The return of positive sentiment in UK small caps continues. However, some of it is certainly unwarranted, as we saw with the profits warning from Ultimate Products last week and a possible warning from Macfarlane. Both shares had been bid up by individual investors, who were clearly wrong-footed by the actual trading performance of the businesses. Still, it means that shareholders received a flesh wound rather than the amputation they would have received if these companies warned six months ago. So it remains a tricky market to navigate, but one we’d happily take versus the doom and gloom of recent times.

Mello London

We will be at Mello London next week, with Mark doing a talk called “Should I invest in the best?” as well as being part of the BASH panel one evening. Company presentations, great speakers and conversation with fellow investors - what’s not to like? And it is not too late to join us. Tickets here, and use the code Simpson50 for 50% off.

Angling Direct (ANG.L) - Final Results

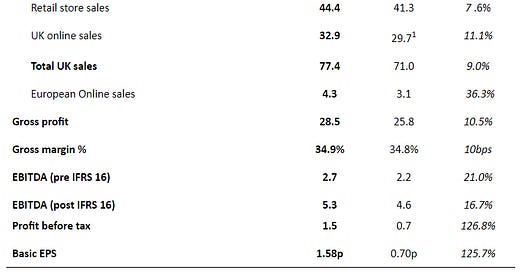

These look pretty good, with 10% sales growth showing significant operational gearing as you go down the income statement:

The 1.58p EPS for the year looks a decent beat on the forecast 1.1p in Stockopedia, but is still a historical P/E of 23 and a forward one of 20.

Although the cash balance has increased, the UK store LFL is 3.1%, so they have partly bought the revenue growth via store roll-outs. Q1 growth more pedestrian, and again, not LFL:

Total Q1 FY25 sales increased 4.0%, achieving growth in the UK and Europe

In the UK, acquired two existing store catchments and opened one further new catchment in Q1 FY25

There is no dividend as they continue to open stores, but retained profits mean Net Assets are growing:

The consolidated statement of financial position remains robust. As at 31 January 2024 the Group had a net asset position of £38.5m (FY23: £37.3m) and a net current asset position of £24.3m (FY23: £23.7m). The Group includes £0.3m of net assets and liabilities of its wholly owned subsidiary ADNL B.V.

This has a £28m market cap, so only just above NCAV, and those assets are starting to become a little bit more productive. There’s still a long way to go to a high ROCE, though. This was just 4% in the year just reported and certainly below their cost of capital.

Gulf Keystone Petroleum (GKP.L) - Operational Update

Both local sales and pricing improving:

Local sales of Shaikan Field crude continue to be robust with gross average sales in 2024 year to 11 May of c.37,000 bopd

Following strong sales in March of c.44,100 bopd, April sales were down slightly to c.38,900 bopd due to the temporary impact of Eid celebrations on truck availability. Volumes have since recovered, with sales in May to date averaging c.48,300 bopd

Realised prices have recently increased from c.$25/bbl to c.$27/bbl, reflecting continued strong local market demand

Based on current guidance, they should be producing revenue of approximately $13.6m/month. With costs and capex at $6m/month, this means FCF has gone from c$4m/month to $7.6m/month. On top of this:

GKP’s liquidity position has continued to improve and the Company’s cash balance was $98 million as at 10 May 2024

This is starting to look like they no longer need the pipeline to reopen to be undervalued. Unlike pipeline sales, they get paid for local sales too! The $10m buyback also announced this week should focus the market attention.

Headlam (HEAD.L) - Trading Update

The pain for shareholders continues here:

Revenue in the Period was down 12.3% year on year, with the UK down 11.6% and Continental Europe down 16.9%1. Revenue in April did not show the expected seasonal uplift usually seen in the Spring period.

It is hard to tell if this is weather-related, a wider housing industry weakness or specific to the aggressive competition Headlam faces from Likewise. Either way, the result is a big loss for H1:

Despite tight cost management and other mitigating actions, the lower revenue has impacted our profitability with a pre-tax loss for the Period of £10.6 million.

The overall result being:

For the full year we expect profit to be significantly below current market expectations.

Ouch! The share price was only down 10%, presumably reflecting that this now trades at 0.6TBV. Perhaps even less if you take their property revaluation:

This strong liquidity position is expected to be further boosted in the coming weeks with the cash receipts from the disposal of a surplus property in Stockport for around £7.5 million, which is significantly above book value. Following this disposal, the Group will own property valued at £142.1 million2.

2. Based on the market valuation undertaken in January 2023

Versus this from their results to 31st December 2023:

However, the net debt is on a worrying pathway:

At the end of April, net debt was £43 million and the Group had nearly £60 million of cash and undrawn facilities available.

Versus year end:

Net Debt excluding lease liabilities was £29.6 million at the end of the year, an increase of £31.4 million from 31 December 2022.

This doesn’t look fatal, particularly as it can be secured against property. However, cash will likely be going towards debt repayment in the short term. Long term, they claim:

Longer term, we expect our market to recover and there is no change to the indicative long-term revenue potential of the Group of £900m to £1bn as set out in March 2024, which together with our transformation programme, is expected to see the Group return to, and beyond, historical levels of profitability.

However, it may be wise to wait until all the bad news has come out before investing for any recovery.

Hummingbird Resources (HUM.L) - Operational Update

At last, some good news from this accident-prone miner:

Hummingbird and Corica (the "Parties") have agreed to remobilise Corica equipment to site and continue the ramp-up in operations towards commercial production at Kouroussa.

This has taken two months to resolve and has put the company’s plans back, despite them utilising other contractors in the meantime. Indeed it seems they still need those in place to make up for Corica’s inability to deliver the original mine plan:

An agreed operational plan is being implemented by Corica and is anticipated to fully ramp up by the beginning of Q3-2024. The plan will be augmented by the previously announced additional ETASI fleet, which is currently being mobilised, and is expected at site over the coming weeks.

The biggest news is that there has been no emergency placing to cover the shortfall. Instead:

To facilitate a smooth transition back to full operations by Corica, CIG has agreed to provide the Company with a short-term loan of US$10 million (the "CIG Loan"). The CIG Loan will be provided in tranches, is unsecured, attracts interest at a rate of 14% per annum and has a maturity date of 30 September 2024, which can be extended by mutual agreement.

That’s a fairly short term loan and a high rate (although perhaps not given the risks here) so the pressure is on for management to deliver in the short term. Although sounds like they may still need to re-term some of the existing debt:

The Company remains in discussions with its primary lender, Coris Bank International ("Coris"), surrounding the mitigation of the financial impacts of the suspension in operation and will provide an update in due course.

So, it's pretty high risk, but also pretty high reward. If they can deliver 200koz at less than $1500/oz AISC, then their $250m EV compares very favourably with something like Pan African, which has similar production and a $700m EV. The presence of the debt magnifies the returns to equity, assuming they can get away with no further dilution. It's only for the very brave, though.

Luceco (LUCE.L) - Q1 Trading Update

Strong start to the year and comfortably in line with expectations:

The Group has performed strongly in the quarter.

· Q1 2024 revenue at £51m, +6.2% year on year and +4.5% on a like-for-like basis.

· Adjusted operating profit increased 30% year on year, benefitting from the end of de-stocking pressures which ended in H1 2023.

· Adjusted operating margin improvement year on year, driven by strong operational leverage.

They are starting to see momentum in their favour, which marks this out as the quality operator we know it is.

There are a couple of risks, namely the risk of margin erosion for car chargers and bad debts. The current valuation is also high compared to recent history and requires either a) a widespread smallcap revaluation or b) significantly higher than Q1's +4.5% YoY LfLs or c) continued operating margin improvement.

The good news is that, once you factor in the implied balance of probabilities, quite possibly, all these things will happen. The operating profit rise of 30% in Q1 compares to an EPS growth forecast of 11% for the full year in Stockopedia. Liberum say:

We leave our estimates unchanged but increase our target price from 170p to 192p to reflect the sector re-rating.

Or to put it another way: "It got close to our previous target so we raised it". Again underlying that it is no longer obviously cheap.

Treatt (TET.L) - Half Year Results

Revenue & Gross Margin down from already pretty low levels:

28% margin certainly doesn’t scream a strong competitive advantage.

However, profits are up, presumably from aggressive cost-cutting, although no details are given on how these are achieved. They guide in line for the full year. They have the dreaded H2-weighting but with good visibility, so this is perhaps less risky than others in similar situations. Paying a forward P/E of 20 for such a performance seems daft, though.

That’s it for this week. Have a great weekend!