Here’s a selection of what we looked at this week on the SCL Discord:

Aeorema Communications (AEO.L) - Trading Update

This trading update reads ok (well, as good as it can be for a non-growing business):

Revenue and profit at the upper end of expectations for the 12-month period:

o Revenue of no less than £20.4 million (FY2024 audited: £20.3 million)

o Underlying profit before tax of no less than £600,000 (FY2024: £437,000) - higher than the guidance of at least £550,000 previously provided on 26 March 2025

o Reported profit before tax of no less than £360,000 (FY2024 audited: £437,000)[1]

Until you realise this:

Underlying profit before tax excludes one-off costs, which are largely restructuring costs incurred in the cost-reduction and rebalancing programme referenced below.

They’ve basically fired people (perhaps person? given that the pre-tax improvement is £50k) and claimed that the lower wage bill means they will be at the upper end of expectations, but it looks a lot like they’ve paid them a year’s salary to go, and they’ve booked this as an exceptional restructuring cost!

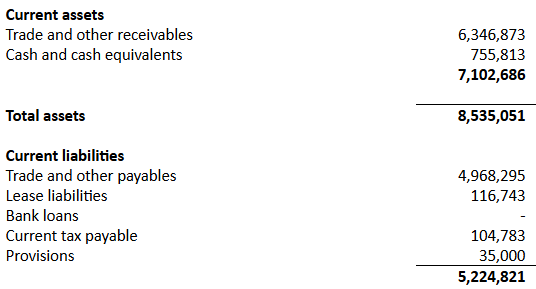

Cash at the year end is up to £4.1m, but this swings wildly during the year. E.g. it was £755k at the HY but was £2.75m when those results were announced in March. The working capital position at the half-year looks like a more normal working capital position for this sort of business:

Hence, the cash balance at the half-year looks a much more sensible figure to use in any valuation.

Itaconix (ITX.L) - H1 2025 Trading Update

They sound like they are getting their excuses in early this year:

With H1 trading in line with expectations and a positive start to H2, the Board's expectations for 2025 remain unchanged. The Board nevertheless continues to monitor US trade policies, the macro-economic environment and customer ordering patterns.

After 13 years listed on AIM, and no end to losses in sight, the best they can offer is an improvement in gross profits:

Additionally, the Company maintained overall FY24's gross profit margins to convert these revenues into record half year unaudited gross profits.

Presumably preparing us for their next raise:

Unaudited net cash and investments as at 30 June 2025 stood at $5.7 million, down from $7.8 million at 30 June 2024, largely reflecting investments in raw material and finished goods inventories.

Luceco (LUCE.L) - H1 2025 TRADING UPDATE

This sounds good:

Continued momentum with H1 revenue up 15% and adjusted operating profit up 10%.

But this is almost entirely meaningless, as they fail to give us any indication of what the like-for-like growth is. It is also noteworthy that Q2 sales growth has moderated vs Q1 (H1 15% vs Q1 19%), but operating profit is higher, although there is still a lack of operational gearing.

The net debt leverage is slightly lower at 1.6x EBITDA vs 1.7x previously, but this level still likely prevents any material acquisition. They also seem to be claiming that they’ve taken positive action here:

Our already limited direct exposure to US/China tariffs has continued to reduce, representing only c.£1m of sales in H1.

Whereas it seems most likely that they simply lost business. It is possible that they may now be supplying the US from the UK instead. However, it would be unusual to relocate an entire production line solely to avoid tariffs on a small portion of sales. That sales have declined is the most likely explanation. The good news is that US sales have always been de minimis.

Nexteq (NXQ.L) - Trading Update

This is an in-line statement with the dreaded H2 weighting:

Group H1 results are expected to be in line with market consensus, with Group revenue for the six-month period expected to be c $40.7m (H1 2024: $48.2m) of which Quixant revenues will be approximately $26.9m (H1 2024: $30.9m) and Densitron revenues of approximately $13.8m (H1 2024: $17.3m).

Duncan is “delighted”, but we are not entirely sure why, with revenue in both divisions down double digits. The market has often fretted about the H2-weighting in the past, sometimes wrongly, and most recently rightly. So when the H1 results are released and we see the profit impact of lower sales and margins, this may cause some concern:

As expected, gross margin has been lower than in recent years as a result of customer and product mix changes.

They also flag less customer concentration:

The Group's focus on diversification of revenue is showing excellent progress, as we target new customers, and focus on organic growth within our current customer base. As an example, one of the Group's previously lower top ten customers is now expected to be in the top two customers at year end.

But given the H1 revenue figures, the most likely driver of a lower top 10 customer moving to top 2 is reduced sales to the higher top 10 customers! However, with order intake up and key Quixant customers retained (although at the cost of margins), this may be finally turning the corner.

Personal Group (PGH.L) - H1 2025 Trading Update

Although these read well:

· Group revenue up 11% to £23.3m (H1 2024: £21.0m), with >90% from recurring revenue sources

· Adjusted EBITDA* up 41% to £5.5m (H1 2024: £3.9m)

The slowing of insurance growth Leo has previously warned about is evident:

annualised insurance sales up 7% to £7.4m (2024: £6.9m).

Versus at the full year:

annualised insurance sales increasing by 18% in the year to £13.9m.

However, they are still hitting record numbers due to inflation. Growth was driven by new customer wins in the previous period, and there have been further wins ready to contribute to H2; however, historically, they have lost customers (employers) as well as gaining them, and while contracts with employees continue, the marketing base can go down as well as up. Good news for shareholders and bad news for those on an NHS waiting list, in that claims are flat after a period of rises.

Benefits and rewards continue their steady 10% growth, though clearly this isn't enough to meet their "aspirations":

Now that the migration onto the new platform is nearly complete, the Group has the capabilities and bandwidth to focus on accelerating growth in Benefits.

The broker flags the possibility of acquisitions:

The B/S remains very strong - cash at period end was c.£26.9m and no debt. We estimate c.£17m available surplus cash which could support strategic earnings enhancing bolt-on acquisitions to provide additional products or expertise.

Some caution is required with cash because, as well as having a regulatory requirement for the insurance business, it will vary during the year as bonuses are paid, and these might not be at the month/period end like with salaries. Still, we agree that they have sufficient cash for an acquisition; however, if the share price is high, don't for a minute think they won't also issue additional shares. Oh, and past acquisitions haven't always gone well - they've only recently disposed of the Let's Connect business they bought in 2017. Still, they appear well on track to slightly exceed current-year forecasts, as further revenue growth is built in from ARR growth.

Portmeirion (PMP.L) - H1 2025 Trading Update

It is hard to tell if this trading update is good news or bad news. Tariffs have a big impact on US but South Korea recovered strongly.

· Sales up 2.8% at constant currency and up 10.8% excluding USA.

· Good rebound in South Korea and double-digit growth in International and Wax Lyrical

· Proactive action taken in response to impact of USA tariffs.

Net debt is up due to earlier shipmen timings, but we are not even close to the October peak, so this will be significant at its peak. There are numerous cost increases due to relocating US sales to UK manufacturing to avoid tariffs & NI/NMW, as well as the tariffs themselves.

Looks like management is equally clueless as to what all this means, as they are unable to guide the brokers to make any forecasts for the current year, now more than 6 months complete. This phraseology on the US underlines the uncertainty:

early signs that retailer confidence maybe returning in recent weeks.

Regarding the US, material falls should have been expected, especially for the "made in China sales", and in the event seem about as modest as possibly could have been hoped for. The company had become overexposed to the US in recent years (e.g. 30% in FY2017, 43% in FY2024), both due to low-quality growth and ROK weakness, and so a reduction also has its upsides. While half-year figures are volatile, these figures take them from 40% to 35% in a single go.

The fact that they made relatively little of the extraordinary South Korean growth is supportive of the narrative about stock overhang. However, while there may be more to come in H2, sales to RoK have been highly volatile, and today's figures are about the long-term average - only time will tell whether there has been some underlying growth, if only due to inflation.

The international (rest of world) segment previously had a far higher share (maybe due to China?) and 10% growth here would be particularly good news if it is sustainable. However the company are cagey about where it is coming from.

Shore didn't feel able to reintroduce forecasts. However, they repeat:

in our view, FY24A will prove to be a base on which PMP will build from

So this may well be the bottom…for now.

Reach (RCH.L) - Half Year Results

Continued price increases are working for now:

Both print circulation revenue £144.3m (HY24: £149.9m) and print advertising revenue £27.7m (HY24: £32.7m) outperformed the volume decline, which remains broadly in line with historical trends.

Volume figures are hidden later:

Print advertising declined by £5.0m, or 15.4% year-on-year; this performance was in line with our expectations given the strong comparative and outperformed volume trends which were down 19% year-on-year, supported by demand from retail and government spend including public notices.

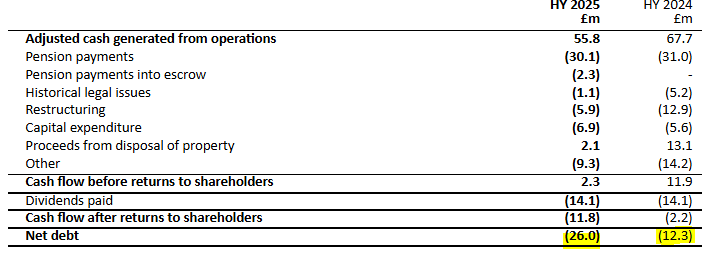

The other elephant in the room is the pension:

Pension costs of £4.9m (HY24: £2.4m) comprise external pension administrative expenses of £2.7m (HY24: £2.4m) alongside the additional one-off past service cost of £2.2m representing a Barber Window adjustment attributable to the Trinity Retirement Benefit Scheme (the 'Trinity Scheme').

But that doesn't appear to be the total, and wasn't last year either:

Other adjusted items comprise of adviser costs in relation to the defined benefit pension schemes of £3.0m (HY24: £1.7m)

And not to mention:

Group contributions in respect of the defined benefit pension schemes in the first half were £30.1m (HY24: £31.0m).

However pension contributions are apparently to fall on an annualised basis:

Contributions paid to the schemes in 2025 are expected to be £55.7m under the current schedule of contributions.

But in reality will rise:

This excludes the c.£5m payment to West Ferry Printers Pension Scheme. It also excludes, an additional £5.5m which is to be transferred to secure bank and escrow accounts during the year

These figures are very material compared to the adjusted operating profit of around £45m per half. Dividends are being paid from debt:

The good news is that the banks seem happy to fund this:

The Group has a revolving credit facility of £145.0m, which expires during December 2028 with an option to extend to December 2029.

Less good news for newspaper readers is the frequent mention of AI, e.g.:

Innovating with AI

The hope here is presumably that there will be something of value left when the pension is paid off. As a baseline we can see this is probably worth two more years of dividend payments, i.e. about 13p.

The Works (WRKS.L) - Final Results

We did wonder whether seeing these results in black and white would deflate the recent shareholder enthusiasm here. However, they appear to have been well-received. These are in line with previous guidance. £9.5m adjusted EBITDA here and £11m next year.

We really have to question if this is a suitable metric for a company with many stores that need refits etc. For example, Revolution Bars used to always quote positive EBITDA, and it didn’t stop the costs of needing to continually refurb from killing the business. TBF, fewer The Works customers are likely to be sick on the premises, although with babies and toddlers typically coming along with the paying customers, it may be a close run thing!

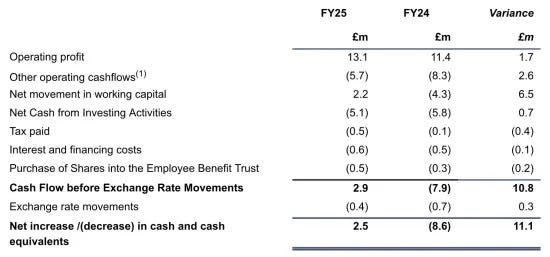

Looking at the cash flow tends to be a better measure of this sort of business:

So here, Free Cash Flow ex-working capital was a paltry £0.3m. No dividends were paid (or will be in the near term), and the share buyback was in the EBT (presumably to offset dilution). So £0.3m is probably the best metric to measure the economic value added during the year. This figure will presumably be better next year if they achieve their £11m EBITDA target. However, if other figures are similar, that would still only be £1.8m, compared to a now £35m market cap. A 5.1% FCF yield isn’t much better than you can get on a risk-free government bond, and this is very far from risk-free.

That’s it for this week. Have a great weekend!

On Aeorema… I am absolutely certain it will not be "perhaps one person" paying them a year's salary? The recent facts are that AEO made £1m on £12m sales three years ago....so the issue is that having had sales then rise to £20m in consecutive years but the profit has fallen to £400k suggests that a proper questioning of "Has the headcount got carried away, do they need to reduce it and improve margins" are the right questions, surely? On the subject of cash, they should be applauded as actually gave the average daily balance as £2m in the last results....that should be a marker for other companies to do the same.

I now expect Aeorema to bring in at least £50k per year in interest on that balance or buyback a considerable number of shares in the coming months

David

Thanks for the alternative analytical perspective on The Works. At the current price, I have felt like there is a Donald Trump level of hype. I just couldn't articulate why I wasn't getting it.