Here‘s a selection of what we looked at this week:

Beeks Financial Cloud (BKS.L) - News Article

The FT reporting that NASDAQ is being forced to stop offering a high-speed trading service to select clients after regulatory scrutiny caused a big drop here this week. We understood that Beeks didn’t offer HFT, and so far, there has been no response from the company, which suggests this isn’t related to their service.

The fall shows the risk of investing in something where momentum traders bid up a popular stock to a very high valuation, and then the momentum reverses. Stockopedia classified this type of expensive, reasonable quality, high momentum stock as a “High Flyer”.

An interesting finding from Mark’s initial research into this type of stock is that investors may be better off selling as soon as the momentum rank drops, even if the overall level is high, than waiting for the momentum rank to drop below average. So it may be that a company with these sorts of characteristics was always going to fall precipitously one way or another and the news article was just a small trigger.

Capital (CAPD.L) - Company Update

the Board has taken the decision, to book non-cash provisions in 2024 primarily relating to historical VAT receivables and various laboratory assets in Mali.

Given the proximity to the interim results, this looks to be more of an auditors’ direction than a board decision! We had half-expected significant writedowns of mining assets, so perhaps only writing down VAT receivables and lab assets is good news.

Some may be concerned that they didn’t write this down earlier. But we can’t discount the changes in Mali being large and recent. Given what the Mali government did to Resolute's CEO in order to get a $160m payment at the end of last year, it isn’t unreasonable to conclude that now might no longer be a good time to keep asking for VAT receivables to be paid!

The impact is:

The Company now expects net profit after tax ("NPAT") for 2024 to be in the range of $18 - 20 million.

But they don’t break this out between trading and write-downs, and according to Tamesis, they haven’t guided them either. Even with write-downs, there is likely to be a fairly big discount to TBV here, and those assets have proven to be highly productive in the past. The drop this week looks overdone, as the write-downs are one-off and not especially material. The problem is that there is little sign of them being productive again at a group level in the medium term. There are simply too many losses from labs & Nevada, plus a mining fleet that doesn't really start to deliver revenue and earnings for another six months, and even then, it is in ramp-up mode. Perhaps more concerning to the market is the drop in revenue:

FY 2025 revenue is expected to be in the range of $300 - 320 million.

Revenue probably isn't the most important thing right now. Indeed, trying to grow revenue by moving into mining, new geographical areas, and pursuing rapid revenue growth in labs has been their downfall.

Also, it feels like all the attempts to make this a more "professional" business and improve governance have destroyed shareholder value. Adding CEO roles and IR, etc., may make them more investable to institutions, but if it had just been Jamie doing deals with his mates, we would probably all be better off (excluding the trading opportunities that institutional buyers and sellers create!).

In this case, the CEO falls on his sword:

The Company's CEO, Peter Stokes, has tendered his resignation which has been accepted by the Board

I would like to thank Peter for his tireless efforts during this challenging time and we wish him the best of success in his future endeavours.

Peter seemed a nice guy, but we are not sorry to see him go. Almost all of the current issues occurred under his watch, and while he probably wasn’t responsible for the strategy, the execution was his and, in many cases, has been poor.

Tamesis maintain its 160p Price Target but with even less attempt than usual to link it to fundamental value.

DigitalBox (DBOX.L) - Acquisition

James Carter, CEO, Digitalbox, said: "The opportunity to acquire some of the Media Chain Group assets is an excellent way for us to extend the audiences currently being served by the Digitalbox brands. With The Life Network containing a significant female US audience footprint, we believe there are plenty of synergies to build around our new site, Royal Insider, which is already presenting traction in this market. The management team will get to work straight away on proving this case before Completion."

These are social media sites from Steven Bartlett’s former company, with the marketing agency having been sold to Brave Bison for £7.7m. Social Chain AG continues as an e-commerce company, so these appear to be non-core for them.

The most important part is that DigitalBox only pay £20k upfront, and the rest is dependent on the business case panning out and being earnings enhancing. Of course, this isn’t that high a bar compared to 5% or so in interest on cash, but it means more than it does during the ZIRP times.

Forterra (FORT.L) - Full Year Results

This sounds good:

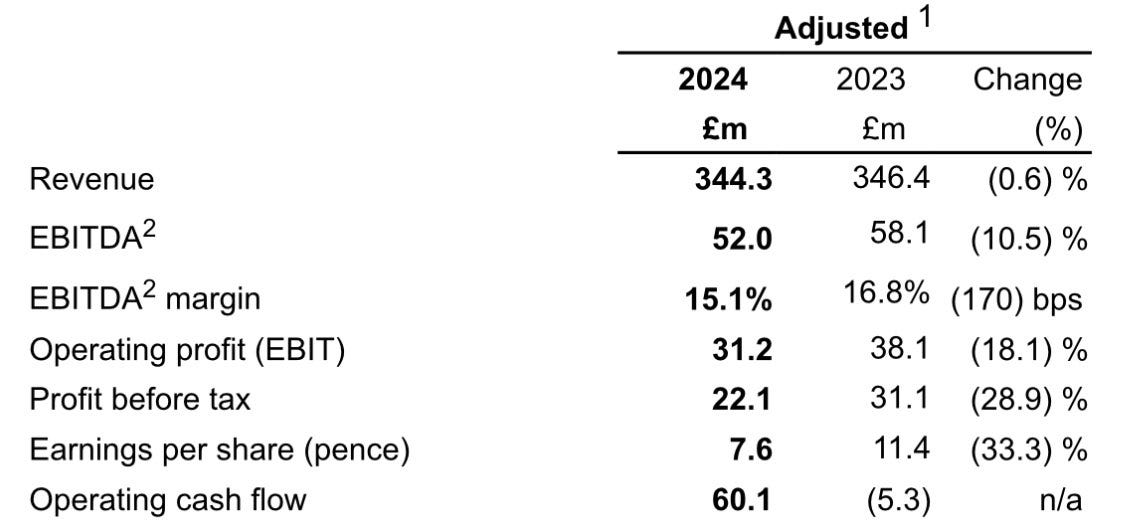

Adjusted EBITDA of £52.0m, slightly ahead of our revised expectations of around £50m

However, the presence of the word “revised” shows that this isn’t something to celebrate:

Given the demand for housing, it seems strange that brick manufacturing isn’t doing well right now. Nor do we get why you’d pay double the rating for this versus something like Brickability, which seems to be performing better, too.

IG Design (IGR.L) - Sale of Property

…completed the sale of its former distribution facility…for $8.4 million. The carrying value of the site was $2.9 million and the sale will realise a profit of $4.9 million (after $0.6m of selling costs and taxes).

This was a known known but it underlines that there may be hidden asset value as well as hidden asset un-value in the company. Having adjusted for the property gain and recently announced $15m write-down of receivables, this works out to be a TBV of around 202p /share, so they are trading on 0.3xTBV at the current price

The other way of looking at this is that they received 11% of the current market cap for this surplus property. This is suddenly looking material, given how far the share price has fallen.

Reach (RCH.L) - Pension Regulator Intervention

As one may recall, there has been a standoff on pension recovery payments, with Reach only managing to agree the 2019 Triennial plan in 2023. This week, we get a view into what went on behind the scenes as The Times reports:

The Pensions Regulator (TPR) revealed that it had to resort to threats of enforcement action, which includes fines and criminal prosecution powers, to force Reach plc, which now owns the Mirror, to lift its payments to the scheme to help fill the shortfall in its funding position.

Reach has been forced to lift its payments into the scheme by £25.5 million over five years after trustees to the scheme, which had a shortfall of £219 million by one measure, appealed to the regulator for help.

This is what the regulator themselves said:

Through negotiation, we were able to help facilitate the trustee and company to reach a mutually acceptable solution without the formal use of our powers. The final agreement included making significant improvements in the deficit recovery schedule with the financial support of the wider group, and improving an existing dividend sharing agreement whereby amounts above a certain percentage increase in dividend distributions will result in a sum matching the excess dividend increase being made to the scheme.

Our intervention, through working with Reach Plc and the trustee, resulted in the scheme receiving an additional £5.1 million per annum from the company, backdated to the start of 2023, which will be paid every year until the end of January 2028. The scheme is expected to be fully funded on its prudent technical provisions basis by January 2028.

This seems to be a pattern with recent pension deals, with deficits being reduced but recovery payments being held constant in order to accelerate the move to being fully funded. In Reach’s case, we can’t help thinking that the Trustee may be worried that Reach will be a significantly smaller business by the time the next Triennial assessment is due, and, hence, want their cash sooner rather than later.

The attitude of the regulator may be of note for other companies that appear to not yet have agreed their most recent Triennial assessment, such as Portmeirion.

Thruvision (THRU.L) - Recent Share Price Movement

The share price collapsed this week. Usually, this means that the market is saying this is all over. However, the company responded by saying:

confirms that it is not aware of any reason for the movement.

Proving a short update on trading:

The Group has recently received several orders from customers in the US, Indonesia and Europe and further orders are anticipated before the end of the financial year. Accordingly, the Board continues to expect that revenue for the financial year ending 31 March 2025 will be in the range of £5 to £6 million.

A further update on trading will be provided in early April.

And the Strategic Review

The Strategic Review continues and discussions are ongoing with relevant parties. It is hoped that one or more offers to either acquire the Group or to provide additional cash resources will be forthcoming although there can be no certainty that such offers will materialise.

Normally, this would shore up the price, but in this case, it fell back down quickly. The most likely explanation is that an institution thought that their holding was now so immaterial that they got rid of it at any cost. The arrival of a couple of late-reported trades backed this up:

We can guess the identity of two possible interested parties. The first is Pentland Capital, who backed the company with £2.5m at 23.5p in October 2023. They own 50% of JD sports, as well as other sports brands, so presumably would want the IP for profit protection in these businesses. The second is $40b US company Johnson Controls, which recently announced a partnership with Thruvision to:

…offer Thruvision's WalkTHRU security technology to its existing loss prevention solutions portfolio, making it available to the many leading retailers around the world it counts as customers.

There is still a material risk that they buy the IP from administrators, and shareholders get nothing. However, with significant inventory and the possibility of one or more bidders, at less than £2m market cap, the share price has now fallen to the level where there may be an incentive for someone to take it as a going concern (or invest enough capital into it to make it a going concern again.)

That’s it for this week. Have a great weekend!