A reasonable amount of news this week, and quite a lot of good news for a change…enjoy!

Journeo (JNEO.L) - Trading Update

Not a huge beat, but a beat nonetheless:

Revenue for the full year is expected to be approximately £50m, marginally ahead of current market expectations, with adjusted profit before tax expected to be £0.4m ahead at £4.8m.

This is totally at odds with what the share price has been telling us, so it is not surprising that the shares were strong this week as they recovered from an oversold position.

They have seen positive trends in all areas:

Within the Fleet Systems division, revenue increased by 16% to £9.2m (H1 2023: £7.9m) and within Passenger Systems, revenue increased by 13% to £5.2m (H1 2023: £4.6m).

Infotec and MultiQ continue to trade strongly delivering revenues of £8.5m and £2.7m respectively in the period and each has a number of significant sales opportunities in the pipeline. Sales order intake increased by 33% to £24m (H1 2023: £18m).

However, this takes the shine off:

Infotec has been advised by its US customer that as a result of passenger ridership on the New York City subway running at 58% of pre-pandemic levels, the next phase of new subway trains will have printed advertising, rather than digital advertising screens. Wiring will however be installed such that if passenger numbers recover, digital displays can be retro-fitted.

However, Cavendish have now added FY25 expectations, which shows a slight increase in profits on the upgraded FY24, so the New York City subway news seems to have minimal effect.

Management here has tended to under-promise and over-deliver lately, meaning a sub-10 P/E, once you adjust for net cash, still looks a little miserly, even after this week’s rise.

Jadestone (JSE.L) - Trading Update & Akatara Gas Sales

A mixed week for Jadestone. The shares were weak at the start of the week, as their trading update had them narrowing their production guidance range down slightly. However, they also reduced the upper end of the range of costs as well, with good news at Montara, at last:

Recent inspections of two further central oil storage tanks, and their associated water ballast tanks, found them to be in better condition than expected, providing confidence that further oil storage capacity will become available in the second half of 2024. This has already allowed Montara operations to continue without a shuttle tanker for most of July 2024 and, in line with previous guidance, the Company expects that the shuttle tanker operation will be phased out in Q4 2024. The H6 and Swift-2 wells at Montara are expected back online shortly after repair work which is currently in progress, and this should result in an increase in Montara production.

To do 20kbopd for the full year, they would need to average 23.1kbopd for H2, and their exit run rate at the end of the year is closer to 25kbopd. So this is very significant growth, led by Akatara. Gas sales here were said to be imminent on Monday and hey presto, the RNS arrived on Wednesday. There are local sales, LPG, and condensate, so this should generate significant cash flow. However, the price has not recovered, and the market still seems to be wary about trusting them to deliver. It may not be possible for the market to ignore the cash flow if/when it arrives, though.

National World (NWOR.L) - Half-Year Results

Strong results and outlook here:

Revenues in July have increased by 13% year on year. The Company will continue to benefit in the second half from three key drivers - the acquired businesses, new launches and relaunches of heritage brands. Tight cost management remains a critical factor as in the whole sector.

Adjusted EBITDA of £5.0 million, up 61% and adjusted operating profit of £4.7 million, up 62%.

Not all of this is organic, where revenue is likely flat, if not down slightly. This would be much better than Reach, though, which they have an apparent dig at:

The Company's primary focus is to build a sustainable and monetisable content business, embracing its news provision tradition but with a wider agenda across all platforms. This pivoting of the business has continued unabated despite the economic headwinds in the first half.

Broker Dowgate join in the Reach pile-on:

Balance sheet. Net cash finished the period at £13.0m, equal to 5p per share. The group has no defined benefit pension obligations or earnouts.

They also say:

We view the encouraging H1 results as firmly underpinning our FY24 PBT/EPS estimates of £11.0m/3.0p.

This is down from 3.1p but a very minor change. There is scope for their dividend forecast to be beaten, though, as National World has declared an interim dividend for the first time. They don’t say if they will reduce the final dividend accordingly but think there is a chance that this beats expectations for payout. The high dividend payout is one of the reasons some investors take the risk with Reach. However, fast forward a few years and Reach may be forced to cut theirs, given the weak balance sheet there, so National World may overtake their yield unless prices change to reflect the valuation disparity.

Like Reach, National World is a company that likes their adjustments, and for both companies, you could argue that restructuring is part of their business model, not a one-off item. Here, the figure has reduced to £ 0.6m from £1m, and the rest of the exceptional are goodwill write-downs, which we think is usually correct to adjust out,

So Mark would go for £4.1m operating profit, not the £4.7m declared, to be the true underlying, but this makes it still pretty much the cheapest UK trading company on an earnings basis.

So far, the share price rise has been modest, reflecting the confident but in-line outlook. However, this doesn’t even reverse the drop on no news that happened over the last month, presumably from boredom amongst smaller investors.

Running the numbers and assuming the restructuring costs are part of normal business and adjusting for cash, then this works out to be a P/E of 5.7 for FY24 and 5.1 for FY25 at the current buy price. On the same basis (and including agreed cash payments to the pension trustee), Reach is on 10.3x for a much riskier business that, in our opinion, is not run as well. We get the concerns with declining revenue and why some may want to avoid the sector, but it seems nonsensical that investors would prefer Reach in the sector on double the rating.

Paypoint (PAY.L) - Trading Update

This seems a very upbeat statement, especially on the Parcels side:

Strong transaction growth of 66.7% to 32.0 million parcel transactions (Q1 FY24: 19.2 million)

They make it sound a bit like this could be quarter on quarter, but with a year-end of 31st March, Q1 FY 24 was the quarter to 30th June 2023. But this is still excellent, as is the quarter-on-quarter growth in the network:

Collect+ network increased to 13,085 sites (31 March 2024: 11,786)

However, the investments in Yodel and Obconnect and higher debt levels make us slightly nervous:

The Group had net corporate debt of £81.2 million (31 March 2024: £67.5 million), comprising cash balances of £8.5 million (31 March 2024: £26.4 million), less loans and borrowings of £89.7 million (31 March 2024: £93.9 million).

Since then they announced a further investment:

The investment comprises the £3.0 million original convertible loan note, which will now be converted into ordinary shares along with a new investment of £10.5 million in cash which, combined, will give PayPoint a 59.3% interest in obconnect.

Which would see net debt possibly approaching the £100m level. They still seem to be happy with the buyback, though which they have been pursuing reasonably aggressively. Which has just tipped the largest holder over a 30% holding. However, they confirm a waiver for Asteriscos to go over 30% due to the buyback, without making an offer.

Robert Walters (RWA.L) - Half-Year Results

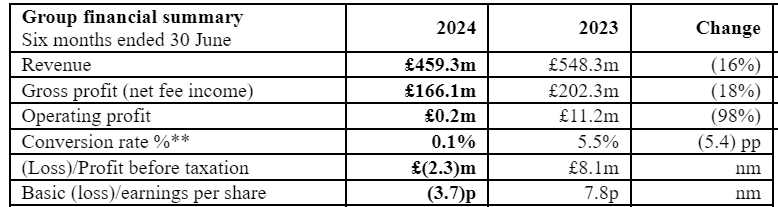

It’s tempting to think that these figures were largely known as they had previously released the NFI numbers:

However, we are not sure the dip into loss-making for H1 was expected. Stockopedia has a 10.1p EPS consensus for the FY vs. 19p for 2023. So, to hit these, they will need to do 13.8p in H2 vs. 11.2p last year, with NFI likely down double digits. Seems a stretch to us.

Also, the net cash balance fall looks worse when compared to last year rather than Q1:

Balance sheet remains strong, with period-end net cash of £48.8m (30 June 2023: £69.8m).

Although this was known, it is now only 18% of the market cap, so it has less impact on valuation. Somehow the shares continue to defy gravity.

SDI (SDI.L) - Final Results

Broker Progressive had to use the word “resilient” in their note title, so things must be bad here!

Revenues of £65.8m (FY23: £67.6m). Constant currency organic revenue decline of 0.5% when £8.5m of FY23 Covid-19 revenues are excluded. 10.7% revenue growth from acquisitions

So that’s organic growth of about -11%. Which is promptly followed by a FY25 profits warning:

Improved staff incentivisation (below Board), and a conservative view on certain sales opportunities, results in a reduction to FY25 guidance**

This leads to a 20% cut in Cavendish forecasts but at least they had the good grace to tell you to look out for the guidance cut. They say they are targeting 6-8% organic revenue growth but need to add headcount to deliver it. Forecast EPS is now 6p, so you could say 60p fair value, and it’s not that far off that level. However, Cavendish doesn’t seem to put a lot of faith in their 6p EPS forecast.

When things were going well, SDI had excellent segmental reporting. Now things have gone wrong they seem a little shy to explain why. This means that the risk is now to the downside, and if you were to buy, you’d want 40p or below to reflect these concerns. In light of this warning and lack of visibility, the shares appear to have under-reacted to this week’s news.

Severfield (SFR.L) - AGM Statement

In-line statement, but with a certain amount of positivity for long-term trends:

As highlighted in our 2024 full year results announcement in June, market conditions are showing signs of improvement although pricing remains competitive for some projects in our shorter cycle sectors, including in the distribution sector. Looking further ahead, our businesses remain well-positioned to win work in markets with positive long-term growth trends including those which are driving the green energy transition.

The order book down slightly:

The Group is pleased with the continuing high quality of the UK and Europe order book which stands at £460m at 1 July (1 June: £478m), of which £369m is for delivery over the next 12 months. The order book remains well-diversified and contains a good mix of projects across the Group's key market sectors. The composition of the order book reflects the continued strengthening of our market position in Europe, with 32 per cent of the order book representing projects in continental Europe and Ireland (1 June: 32 per cent).

But this looks to be more timing than any change in trend.

The Group's cash and balance sheet position remains strong

Not that there were any fears here, but it would be nice to have had the actual numbers. This means the company is on a P/E is 9 on improving trends:

So surely this is still too cheap for a company at the start of the upcycle.

Sylvania Platinum (SLP.L) - Q4 Results

Another weak 4E PGM production quarter sees them come in at the lower end of their guidance for the year. Lower grade and recovery down a little are the reasons. However, they managed to produce a slightly higher byproducts volume this quarter.

Improved pricing means that they managed to largely maintain their EBITDA at $2.8m vs $3.2m the previous quarter. This is less than capex in this quarter and only just above sustaining capex on existing operations. The majority of their earnings for this quarter were from interest earned on their cash balance.

The problem is that PGM prices have been weak post-quarter-end and unless pricing improves, next year will see EBITDA of around $6m versus $13m for the year just ended. Capex will continue to erode the cash balance, which means the company is on a forward EV/EBITDA of around 15. This is far too high, given where they operate.

Many will hold this as a geared play on PGM pricing recovering, and if it does, then this may look cheap again, but when PGM was high, this traded on an EV/EBITDA of 1-2, so the upside is probably limited, and the downside still present if there is no recovery, depsite the presence of a large cash balance.

That’s it for this week. Have a great weekend!