1 profits, but H2 profitable instead of loss-making such that they make it back:

Business simplification, efficiency and cost-saving initiatives will drive profit recovery in H2 such that we expect to deliver a profit in that period, compared to a loss in that period last year. We have executed a number of cost saving initiatives during H1 including the closure of the Chinese manufacturing facility and significant restructuring within DG Americas which positively impacts the higher H2 profitability.

Its all bit confusing. Brokers have them generating around $32m profit this year, but H1, when usually all the profit is made, will generate just $13m in profit. So an H2 loss of $9m last year becomes $20m profit. How inefficient was that Chinese manufacturing plant?

Sure the more logical outcome is either the use of huge adjustments to give the appearance of a turnaround or simply they will reveal the miss later when they have greater clarity on H2 trading. The market inexplicably seems to have liked this update and bid the shares up. Perhaps this is re-assuring for some:

Cash generation remains strong. At the 30 September 2024 the Group ended with net cash of $7.4 million (H1 2023: Net Debt $15.1 million) driving a positive average cash balance for the period.

While it is reassuring that they have a positive average cash balance, this doesn’t, of course, mean that they have a positive cash balance throughout the year. They still have very significant working capital flows. As such, investors can’t just take the large cash balance at the carefully chosen year-end and conclude that they have free cash to distribute. Indeed, this almost went bust a few years ago while reporting net cash on the balance sheet at year-end. They are in a better place right now, but the investment case is heavily reliant on a continued recovery in profitability, and this week’s update raises a big question mark over that.

Nexteq (NXQ.L) - Trading Update & CFO appointment

We commented after the last profits warning and resignation of almost all the board, that the internal appointment for the CEO role, Duncan Faithful, had little incentive to unnecessarily kitchen sink future results:

Duncan Faithfull, who was appointed as the new CEO of Nexteq in August 2024, has been conducting an in-depth business review of the Group, looking at trading patterns across both brands; the growth drivers for the medium term; the investment required to drive that growth and the operational mechanisms to deliver it.

It seems that Duncan has found the kitchen sink eventually, though:

Since the H1 2024 results announced on 10th September 2024, the Group has continued to see ongoing, cross industry de-stocking, resulting in reduced order intake levels. In addition, while customer retention remains impressively high, we have seen certain customer product and project launches being delayed into Q1 2025, from Q4 2024, with customers opting to delay agreed new project expenditure into a new budget year.

As a result, FY24 Group revenue is expected to be 10-12% below previous market expectations.

Margins are maintained, so they guide at least $6m PBT. That is until the newly promoted Group Controller becomes CFO, and presumably audits his own work to find if there are any other challenges he wasn’t previously aware of. House broker Cavendish, title their accompanying note:

Nexteq - Strong cash, investing in robust FY26 growth

Conveniently, it references a period outside of their forecast window. When we look back in that window we find it gets much worse. When a company flags a revenue miss due to delays, it is normal for the broker not to upgrade during the following period. However, in this case, it doesn't seem to be a lack of upgrades that is the issue, but a huge 2025 downgrade. They have gone from $9.1/$9.1 PBT 24/25 to $6/$3.6

One problem here is that the last round of product development hit a weak market and poor returns on investment. It seems that they backed the wrong horse with Intel, which has a much shorter platform life than AMD and was rather old-tech at the time. Even though their markets don't need the latest tech, they are now talking about another round of investment that is killing 2025 and is more significant than it would have been had they chosen more wisely. Also, they may need to introduce an ARM/Qualcomm product to have a comprehensive offering, which is yet more work.

So what first appears as a minor miss in revenue due to timing issues, is actually a 60% cut to FY25 forecasts, despite the benefit of FY24 profits being delayed into FY25. Duncan hasn't just found the kitchen sink to throw out. He's had to bin the whole kitchen.

What looked like a forward P/E (adjusted for their net cash) of around 6 has become a P/E of around 11, even after this week’s falls. They have been prepared to be quite aggressive with their buyback to support the share price after the last warning, so they may well do the same. With hindsight, they have been buying back shares on a cash-adjusted forward P/E multiple of around 15, so they have probably destroyed shareholder value with the buyback so far. So, while it may certainly support the price, it hasn't proven to be the smartest move. This time, they only have 3% left to buy, and realistically, there is nothing new they can announce until after the AGM. AGM last year was April 16th, so it's going to be a long, dark winter until they can extend the buyback sufficiently to make a difference to the price.

Despite this doom and gloom, it may be too early to conclude that the business is fundamentally broken, and the cash buys them time to turn it around. However, it would need to fall sub-60p to start looking cheap again on 2025 earnings, even adjusting for the forecast cash pile and trusting that they have now got conservative forecasting in place again.

Touchstar (TST.L) - Trading Update

H2 weighing turns into profits warning, quelle surprise!

Management now consider that the revenue for FY24 will below their previous expectation and will be broadly similar to the first half with a consequential impact on profits for the year.

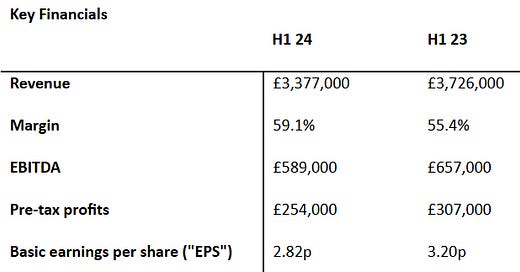

These were the interims:

So if we guess 2.5p EPS for H2, that is 5.3p for the FY, versus 7.6p last year and 8.7p forecast. So that could well be a 40% miss on EPS, and a 15x forward P/E. The 23% fall in the share price may look a little light in this case. However, they also say:

The second half is still expected to be strongly cash generative. Management's expectations for trading in FY 2025 remain unchanged.

That's also a little disappointing because the reason for the miss really was that:

a significant order due to be delivered in 2024 has now been rescheduled for rollout in 2025.

Then you'd expect 2025 to see a boost, not be flat. But in reality, they are never going to upgrade, as no one puts much faith in the 2025 numbers anyway. Here's what they said about cashflow:

Trade and other receivables were higher at H1 24 at £1,974,000 (H1 23: £1,057,000). The business experienced a high level of trading in June so those monies will flow into the business over the next few weeks. Additionally, inventories were built ahead of the expected level of activity in H2 24, these stood at £1,364,000 at the Period end (H1 23: £1,057,000). This should enable orders to be delivered and installed in a timely manner.

So inventories probably won't come down, but another £1m of cash flow could be possible from receivables by year-end. Cash adjusting the P/E, we have a 10x multiple this year, but it will drop to about 5 next year if we believe forecasts. So, possibly not the terrible news it first appears. The strategic review means that the outer may come quicker than that. However, a huge spread and lack of clarity on future trading mean we are not particularly keen to roll the dice on this one.

Ultimate Products (ULTP.L) - FY Results

Here’s the headlines:

Financial highlights

· Total revenue down 6.5% to £155.5m (FY23: £166.3m)

o As previously flagged, the decline was due to Supermarket ordering being held back by overstocking, weakened consumer demand for general merchandise, and strong prior year comparatives (which were bolstered by the exceptionally strong demand for energy efficient air fryers in FY23)

o International sales increased 7% to £54.3m (FY23: £50.7m), driven by increase in sales to European Discounters

· Gross profit down by 5% to £40.5m (FY23: £42.7m), with gross margin remaining steady at 26.0% (FY23: 25.7%), with the freight rate rises seen over the summer not impacting our financial results in FY24

· Adjusted EBITDA* down 11% to £18.0m (FY23: £20.2m)

· Adjusted profit before tax* down 14% to £14.4m (FY23: £16.8m)

Calling them highlights may be a push! However, they are more optimistic going forward:

Although weak UK consumer sentiment continues to hold back short-term sales in the UK, we are pleased to see growing momentum internationally, with strong demand for our leading homeware brands being driven by European discounters. In addition, we are encouraged by the easing of the current margin headwind to freight rates. Therefore, whilst UK trading remains challenging, we believe that gradually improving consumer sentiment and the significant opportunity in Europe will drive sales growth in the medium term, giving the Board cautious optimism for the year as a whole and hence maintaining its expectations for the current financial year.

Reading the broker's notes, it turns out that H1 trading has been weak, and they are reliant on it strengthening in H2 to make the FY2025 numbers. This is especially the case with the UK, but they are also dependent on growth continuing in Europe and freight rates falling back. So we’d say this is a soft profits warning.

The overstocking issues at these [German] supermarkets impacted demand for such [SDA, cookware] products, which led to the 15% (£7.4m) fall in overall Houseware sales. A separate effect of the overstocking issues can be seen in the growth of our small Clearance division, which saw sales increase 269% (£10.6m). As mentioned above, the Clearance division used to be core to the Ultimate Products business. Although in recent years it has been surpassed by our branded offering, it continues to enjoy longstanding partnerships with big brands, helping them manage their end of line and overstocking while still protecting their brands and core distribution.

The increase in clearance was also evident in the UK when Leo visited the Autumn Fair. The buybacks continue, which may support the price, while management believes that this pause ends and growth returns.

That’s it for this week. Have a great weekend!