There was no LCL this week due to the Queen’s funeral.

In small caps, the Interim Results season continued with pace. However, this was overshadowed by political news continuing to drive a large sell-off in the pound versus the dollar. In such an environment, we strongly prefer companies with large amounts of dollar earnings. However, sooner or later, UK domestic stocks are going to end up so cheap that they will be hard to ignore, despite the large macro headwinds in the UK.

Mark also continued his article series for Stockopedia, looking at some of the picks from his earnings-based screen. Subscribers can check out this, plus previous articles here.

Strix (KETL.L) - Interim Results

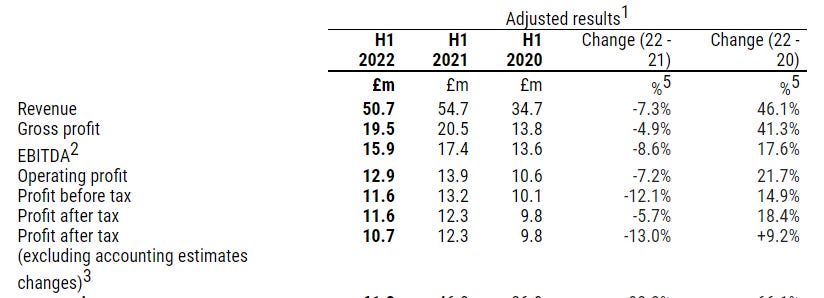

The management describes these results as “Robust”, but with all metrics down, including PAT down 9.7%, we’d hate to see fragile results!

Who knew kettle sales would be so discretionary!

They maintain their interim dividend, but net debt is increasing, so this isn’t being paid from FCF. This is the FY guidance:

In light of the significant and well-publicised macro headwinds which have resulted in a reduction in demand in the key export markets, adjusted profit after tax consensus for the full year is anticipated to be in range of £27m to £29m.

That’s a bit weird. Are they quoting current analyst consensus, or is this their guidance? If it’s analysts’ consensus, then they don’t actually say they are in line. If it is the company’s consensus, then do the board members disagree on the potential outcomes!?

PAT was £10.7m in H1, so this leaves a lot to do in H2. Stockopedia has £31.5m, so in reality, this looks like a small profit warning. You could argue that the share price has been expecting this, though.

It also depends which profit value they are referring to, as well. They have changed the useful life of some production machinery, which will reduce depreciation and increase PAT. They flag this to shareholders, which is a positive, but then without this change, it would presumably be a bigger miss.

A forward P/E of 10 was starting to look good value, but much less so when you add in the £61.3m net debt and consider that they now look like they will miss the EPS figures that this rating would be based on.

The share price suggests that the market agrees that this was a profits warning.

Smiths News (SNWS.L) - Post-Close Trading Update

The Board expects Adjusted EBITDA (ex. IFRS-16 leases) for the 52 week period ended 27 August 2022 to be not less than £40m, ahead of market expectations.

The market clearly wasn’t expecting this as the price had been weak recently. However, perhaps the key word here is adjusted, since they also say:

As outlined in our announcements on the administration of McColl's Retail Group in May 2022, the administrators have confirmed that unsecured creditors can expect to receive estimated distribution prospects of between 20% and 40%. The Company has provisioned, as an exceptional, for the bad debt risk at £4.4m, at the lower end of the guided range of distribution prospects, which will impact statutory profit after tax for the full year.

So this is a beat if you exclude the bad stuff that happened!

Still, this was at least known by the market, whereas the better trading wasn’t. And it means they can continue to return significant cash:

Given the good performance of the business, the Board continues to expect to be in a position to recommend a final dividend for FY2022 of no less than 2.7p per ordinary share held, taking the total dividends for the year up to the full distribution permissible under the Company's current banking facilities (£10m per financial year), for payment in February 2023.

This is a 14% yield. This company remains a melting ice cube, but it may be melting less quickly and more profitably than investors have given it credit for.

Biome Technologies (BIOM.L) - Interim Results

These were not great results for what is meant to be a growth business in an exciting green tech area:

The Group generated revenues of £2.4m (H1 2021: £2.6m) and gross profit of £0.9m (H1 2021: £0.9m)

The usual issues are given as way of explanation:

Biome Bioplastics is also experiencing other customer launch delays related to raw material supply, logistics and uncertainty of end-consumer behaviour in the current economic climate, all of which have and will have an impact on the revenue generation of this division

The only bright spot is that the original part of the business that they pivoted away from seems to be doing well:

The Stanelco RF Technologies division is working to deliver the major contracts announced previously. Elongated lead-times for critical components, particularly electronics, have delayed some shipments. However, key issues have been resolved and these shipments have or are expected to occur in H2 2022 with revenues from this division in the second half expected to be above previous Board expectations

Overall they manage to issue a “substantially below” profit warning not just for this year but next year as well! And are resorting to working capital finance.

This company presented at Mello in Chiswick pre-COVID, and Mark liked the story until he saw how much the board paid themselves. If they really believed in the environmental benefits of this technology, surely they would have taken a smallish salary and options while the business builds to a commercial scale. Instead, they paid themselves like they already had a successful company. They may well have killed the golden goose this time.

Warpaint London (W7L.L) - Interim Results

· Group sales increased by 37% to £25.2 million in H1 2022 (H1 2021: £18.4 million)

· UK revenue increased by 17% to £10.4 million (H1 2021: £8.9 million)

· International revenue increased by 55% to £14.8 million (H1 2021: £9.5 million)

· Gross profit margin increased to 39.0% (H1 2021: 34.5%), despite continued supply side price inflation and higher than historic freight costs

Impressive to be driving both high sales growth and increased gross margins in the current consumer environment. As we’ve seen with competitor Creightons, one usually comes at the cost of the other at the moment. The outlook is much more positive than Creightons too:

We are well capitalised with a healthy balance sheet and have significant opportunities for further growth, both already planned with customers and additional ones in discussion. I am confident that the Group will continue to perform well for the remainder of the year and beyond.

The 2022E P/E is 13.5, and broker forecasts are for modest EPS growth 2022-23. So not cheap for a consumer stock in the current market, even one executing well.

Thruvision (THRU.L) - Trading Update

They announce a new follow on order from US customs:

The Company has been awarded a further contract, totalling $2.7 million, to complete the process of upgrading US Customs and Border Protection's (CBP) existing fleet of Thruvision 8-channel units to the latest 16-channel variant, running Thruvision's AI detection algorithm.

Looks like this was already expected, though:

This latest contract, awarded via Thruvision's US Government contracting partner, is a follow-on order to the one received in the second half of FY22 and is in line with the Company's expectations for FY23.

But it looks like profit protection will only be flat versus last year due to weakness in the retail sector:

Our other key market is retail Profit Protection, where the economic situation has obviously become more challenging for retailers since our April update. Trading in the current financial year to date has been consistent with the same period in FY22. Sales activity levels are also consistent with last year as we head into our historically busiest period for order intake.

They say results to 31st March are due at the end of September due to audit manpower issues and increased scope. They sell mostly physical goods and so material audit findings seem unlikely. But this is cutting it pretty fine versus a potential suspension, so let’s hope there are no further delays.

Hostmore (MORE.L) - Interim Results

The headline numbers look good, but this is compared to a period with a lockdown so not really like for like:

The outlook is weak, however:

LFL revenue for the 10 weeks since the reporting date is 14% lower than the FY19 comparable period and reflects the impact of weaker consumer demand and other factors including rail strikes (which are expected to continue periodically in the second half) and heatwaves; this impact has been partially offset by ongoing cost saving initiatives.

This perhaps should be expected. However, the market reaction suggest it wasn’t!

The guidance is weak too:

In the absence of further Government support measures having been confirmed and considering both the uncertain consumer demand and the enduring inflationary environment as we enter our traditionally busiest period of the year, LFL revenue expectations for the second half are now forecast to be 11% lower than the FY19 comparative.

But perhaps is now superseded by the mini-budget today?

The company is clearly in cash preservation mode, so the relatively weak balance sheet and net bank debt don’t put them in a particularly comfortable position. Management must think they can survive, however, as they are buyers of the shares this week.

Xaar (XAR.L) - Interim Results

The revenue growth looks good here, especially as it is accompanied by gross margin expansion, too:

Despite these positives, it is still not managing to make them profitable. This turnaround story seems to be taking forever.

They guide in line for the second half, but that’s hardly challenging when forecasts are for just over break even. At a £172m market cap, there is a whole lot of hope still built into their valuation. Strangely, this is one speculative company that hasn’t been pummelled by the current bear market.

They have net cash of £12.7m, but this doesn’t move the valuation dial much with the current market cap. It does provide a level of security. However, they had a £7m operating cash outflow in the 6m period due to working capital requirements, and it wouldn’t take much more of this to see the cash dwindle away to nothing.

The outlook is strong:

There is positive momentum across the Group and, while remaining vigilant to macro-economic conditions, principally of cost inflation and the ongoing impact of COVID-19 related 'lockdowns' in China, we are confident in and excited by our future and look forward to the launch of our aqueous printhead later in the year.

However, the CEO always sounds confident here, whatever happens. And with a forward P/E of 45 for 2023, any further delays in generating sustainable profit growth should be punished by the market.

That’s it for this week, have a great weekend!