Ingenta (ING.L) AGM

A quiet week for news this week, so we’ll take the opportunity to report back on an AGM that a few SCLers attended. Attending AGMs may be an important part of corporate governance, but it is not something that many SCLers make a regular effort to do. In many cases, the information gleaned versus the time taken doesn’t meet the excess return threshold. However, in this case, a few people thought it worth making the effort. Partly, this was due to a lack of engagement from the company via other means, and partly because this is one of the cheapest companies on the UK market, and exceptionally so for a SaaS software business. Any gains in confidence from understanding the business or motivations better would enable us to position ourselves to capitalise on a larger-than-usual upside. Here are the key points that were raised in the meeting:

Cash Balance

At the end of 2024, the company reported £3.6m of cash and no debt. However, they also failed to earn any material interest on the cash. One possibility was that the company had very significant working capital swings, and the cash balance was due to extreme window dressing. Given this is a third of the current market cap, understanding this makes a material difference to the investment case. It turns out that they had a potential use for that cash until very recently (a potential acquisition is our guess), which would have required instant access, and their bank required them to lock the money up to earn interest. They were slow to realise there were other options. Their increasing move to SaaS billing means that this cash level is more consistent through the year (but perhaps not growing as quickly on the balance sheet date). From a valuation point of view, we much prefer this, and their cash flow forecasts show that the cash levels should not drop below £3m in 2025, making this genuine free cash.

It is not great that a CFO took this long to realise that money market funds would give instant access and a high level of interest. However, we have some sympathy - it is a big role for a company operating in multiple regions with multiple products, increasing sales efforts, and negotiating a potential acquisition, all with a small finance team. The risk is that if this sort of thing is slipping through the cracks, is anything else?

The other good news is that with no cash interest forecast by their broker, Cavendish, with this now earning interest, this should add around 5% to 2025 PBT (assuming 6 months of interest) and 10% to 2026, above the Cavendish model (which doesn't yet exist for 2026).

The bad news is that we probably can’t expect another tender offer, as they are acutely aware that their current market cap and level of illiquidity put off some investors. We may get a dividend, currently around 6% yield and assuming they don’t make a major acquisition, they have signalled their willingness to grow this further.

Delisting Risk

This is clearly a risk for any company with this market capitalisation and liquidity level. It is far too undervalued to sensibly raise capital, and the costs of maintaining admission, including IR, are high for the size of the company. In this situation, sensible companies would consider their options, and we don’t think this is any different. However, based on the answers given, we are confident that no delisting is imminent. We were also assured that the lack of recent IR (most notably no IMC presentations) was not a conscious decision but something they hadn’t prioritised. The CEO, who is US-based, comes across as someone who is very busy with sales efforts across multiple products, and his natural focus is on that side of the business rather than IR. They have met institutions regulalry but appeared to take on board the need to engage individual shareholders more, as we tend to be the price-setters, and any deal they may want to do in the future using equity will be priced off the level we set, even if the bulk of the cash will come from institutions.

Growth prospects

One of the aspects that puts some investors off is that the top line has not grown for many years, and new product sales only seem to keep pace with the decline in legacy revenue. However, listening to the CEO speak about the scale of the sales opportunities, one couldn’t help thinking that the idea that this is a permanently declining business is wrong. Here are a few of the reasons why:

They have multiple bids in to implement their software on both sides of the business across many potential clients. Part of their recent guidance that profits would take a short-term hit as they ramped up sales headcount is to deliver these business wins.

They now have agreements in place with software resellers to scale the business more effectively, with the reseller doing the integration, which is reasonable margin business but people-intensive work. When the reseller makes a sale, Ingenta charges license fees as soon as the end user has a QA environment set up, making this a quick-to-scale revenue stream.

They have won music publishers in addition to their historical book focus, and are really pushing to win a contract with games publishers, as this will act as a reference and the foot-in-the-door tends to lead to additional business wins.

One competitor has been bought out by a music publisher, and they are seeing RFQs to replace their software with Ingenta, as other publishers fear the business risk of a competitor managing their royalty reporting.

In terms of legacy business, they said that this can be quite lumpy & unpredictable. Companies make plans to replace Ingenta, and therefore ramp down spending, only to see the cost of replacing them and then changing their mind, leading to ramping up spending again. They have made efforts to add value to retain clients. For example, adding a web interface to older software has led to an additional revenue stream for one client, and that client is ramping up spending again on the core software. They then have the scope to sell that additional package to all other legacy clients.

Finally, we received reassurance that there was little exposure to NGOs on the content side that were solely funded by the US government. There are NGO clients, but these are mostly super-national bodies, such as the UN.

Conclusion

The attendees we spoke to came away reassured that there is far more going on below the surface than appears on the surface. We don't think we're suddenly going to see huge contract wins that transform the business, but there are enough opportunities out there that they could win enough small, sticky SaaS businesses to grow revenue at a 20% CAGR for a few years, while adding to their cash pile. The strategy of investing in sales headcount to deliver that growth is, in our opinion, absolutely the right thing to do, despite it costing them declining EPS in the short term and the market not liking it. FWIW, the CEO came across as incredibly passionate about the products and genuinely excited about the sales prospects. If they achieve growth rates of this magnitude, it is clear that a P/E of around 8, with a third of the market cap in available cash, is simply the wrong price by a large factor.

Here is some of the more timely news discussed this week:

Kitwave (KITW.L) - Interim Results

This fairly big profits warning here, with adjusted EPS down 19% for the HY and brokers taking 17% out of the FY guidance. The bright spot appears to be that they downgraded next year's forecast by only 10%, and there are some factors that are unlikely to repeat, such as the duplicate warehouse costs. It's been difficult to pass all the NI costs this year, the market should adjust in time. But blaming consumer confidence seemed a touch weak as that's not really reflected in the data, and we're only talking about the purchase of Calippos, not sports cars!

However, this is not expensive if you take their forecasts and adjustments at face value, and much loved stocks rarely lose their lustre quickly, but distributors rarely get high ratings, for exactly the reason that they usually add the least value in the chain (as measured by GM) and are therefore vulnerable to the types of cost increases we’ve seen.

One factor that may be overlooked is that they have had the lowest diesel prices for many years, which is typically a tailwind for distribution businesses. That they’ve had this unexpected bonus and still missed forecasts suggests things are worse than they were willing to admit. So the risk is that they are waiting until nearer the time for a bigger downgrade to 2026. And the fall yesterday only really took the price back to where it was in April (although that was clearly a bad time for wider market sentiment).

Mpac (MPAC.L) - Trading Update

There is a positive move on the pension scheme. Payments will continue to be made into escrow in the short term, but are expected to return £5m to the company on full buyout. Of course, this is largely their own money and nowhere near the surplus they liked to claim based on IFRS 19, but Mark honestly thought that there was no way they’d achieve a buy-in/out without huge payments to the scheme. Some of the gain will be due to the years of recovery payments they’ve already made. However, he’d clearly underestimated how interest-rate sensitive the scheme would be.

The bad news is that the rest of this week’s news is a big profits warning:

Accordingly, due to the expected impact from slower orders in Q2 the Board now expects FY 2025 revenue to fall significantly below the Board's previous expectations.

Mpac have never been shy about spinning things, so this isn’t actually bad news according to them, but an:

opportunity to accelerate US consolidation plans and optimise cost base for when conditions improve

This does actually sound sensible:

The Group's facility in Cleveland Ohio will be closed, consolidating it with the business acquired in 2024 in Boston Massachusetts improving utilisation rates. The Group is also reducing capacity in Mississauga Canada.

Why run three plants when two will do. The question is that if this was a no-brainer, why not do it sooner? The reality is that the downturn in trading gives them the political cover to close a US plant that they always wanted to following the recent acquisition. They say:

The restructuring will incur non-cash impairment charges in the region of £11.5m.

But not that there will be no cash charges. Also, the impairment charge is large, and while it's nice that it's non-cash, so was IG Design selling their whole US business for £1, technically. Being non-cash doesn't mean it's not an expensive strategy. This is what Shore say on exceptional costs:

The restructuring of activities in North America, delivering a guided c.£1m p.a. operating cost saving, brings forward costs in FY25F. These emerge as £0.7m in cash costs to be provisioned at the H1 stage. A £9.6m intangible write off for Switchback goodwill/intangibles is also to be made (noncash), with a £1.9m property lease provision (to be funded through the cash flow statement over the remaining 5-year term of the lease in Cleveland). A £1.5m pensions one-off administration cost for the transfer of the UK scheme is also in exceptional items. So, total FY25F exceptional costs of £13.7m are guided.

Pension scheme payments/administration are more one-off than usual. However, Shore reveals that part of their "non-cash" impairment is actually cash payments to the landlord of their Cleveland facility, just paid over five years. Total adjustments are 75% of their EBIT, showing that old habits die slowly.

They then say they've found further savings:

This and other cost saving measures have been designed to maintain existing operating margins despite the reduction in revenue, offsetting the impact of reduced operational leverage. This will further provide a more efficient baseline cost for future growth when global markets improve.

Again, are they simply admitting they were running with a bloated operation until they were forced into action by this downturn? It may well be more political cover. After all, we know that labour protections are weak in the US, and Somero, for example, simply flexes their workforce as required. The same may be happening here. However, that labour cost will need to come back once conditions improve.

The impact here isn't just one-off weaker orders, at least according to their brokers. Shore take 24% out of revenue for FY25 and 28% out of future years, with a similar impact on EPS, as cost savings mitigate the revenue fall somewhat. Equity Development are less aggressive on FY26 EPS, but this is largely just their willingness to take the company's view on exceptional costs.

This sounds a little frightening:

Actions to reduce debt have been taken, which include implementing new controls to improve operational efficiency and cash milestone delivery, re-negotiate customer and supplier terms, reduce capital expenditure and minimise discretionary spend. The Group expects to remain comfortably within its covenants.

Shore have £23.0m EBITDA for FY 2025 with £47.2m debt, so that's 2.1x. Many companies quote covenant multiples in their annual reports, but MPAC do not, and therefore we must assume they are lower than average, but not entirely inconsistent with their "comfortable" claim, perhaps 2.5x?

Most companies quantify the "downside scenarios" or "stress tests" for going concern. In some cases, we agree these are genuinely credible downside scenarios (90%+ certainty worst case), and sometimes we don't. In MPAC's Annual Report, they pointedly fail to give any indication of what any of their stress test scenarios are, and therefore, we must assume we wouldn't agree with them.

With all the adjustments, profits warnings, restructurings, intangibles, pension “surplus”, contract assets, enlarged trade receivables, prepayments, debt and enlarged contract liabilities, it is very hard to value. One approach is to acknowledge that all this noise has been going on for years now without the company actually collapsing, and so there appears to be something sustainable here, and it is just a matter of looking at the owner's cash flows. There are two problems with this, though - there is no recent dividend history, and they raised £30m (gross) in September 2024. The next best thing is to look at the forecast all-in cash flows. This is £7m in FY 2026 and £8m in FY 2027. During this time, they are growing EPS (very heavily adjusted EPS), suggesting that some other kind of value could be accumulating; therefore, a 10x cash flow rating is arguable. So that's £7.5m x 10 = £75m, or about 10% below the current market cap.

This is also a 4% hit to the Onward Opportunities Fund, FWIW, who have egg on thier faces having this as their (former) largest holding:

Thruvision (THRU.L) - Contract Win & Placing

We got two announcements this week, that are perhaps not as unrelated as they seem. The first is described as a material contract win:

The Group is pleased to announce that it has secured a material contract for 20 systems, valued in excess of £1 million, from a new government customer in Asia (the "Contract"). The Contract was secured through close collaboration with the Group's regional partner and builds on the recent successful deployment of multiple WalkTHRU screening lanes at a major cultural event in Asia. The order is for Thruvision's highest specification systems and is scheduled to be delivered during the next few weeks. It underscores growing demand for the Group's advanced security solutions in high-profile government applications. This contract resulted from one of the "Material Opportunities" referred to in previous announcements.

Not as large as we imagined when we read the title, and it sounds like it must still be covered by stock. It also bought them more time:

Given the recent encouraging trading performance and the continued strength of the sales pipeline, including both smaller and more material opportunities, the Board now considers that the Group's cash resources will be sufficient to last until the end of the calendar year, although this is dependent on future trading performance and conversion of the sales pipeline in line with the Board's reasonable expectations.

Understandably, the share price reacted positively to this news, given that short-term insolvency was a real risk here. This is then followed up by a £2.5m raise at 1p.

The net proceeds of the Capital Raising will be used for the Group's general working capital and to invest in sales, marketing and product development to drive revenue growth. The Directors believe that the net proceeds will provide the Company with sufficient working capital for at least the next 12 months and would enable the Company to achieve cash flow break even during FY27 on the basis of achieving c. £10 million of revenue in that year.

The big question is how realistic that £10m revenue figure is? We would be happier if they had said the cash enables them to deliver material expected near-term orders, rather than further increasing SG&A costs, which is what got them in trouble in the first place. Well, that, and lumpy orders.

But is 1p with little chance of immediate insolvency a better deal than, say 0.8p with the scythe hanging over their heads? Probably, but then it depends on whether they use the cash wisely. These are the changes they highlight:

As previously announced, the Group has undergone significant senior management changes with the departure of the previous Chief Executive, Tom Black subsequently assuming the role of Executive Chairman in October 2024 and Victoria Balchin moving from Chief Financial Officer to also become Chief Executive Officer in January 2025.

In addition, significant changes have been made to the Group's sales management and to the sales approach being adopted.

In combination, these changes have contributed to a much-improved performance in the first quarter of the current financial year ending 31 March 2026 ("Q1 FY26") relative to the same period in the previous year.

We are unclear whether the first sentance is trying to imply that the ex-CEO was (in their opinion) a bit crap, or that the new board is cheaper. However, they are clearly claiming that improved sales are due to a change in approach driven by the new management structure, rather than random chance, and are therefore sustainable.

the Board has concluded that the standalone option is the best one available to the Group, subject to securing the necessary additional funding, and is therefore undertaking the Capital Raising to provide the Group with the funding required to enable it to proceed on an independent basis. As a consequence, the Company is no longer in discussions relating to the possible sale of the Group's trading subsidiaries.

This is a shift since the 23rd June when they said:

The option of selling the Group's trading subsidiaries remains under active consideration.

The only interim news that has been disclosed is a £1m contract win, which seems modest in terms of previous annual revenues and claimed sales pipeline. Therefore, what has probably changed is some combination of outsiders' willingness to support a capital raise and unwillingness to make an offer for the trading subsidiaries. They have again declined the "opportunity" to state or reiterate the size of the so-called "material opportunities", rather just repeating yesterday's trading update.

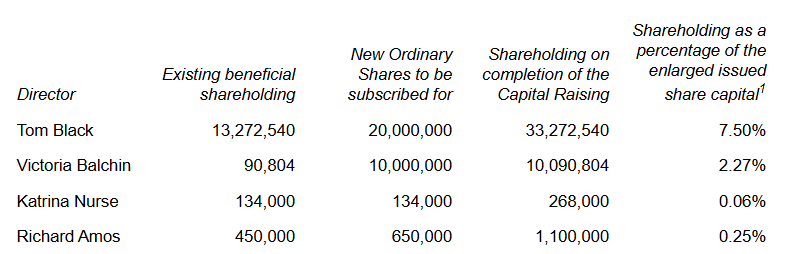

Directors are willing to support the raise, with Tom Black roughly keeping his percentage holding and new CEO (former CFO) Victoria Balchin adding significantly to hers:

One of the non-execs only finds £1,340 to invest. We guess the directors have to calculate if the company will last long enough to make back their investment after tax, and she’s the most pessimistic:

Other contributors:

Schroders have subscribed for £420,000 in the Placing by subscribing for 42,000,000 Placing Shares, Pentland have subscribed for £310,000 in the Placing by subscribing for 31,000,000 Placing Shares and Herald have subscribed for £215,000 in the Placing by subscribing for 21,500,000 Placing Shares.

So roughly 125.5m have gone to directors or the top three, leaving 87m (£870k) to find from elsewhere, plus the £250k Retail Offer. We’d imagine Allenby will manage to fill the institutional gap, but that the Retail Offer may be a stretch given how few want to hold shares in such a small company.

That’s it for this week. Have a great weekend!

If there are corporate warts to be found they will be disclosed under the close scrutiny of SCLWS's investigatory analysis.