Mello 2025 is fast approaching on the 3rd and 4th of June, back in Chiswick. Here’s the current lineup:

A reminder that tickets can be purchased here, and the organisers have given us a discount code M25Simpson50 to get 50% off ticket prices. See you there!

Here’s a selection of what we looked at this week:

Begbies Traynor (BEG.L) - Year End Trading Update

This is the headline:

strong financial performance, with revenue, EBITDA and net cash ahead of consensus expectations

However, looking at the details, it’s a very small beat here on revenue & EBITDA, and not on PBT. There’s also a notable lack of operational gearing, as the percentages get worse as we go down the income statement:

· Revenue expected to increase by c.12% (c.10% organic) to c.£153m (2024: £136.7m)

· Adjusted EBITDA expected to increase by c.10% to c.£31.3m (2024: £28.5m)

· Adjusted PBT expected to increase by c.7% to c.£23.5m (2024: £22.0m)

But still, much better than a miss….or is it? Looking at the Shore note, they reduce EPS by about 4% for all forecast years! On the other hand, Equity Development and Canaccord upgrade their EPS estimates. It may be Shore just getting ahead of themselves, after all, their future year forecasts are still ahead of EDs. Probably the net impact of all this is absolutely no change to the forecast consensus. Making the headline that they started with sound a little too optimistic.

Camelia (CAM.L) - Tender Offer

We were beginning to fear that the management here was going to waste all the cash they had raised from recent non-core asset sales. It seems like it won’t be all of it though:

Camellia plc (AIM: CAM) announces that it is proposing to return up to £18.9 million to Shareholders by way of a Tender Offer pursuant to which Qualifying Shareholders are invited to tender some, or all, of their Ordinary Shares at the Tender Price of £ 54 .00 per Ordinary Share. The Tender Offer is for a maximum of 350,000 Ordinary Shares.

£18.9m, 350k shares is only 12.8% of the equity. But with the trust and directors not selling, there will be much more available. How much depends on how others view it. The price is finely balanced, which means they’ve probably got it right. High enough that it’s a decent gain in any purchases in the last year or so, but not so high that it’s a compelling offer. After all, tendering at such a big discount to TBV increases the TBV/share of those that don’t tender. At the current price of £53, we estimate they will still be on 0.38xTBV, assuming they manage to get full acceptance of the tender offer.

When asked about the rather modest level of the tender on their results call, they talked about a level that will get support at the AGM. So the controlling Trust don't want a high price is my reading of that! After all, by not tendering, they increase their ownership stake and the discount to TBV. At least someone still has faith in the management to deliver returns from the agricultural assets.

Getbusy (GETB.L) - AGM Trading Update

The board is pleased to report that annualised recurring revenue ("ARR") at 30 April 2025 was £21.3m, up 6% year-on-year at constant currency

ARR tells us very little here, as it was up by a similar amount last year, and overall revenue grew slower than inflation. Plus, this is way below the 12% revenue growth they need to hit their forecasts. As usual, Getbusy aren’t very busy.

Impax Asset Management (IPX.L) - HY Report

Massive dividend cut (much worse that it looks), balanced by a one-off buyback. They are evasive about the details, but here's one working:

Last year they paid 4.7p interim, 22.9p final, now they are paying 4p interim. They say "We are also rebalancing the split between the interim and final dividend, so that distributions to shareholders are less heavily weighted towards the final dividend, in line with common market practice." Common market practice is 1/3rd interim, 2/3rds final. Therefore, the final will be around 8p making a total of around 12p, approximately half of last year. Confirming this, Equity Development forecast 13p dividends from now on.

This is an acknowledgement from the company for the first time that there has been permanent value destruction from the 2022-3 investment underperformance and mandate losses. While this was clearly flagged, it is a major climbdown from the position of a year ago when the CFO said in the H1 presentation:

[the 55%+ dividend policy] really just gives us the flexibility to be able to maintain and grow the dividend at all times including when there is some earnings pressure

Then, in what appears to be some confused thinking about strategy, they also announce a £10m buyback. To put the £10m buyback in context, they have 132.6m shares in issue, so this is worth about 7.5p a share on a one-off basis versus a dividend cut of 9.9p per annum. At the current share price they would buy back 4.6% of the share capital, further reducing the value of the residual dividend, although not materially so. Leo’s most recent modelling in March had assumed two years of uncovered dividends held at 27.6p, followed by an 18p sustainable and growing dividend, which would have represented a 15% yield in two years' time on the XD price of shares bought then 173p. Today's announcement constitutes a massive reduction in short-term shareholder returns, a massive increase in the cash they feel they need to hold on their balance sheet, and a very significant reduction in the sustainable dividend level.

Equity Development say:

Cash and on-balance sheet investments (seeding of funds) now make up 37% of the market capitalisation (and that is at the low point of the annual cash cycle due to dividend and annual bonus payments in H1).

The level of cash is now irrelevant because the company has made a screeching U-turn, and there is now absolutely no prospect of it being returned to shareholders. Maybe (despite what the annual report says) it was always required as a regulatory buffer, but the reason is irrelevant - it is locked up indefinitely at best, and at worst, it will be used to make a series of acquisitions in order to rebuild the AuM empire.

Jadestone Energy (JSE.L) - FY Results

This looks like the upper end of the 18-21kboepd guidance range:

Strong portfolio performance year-to-date 2025, with production for the first four months of 2025 averaging 20,830 boe/d, a 22% increase year-on-year and an annual record for this period.

Net debt US$54.2 million at 30 April 2025 is a big reduction, although this is after the $39m asset sale and before drilling on Montara.

Certain of Jadestone's shareholders have requested that the Company seek authority to repurchase shares at the 2025 AGM on 20 June 2025.

Sounds like there is pressure here to do something about the low share price. Management don’t have to execute the authority, though, and we’d guess they’ll wait until the major capex for this year is over.

Luceco (LUCE.L) - Q1 Trading Update

Unfortunately, they fail to provide any like-for-like figures:

· Revenue of £61m is up 19% year-on-year benefitting from acquisitions made in the prior year, and continuing strong growth for our EV offering.

· Gross margins remain healthy with stable input prices and improved manufacturing efficiency.

· Adjusted operating profit increased 8% year-on-year.

The lack of LFL makes this largely meaningless. Nor do they explain the lack of operational gearing; instead, this sounds like they should have seen profits rise at least in line with revenue:

· Gross margins remain healthy with stable input prices and improved manufacturing efficiency.

· Adjusted operating profit increased 8% year-on-year.

As we know, but some may not:

Tariff impacts are anticipated to be minimal for the Group, as US sales of China sourced product represented only approximately £4m in 2024.

This increase in leverage is particularly disappointing as they previously claimed an adverse "timing issue" on receivables at the year-end. It is, however, very well within the covenants of 3.0x:

Bank Net Debt : EBITDA ratio of 1.7x which remains within our target range of 1-2x.

This is up from 1.6x at the year-end, a reminder that they have little to no scope for the acquisitions, which they rely on for growth. Markets have worried about these sort of debt levels before, but perhaps the difference now is that we may be coming out of weak market conditions rather than going in.

It does sound like Q1 is ahead of expectations but that they want to keep something in the tank:

The first quarter performance has been pleasing, with momentum maintained from the end of the prior year. We continue to be encouraged by improving lead market indicators and a more stable cost environment which means we are well positioned to deliver profitable growth in 2025.

The sudden enthusiasm within small cap markets meant that investors focused on this rather than the concerns we’ve listed this week. This remains a decent company, just one on a higher rating than the recent past and with more constrained growth given the debt levels.

Revolution Beauty (REVB.L) - Formal Sale Process

The board of the Company (the "Board") can now additionally confirm that it has received a preliminary approach regarding a possible offer for the entire issued and to be issued share capital of the Company.

Against this background and to widen its strategic options, the Board has now unanimously concluded that it would also be appropriate to investigate the sale of the Company and therefore has decided to commence a "Formal Sale Process" for the Company (as referred to in Note 2 on Rule 2.6 of the Takeover Code) (the "Formal Sale Process").

The party who made the approach has agreed to participate in the Formal Sale Process.

They pointedly don’t mention where the possible offer was priced. These FSP haven’t been ending well for similar companies recently. However, this one has at least been kicked off by an approach. You have to surmise that if they were happy with the offer price, they wouldn’t have had the FSP. So, an offer price probably around the current share price, but at a premium to the offers of fresh equity would be our guess.

Renold (RNO.L) - Possible Offer

Two possible private equity bidders, with the highest being an 81p possible offer. That's a 15x forward P/E multiple once you adjust for the debt and pension deficit. It looks a bit better on the EV/EBITDA measures:

The 2024 deficit was £57.1m. There's £44.8m of net debt at year end, so the options to leverage the business further may be there, but are not as significant as companies with net cash. They propose paying £182.6m for the equity, and let’s say they have to put £60m into the pension funds. So £242.6m cash paid. So roughly £287m EV, could be more if the pension trustee wants a buyout to secure their interests. This is around 7xadj. EBITDA so fits with PE now being willing to pay up to acquire industrial businesses of this sort of size.

This pretty punchy valuation shows how much Private Equity are willing to pay for a business with no top-line growth but some sticky customers, compared to what investors value the business. Many of us didn't hold this company on the basis that it looked a bit expensive compared to other UK small caps, even though the absolute valuation wasn't high. With the debt, the scope to leverage the business is reduced. However, they may just be planning to up prices by 20% on day one instead if customers really are sticky.

The most interesting part is that the pension deficit hasn't put the acquirers off. The biggest fear is surely the risk that the bidders haven't yet seen the size of the pension trustees’ demand. If they demand a full buyout and that gets priced somewhere north of the £60m level, it is possible that both bidders would walk. The presence of two bidders reduces this, as they surely must know that buyout valuations are typically higher than the Triennial valuation.

Shoezone (SHOE.L) - Interim Results

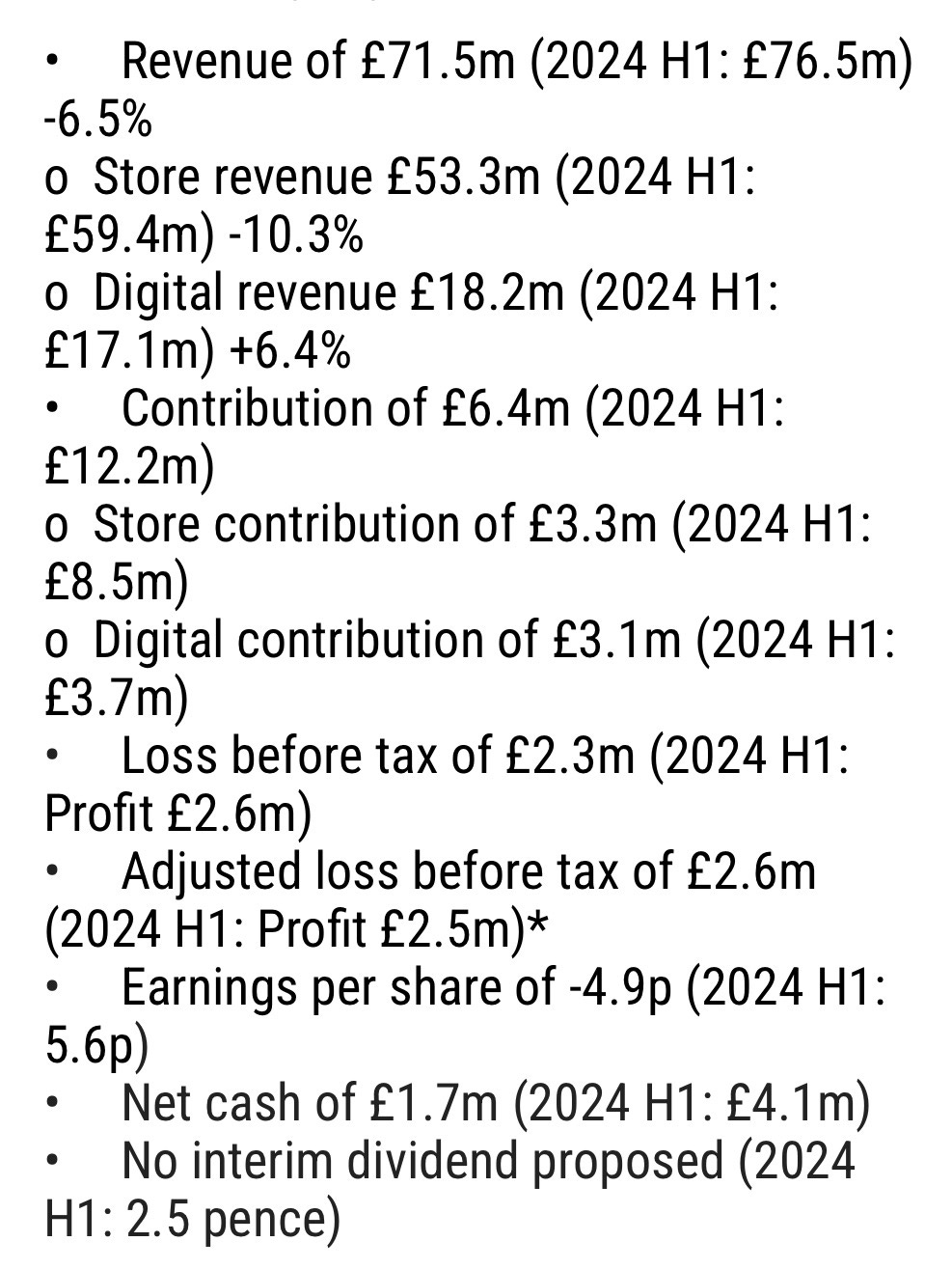

These look poor considering this is meant to be recession-proof as the lowest cost supplier:

Revenue is down, similar losses and the dividend has been cancelled. This is always significantly H2 weighted, though, and Zeus maintains their estimates. Looks a big ask for H2 to us, though. They highlight lower container rates and stronger £/$ which definitely are cost tailwinds. However, sales need to grow by £3m in H2 vs a 6% decline in H1 to hit Zeus’s figures. They are also a living/minimum wage payer with likely many part-time workers, so this is surely a big cost headwind. However, forecasts were previously cut for this effect.

There is a recovery forecast for FY26, and if they were trading on 5x this figure, we can see the case for taking the risk. However, they are on 11 times what looks like it may be an optimistic forecast. Many investors are clinging to past glories here rather than looking at how the business is really performing today.

One positive may be if the UK brings in a tax on small-value parcels. You can get a pair of trainers posted to you now for £5 from Temu with free delivery and returns. The cheapest Shoezone trainer is £13. However, this is vague and far enough in the future to not make a significant difference to the (over) valuation.

That’s it for this week. Have a great weekend!

The usual interesting slant on the figures of reporting companies. Always worth a read.

The points raised on Begbies Traynor's actual operational gearing versus the headline figures, or the deeper dive into Impax Asset Management's dividend implications beyond the "rebalancing" narrative, are good examples of the scrutiny needed in this segment.