Small Caps Live Weekly Summary

CARD OMG RST RWS THRU

A return of one of our favourite features this week:

Questions submitted by investors but not mentioned in company presentations:

Oxford Metrics

The management team here seemed keen to wrap things up on their IMC presentation, ending it at 37minutes, and this persistent offender left a couple of questions unanswered:

The company has an Enterprise Value of just £16m, making it a microcap on the UK market, and one where individual investors tend to set the market price. Why then does the company present to only analysts on the morning of results (but after those analysts have already published their updated notes), yet the vast majority of the owners of the company have to wait almost 2 days to hear from management?

The company’s analysts’ forecasts vary significantly. For example, Panmure Liberum have 2.3p EPS for FY26 and 2.7p EPS for FY27. Progressive are far more optimistic with 2.8p and 3.2p for the same periods. Panmure‘s dividend forecasts are flat, whereas Progressive are forecasting significant rises. This makes it difficult to value the business. How do the company view the large variation in forecasts?

Here’s a selection of what we discussed this week. (Remember this is a summary of many opinions, and isn’t the view of any one commentator; check out the actual discussion on Discord if you want the nuance of the different opinions.)

Card Factory (CARD.L) - Trading Statement

This starts off reading like a profits warning:

Over recent months, the pressures facing the UK consumer have been well publicised. It is an inescapable fact that these pressures have impacted consumer confidence and shopping behaviour, contributing to soft high street footfall

Which quickly becomes explicit:

…conditions have persisted as we moved into our most important trading period, leading to a UK store sales performance which is lower than our previous expectations.

Helpfully quantified as:

On the assumption that current trading trends persist over the remaining seven weeks of our financial year, we now expect to deliver adjusted Profit Before Tax for the full financial year between £55m and £60m.

Unhelpfully, they don’t provide previous guidance or market consensus. At the Half Year, they said:

…expectations of mid-to-high single-digit percentage growth in Adjusted PBT in FY26 are unchanged

Let’s say they meant 7% and their adjusted PBT last year was £66.0m, then they were saying £70.6m before this update. So this is a 19% downgrade to adj. PBT, and we are guessing the new consensus will be around 12.2p EPS, assuming the tax charge doesn’t change as a percentage.

There is a further risk here, as this is an example of a company that could be affected by flu in the next few weeks. On the plus side, it was cheap on forward earnings prior to today’s warning. As such, 26% down looks a slight over-reaction, given that it was already on a P/E of 6. That neither Singer nor Edison can be bothered to update us particularly quickly doesn’t build confidence, though. And it could be argued that, if it was trading at 6x forward earnings on 10% EPS growth rates, 5x is more than fair for declining EPS.

When forecasts did finally arrive from Edison, a 12.26p FY26 number made our previous guesstimate look like it was on the money. We assume the “e” indicating estimate next to forecasts for the year ending January 2025 is a mistake, which does make you question the rest of the Edison note, but this is a common error we see on Brokers’ notes, including ones that are normally considered higher quality.

Oxford Metrics (OMG.L) - Preliminary Results

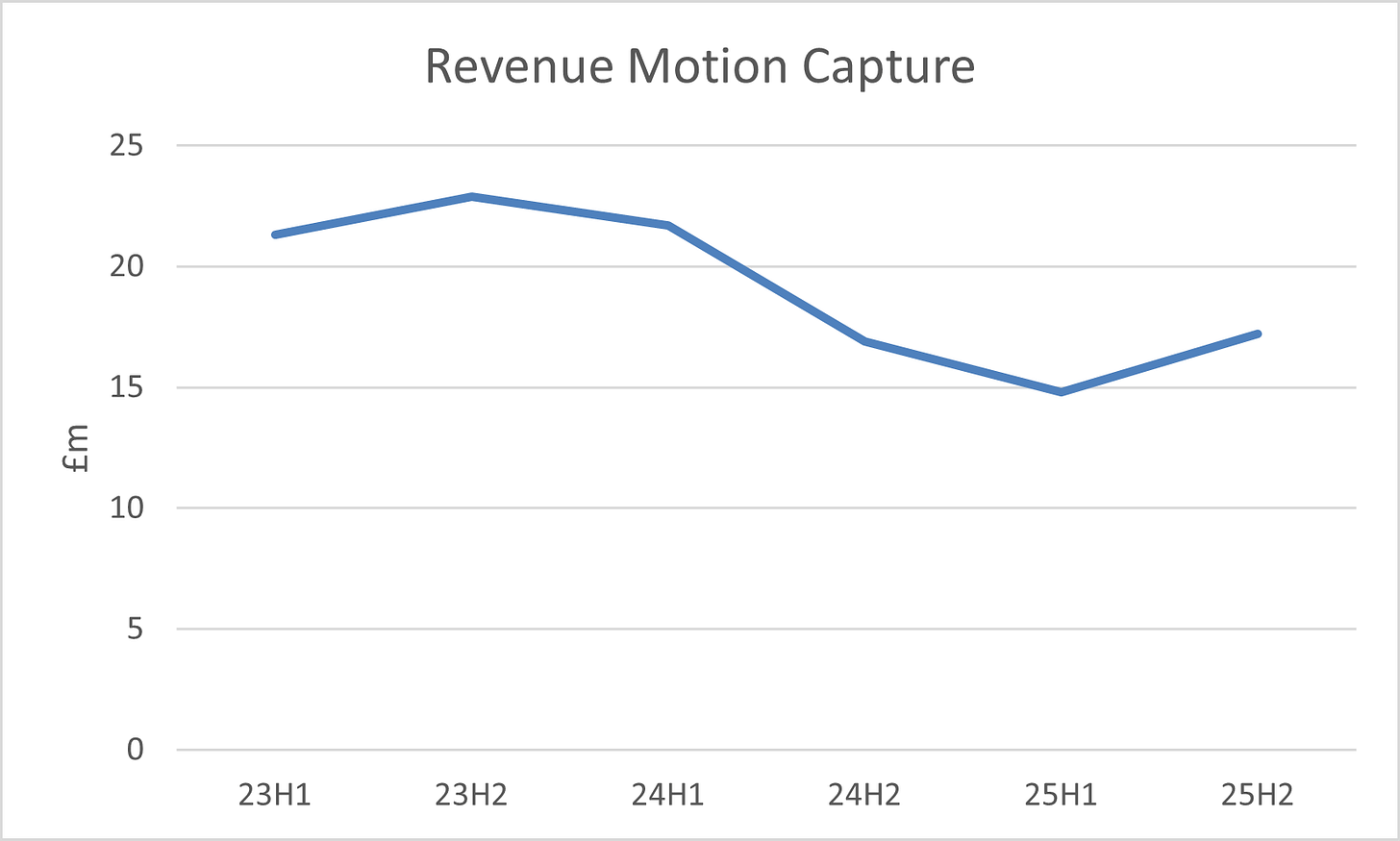

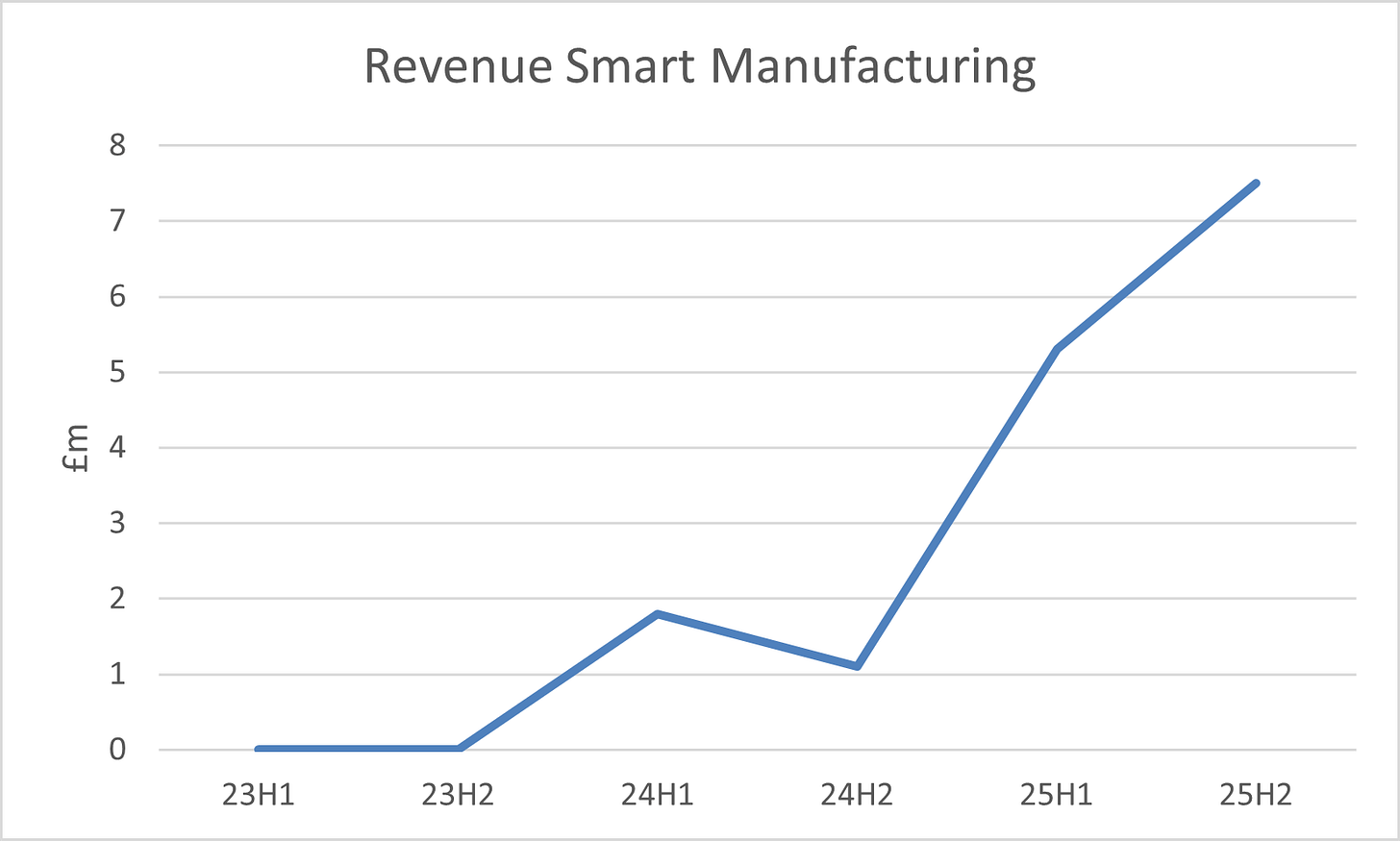

Breaking out the results into half years shows this is going in the right direction at last:

There are further signs that both BUs may be turning a corner:

Smart Manufacturing revenue up 341% to £12.8m (FY24: £2.9m), including 38% organic growth and contributions from two acquisitions.

38% organic revenue growth is certainly bucking manufacturing trends, although this will be off a relatively small base. We were super sceptical on the move to Smart manufacturing. It looked like a Hail Mary pass of desperation, but it actually seems to be paying off, so some of us are eating our words on that one.

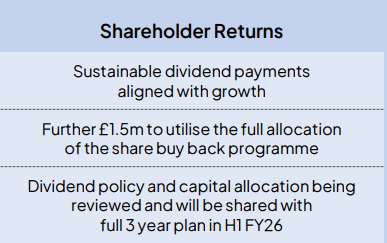

They don’t seem to mention the big miss on EPS. This is largely caused by deferred tax and a much higher finance expense that they don’t deem to explain in the results narrative. However, assuming they hit the EPS forecasts, or you are willing to take adjusted EBIT figures, this remains very cheap on an Enterprise Value basis. The big question remains what they intend to do with the cash. They are flagging that they are only considering bolt-on acquisitions. At the moment, they are buying back shares, but only have £1.5m left of the current programme.

Perhaps a little worryingly, they are develoing an updated 3 year plan. The new “strategy” will almost certainly involve cutting the dividend, as the second ignored question above implies. You just don’t get a CFO saying “we recognise we need to return to cover on the payment”, when EPS is flat, without a big dividend cut coming.

If we assume 2x cover on a 2.6p EPS, then this would be 1.3p, versus 3.25p for the year just gone. If the dividend is slashed and the buyback gone, we can expect the share price to take a big tumble from here. It has been suggested that perhaps the management is playing 3D chess, and they will knock the share price only to tender for shares. However, the management here gives the impression that they would struggle with the rules of Hungry Hippos, let alone any form of chess.

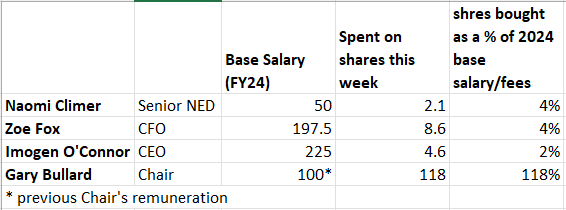

The incoming Chair was keen on these results, splashing out £118k on shares. However, those developing the updated strategy didn’t seem particularly keen to part with their own cash:

We don’t yet have the 2025 AR, so salaries are probably higher and don’t include any bonuses, making these token amounts look even worse. Spending only 2-4% of base salary certainly sends the message that they feel a duty to try to support the share price, but they expect it to fall significantly in the medium term.

Restore (RST.L) - Trading Update

While we weren’t aware that CEO Charles Skinner was actively working to dispose of Harrow Green (their office moves division), it was impossible to watch a presentation and not be struck by how it was the odd one out, and not just because of its recent underperformance, but in the fundamental revenue profile, which is non-recurring and unpredictable.

So the disposal makes sense, although they will lose some cross-selling ability for the box storage business, and there is the eternal question of whether a business or asset should be sold at the earliest opportunity after deciding it is non-core, or you should try to restructure it first and/or wait for the most favourable operating or market conditions.

Due to the debt and recurring adjustments coming from the acquisition-led growth strategy, the nominal PE of 10 is not as cheap as it sounds, so you do have to trust the growth strategy and the accounting. One small red flag on the trust front is this:

In addition, the Group now expects to exceed its medium-term adjusted operating margin target of 20% on a continuing operations basis in FY25.

It was clearly understood before that this margin could be achieved with Harrow Green as part of the company, even if Harrow Green itself would struggle to make 20%. it seems a little disingenuous to crow about how they have met the target earlier when most of the reason was due to dumping an underperforming division for a loss. It is also potentially concerning that they have not raised the margin target in light of this disposal.

Potentially the next least coreish business on the chopping block is this:

The Technology business is now much improved, with leaner operations and a focus on larger customers who have more uniform and higher quality IT assets. We are continuing to see growth as customers return to a more normalised hardware refresh cycle, particularly through value-added IT resellers, and increasingly outsourcing more of their IT requirements. Divisional profitability is improving and progressing towards our medium-term target of 15% adjusted operating margin.

RWS (RWS.L) - Final Results & Directorate Change

Here’s the line everyone is looking for:

This had a phenomenal dividend record of increases, so this is particularly embarrassing for them to have to cut. It’s all smiles on Julie Southern leaving as Chair, with the CEO saying:

Our thanks go to Julie and David for their significant contributions to RWS, including for their strong support and counsel during my first year as CEO and at an important time for the Group.

But only lasting 26 months and with a share price chart that looks like this during her tenure…

many will view this as a failure.

On the dividend, the reduced payout is still a 9% dividend yield, so not all is lost. The rest of the results were known from recent trading updates, although the scale of the adjustments stands out:

Mostly non-cash intangibles, but the restructuring charge is big, too:

They better actually deliver on those cost savings.

Operating cash flow is actually pretty good, but they continue to capitalise significant intangibles:

Operational free cash flow was £80.1m (FY24: £55.1m) reflecting working capital improvement and tighter cash discipline. Working capital improvement has been driven by enhanced receivables collections and payables optimisation. There has been a marked improvement in the ageing of account receivables in the year. Cash conversion improved to 126% of adjusted net income (FY24: 51%). Capital expenditure included purchases of intangible assets of £22.2m and property plant and equipment of £3.4m.

This sounds fairly good considering recent performance:

Trading in the early months of the year has been encouraging and we have maintained the positive cost control momentum seen in the second half of FY25. As we realise the benefits of the new operating model and action taken in FY25, in FY26, we expect the Group to deliver: • Low single digit OCC revenue growth with... • Moderate margin expansion, with gross margin expected to expand by c.150bps and adjusted operating margin expected to expand by c..100 bps; and • Continued strong free cash flow conversion.

So we have a historical P/E of 6-7, and the above should see 10-15% PAT growth in FY26, giving a forward P/E of 5-6, and a FCF yield of probably 10%+. Plus, they are not immune to a weak industrial and marketing economic environment, so they potentially will have faster growth in better economic conditions.

With all of this, we called the initial drop on the surprise dividend cut as wrong, and the price duly recovered on the day. Whether it keeps these gains and recovers further depends on whether they can break the cycle of downgrades and the newish management actually start to deliver.

Thruvision (THRU.L) - Imminent contract award

The use of an “RNS Reach” was the first clue this wasn’t the kind of news we’d been hoping for:

Notice of Intent to Award for its’ SpotCHECK people-screening solution, to support aviation worker screening under the TSA National Mandate at a large Pacific Northwest airport in the United States.

It is just two machines, if the order proceeds. However, they do say they still expect several other orders by the end of the calendar year.

This is basically bad news, as the implication is that this is the closest they have come to a contract win recently and leaves them 85% short of the H2 revenue target with only two full working weeks left.

However, perhaps importantly, as brokers’ forecasts now currently show them needing an additional equity raise before they reach cash flow break-even, it seems even bad news is better than no news at all as the shares rose over 30% on this announcement. Now it may be that investors were expecting terrible news, so that bad news is an upgrade. However, it may also be a symptom of now being a pico-cap, and being much more akin to a gambling chip than an investment.

That’s it for this week. Have a great weekend!

IMC allowing companies to duck questions is a serious flaw in their offering. I’ve pointed it out to them many times. It’s like paid-for research - companies are free to put lipstick on pigs. I agree with your comments about OMG. It’s obvious the company is flagging a dividend cut so if Progressive is forecasting a rise it is likely to be paid-for rubbish. I don’t think you are wrong about the smart manufacturing acquisitions. The revenue looks good but where’s the profit? Sempre’s profitability has declined since it joined OMG, hence the announced restructuring, so it seems obvious that acquisition has disappointed. I don’t like the way they are starting a new strategic plan before the current one has finished. Their performance on that one has been rotten so no doubt starting a new one means ‘nothing to see here’. I think investors are hoping this one will return to past glories. Not under current management methinks.