If last week was the week for companies to all issue in-line trading statements, this week was the one that they all chose to release profit warnings. Or perhaps poor H1 results, but with a claim that they’d make it all back again with an unusually strong H2. The market rarely chose to believe them.

This has highlighted how bonkers the UK small cap market has been recently. Most stocks have been weak, apart from the odd few that have followed a pattern where they start a small move upwards in illiquid markets; investors jump on it, thinking someone else must know the results are good, despite no upgrades in broker forecasts or other good news. Then, short-term traders jump on the bandwagon, taking the price above any rational level based on news flow. In many cases, the underlying trading is weaker than expected, and the company warns rather than beats expectations.

For example, IG Design (IGR.L) doubled on a very slight, heavily-adjusted beat in April this year, only to profit warn this week and look to give it all back. This left their broker Canaccord with an egg on their face, as they must surely now regret titling their July note "Price weakness presents buying opportunity" when the shares were £1.90.

We guess those who can call these types of moves correctly make money. However, it has a lot of the features of gambling rather than investing, and most gamblers lose in the long term.

Andrew Sykes (ASY.L) - Half-Year Report

These results essentially flat on last year:

But the outlook is weak:

Trading in the second half of the year to date has been more subdued than in the comparable period of last year.

Cost cutting saves the day, though:

The Group's focus on continued cost control and operational efficiency will continue to limit the impact of these subdued revenue opportunities. Overall, Management remains confident of delivering full year results in line with the Board's expectations

There are no market expectations, so we can only guess what they might be. This remains a cash machine, although one where the management is unable or unwilling to invest in growth. So, the main attraction remains the dividend payout. The main dividend is around 4.7%, which isn’t bad but not worth holding for alone. It depends on your view of how much they can pay out in special dividends in the future as to the relative attractiveness of owning the shares.

Card Factory (CARD.L) - Half-Year Report

Shareholders here were greeted with an unpleasant gift this week as these results were so bad that the company had to lead with the R-word:

Resilient revenue performance with further strategic progress achieved including successful partnerships expansion.

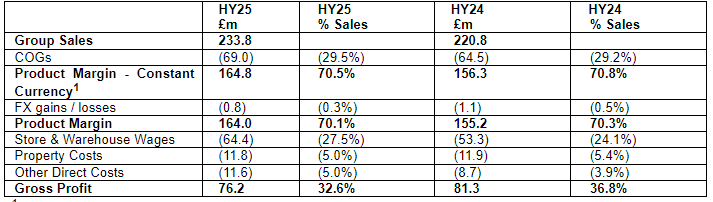

Normally "Resilient revenue" means just short of a total collapse, but in this case, it isn't too bad, growing around 6%:

But it is easy to see why they may want to draw our attention to the revenue line. PBT was -43% !

It is clear that it is wage costs that are the issue:

We wonder if they could also have a Next-style wage issue in the future to add to their woes? In terms of outlook, they say:

Albeit we are yet to trade through the key Christmas period, the strong topline performance in the first half, combined with our robust actions to mitigate inflationary pressures, means that our expectations for the full year are unchanged.

But given these interims, the risk must now be to the downside. And the market certainly called their bluff, with shares dropping from over £1.40 to £1.06 in response to these results. So this is yet another stock that was bid up by over 50% on no news and looks set to give it all back. It is tempting to think that this is a buy once the shares settle back down towards the 90p level. However, these results mean the chance of a warning is much higher now than it was when they last traded at that level. It is naive to think that a warning when it comes won’t hit the share price further.

DigitalBox (DBOX.L) - Interim Results

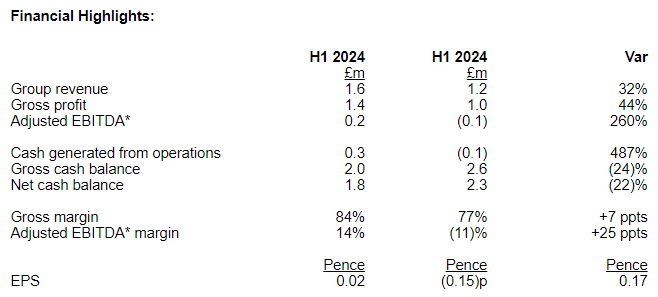

All the numbers are pretty positive here apart from the cash balance:

But it is worth noting that these are not organic growth due to acquisitions, and they don’t break these out.

They say that they are trading in line with market expectations for the full year. Their broker, Panmure Liberum, thought these were ahead but say:

With the key trading season ahead it is too early to upgrade estimates but our confidence in our forecasts is increased.

If one is willing to net off the cash, it makes it pretty much the cheapest share in the market. However, it must be noted that National World is not far off this rating and has much better media brands.

This is an interesting statement:

We anticipate further consolidation across the market as media companies look to grow audience and extract cost synergies. Digitalbox is alive to all strategic options these opportunities present and has the tools and technology to further grow brands it is engaged with.

Last time they said:

Having successfully built a larger portfolio from our cash reserves, we continue to remain vigilant for fresh acquisitions that not only suit our model, but also could offer a quick return on our investment (ROI). With a strong track record of achieving a relatively quick ROI, we expect the general market conditions in 2024 to present further opportunities.

So it sounds a lot like they would also consider accepting an offer for the business, as much as building scale by acquiring further digital media sites themselves. Perhaps National World would be interested. The business case on a purely financial level easily stacks up, given they would get a fair amount of cash back almost immediately and save £300k listing costs that are certainly hurting profitability and cash flow for this size of company.

The remaining overhang of the Downing Strategic Microcap Fund stake is perhaps a risk and an opportunity, as they will be keen to maximise their short-term return.

Dialight (DIA.L) - Saminina Litigation

On Tuesday, we got this rather terse statement:

The Company is currently reviewing the detailed jury verdict and judicial rulings in conjunction with its legal advisers and will release a further announcement as soon as there is greater certainty over the implications of the verdict.

It was only the 28% fall in the share price that gave a clue that the verdict was largely not in their favour. But it would be nice if they actually said this rather than that they are reviewing the judgment without giving any indications of what the judgment was. The next day, they said:

The jury awarded damages of $0.9m to Dialight in respect of Sanmina's breach of contract, and awarded c.$5.3m in damages against Dialight in respect of Sanmina's AR claim and c.$3.4m in damages against Dialight in respect of Sanmina's E&O claim.

The Company is considering potential post-trial motions in respect of the levels of damages, interest payable and legal costs. It is also reviewing its options with regards to appeal.

While we don’t know the costs, the initial thought is that a 28% drop is an overreaction. However, a quick look at the chart reveals that this is yet another company that was bid up for absolutely no reason, and the fall simply reverses this irrational exuberance:

Indeed, this has been a serial underperformer ever since we can remember. Every now and then, a new set of shareholders come in thinking, “it can’t be that bad” before realising that it is.

Personal Group (PGH.L) - Interim Results

Reasonable growth here:

But more importantly:

Trading in Q3 2024 continues to be in line with management's expectations. This combined with the Group's growing proportion of recurring revenues underpins the Board's confidence in achieving market expectations for the full year

They cite strong new insurance sales, robust insurance retention rates and high / increasing recurring revenues to support this. Given the H1-H1 increase, it would seem current broker forecasts are conservative.

A broker change, with different ways of adjusting the figures makes comparisons difficult. But it is clear that revenue is now forecast to slightly miss the £44.6m Cavendish gave in July, with Canaccord now saying £43.6m.

This is also very H2 weighted: Basic EPS of 5.4p (H1 2023: 4.5p) versus FY 16.4p (15.1p). But that still means 11p to do in H2 to hit forecasts vs 10.6p the year before. So, we can see why they would want to hold some in reserve rather than upgrade. There is a long way to get back to pre-covid trading, though, which is both a risk and an opportunity.

Regardless of whether this is a minor disguised revenue warning, the most impactful thing from today is the introduction of forecasts showing strong future growth. For whatever FY 2026 forecasts are worth, they say an EPS of 24.0p and cash increasing to £28m despite paying high dividends growing to 19.2p. That surely implies good returns on the current market cap, as long as the FCA doesn’t get involved with their insurance operation.

SDI (SDI.L) - AGM Trading Update

This is another company travelling hopefully. They say in line but more H2-weighted than usual.

Profit and revenue delivery in FY25 will be weighted more towards H2 than in FY24 due to the current financial year starting slowly, reflecting conditions in certain customer markets.

The market doesn’t seem to believe them, and it marked the shares down in response. We’re not sure we’d be willing to take the contrary view here, as another miss seems by far the most likely outcome.

That’s it for this week. Have a great weekend!

Highly interesting as always. Thanks for sharing!

Completely agree with your opening paragraphs.

keep up the great work!