Here’s a selction of what we looked at this week:

Braemar (BMS.L) - FY25 Trading Update

Here’s the key bit:

Global charter rates, notably in the Tanker and Dry Cargo markets, came under pressure in the second half of the financial year, due to increased geopolitical volatility; however, the impact of this was partially offset by a strong performance in other parts of the Group such as Sale and Purchase.

The result is a7% cut in revenue expectations and 6% off underlying operating profit. This should be no surprise to anybody who has been watching tanker and dry cargo rates.

It seems that the Baltic Dry is finally flat YoY, so it may be worth looking out for any overreaction.

The Group's forward order book at the end of February 2025 was strong, having increased from H1 ($80.9m) to $82.2m (FY24: $82.6m) and fixture levels achieved in FY25 are expected to be maintained in the year ahead.

The shares were down 13% but bounced somewhat, but this is still above the share price level of two weeks ago. So this is more a case of previous irrational exuberance recently than a big drop in response to this update.

This update also gives us a nice insight into the difference between company-paid research (Canaccord) and open research (Zeus). Canaccord titled their note “Opportunity Moment”, whereas Zeus cut to the chase:

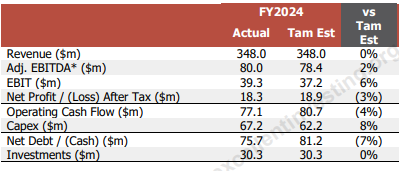

Zeus estimates are cut as shown in Exhibit 1 (below) and our rating is downgraded to HOLD from BUY. Our target price is reduced to 230p from 330p.

Capital (CAPD.L) - FY Results

Shareholders of the sensitive disposition should probably stop reading after the first line:

Probably best not to look at that EPS, even the adjusted one! Broker Tamesis say that these were mostly better than their forecasts, but that’s not saying much:

Listening to the management call, it seems there are a number of bright spots. Founder Jamie Boynton is firmly back in his executive role, with no immediate plans to replace the CEO that they lost recently. MSALABS continues to grow its revenue and is expected to be profitable in H2. The US looks to be heading to break even. The core drilling business seems to be doing ok. Only mining won't really deliver in 2025 with the ramp-up. This will have a big depreciation charge, but that will be non-cash, so the net debt will likely come down.

The strange part is that none of this appears to be reflected in the Tamesis broker forecasts, which are for a further collapse in EPS in 2025 to 4.4c. So it remains a bit of a mystery. Only really the large discount to TBV for assets that have historically been very productive makes the case that this is a buy. Everything else points to wait-and-see.

DigitalBox (DBOX.L) - Final Results

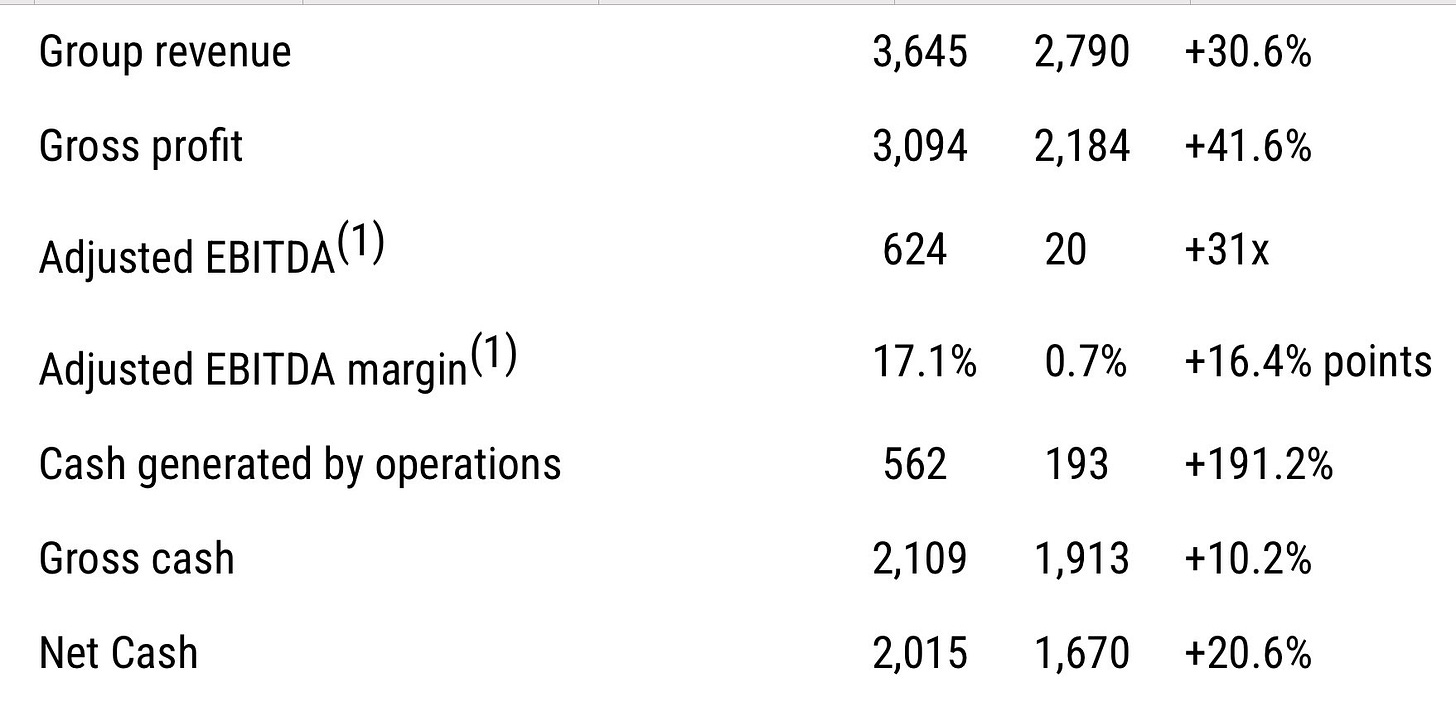

These look pretty good:

The revenue growth isn't all organic, of course, but there is operational gearing, and net cash has increased despite the acquisitions made. One of the key points is that they have done this in very difficult advertising markets. Although it is worth noting that revenue is only just nudging where they were in 2021.

We know the forecasts are out of date, because the brokers couldn't update them during the "offer" period. These results are in line with the lastest improved revenue guidance, unsurprisingly, as the last trading statement was 2 months ago and after the period ended. Howevr, is this a miss on EPS:

That would probably be a little harsh. Probably the fairest assessment of where they are as a business is to take EBITDA and take off Depreciation, SBP and New product development = £423k. Which would be £313k on normal tax rates. So that puts them on a normalised, cash-adjusted P/E of around 10. Not necessarily cheap in current markets, but then there are multiple headwinds that can become tailwinds:

Global insights indicate a steady and measured market recovery throughout 2025, and we see no reason to question these forecasts at the current time. With improving conditions ahead, we are confident that the business is strategically placed to capitalise on the market's anticipated resurgence.

Plus, if this is achievable:

Over the next 3 years we have an ambitious plan to at least double the size of the business. This will involve organically launching and expanding brands to build audiences in English language markets.

They clarified on the IMC presentation that this isn’t all due to organic growth. However, doubling revenue means that EBITDA will probably be 3-4x higher with the operational gearing. It is fair to say that a £2-3m EBITDA company won't be on an EV of 1, so the big question is, can they deliver?

Given the previous strong track record, it seems a bit daft that the shares traded down on these results, but like so much of the market at the moment, if it doesn’t have a buyback in place or a tipster promoting it, then results get sold into.

Goldplat (GDP.L) - Interim Results

Revenue was down, but EPS was up 19% due to the change in the business model in Ghana. The benefit is that the balance sheet looks a lot stronger, and the financing costs are much reduced. So, while many shareholders wouldn’t have preferred to do the capex at this time, having it forced upon them has had some benefits. If the company are now most through the changes, then the risks of implementation are now reducing too.

Inventories were elevated at year end due to the issues with the gold marketing board in Ghana:

We know £2m of that was due to the delayed exports. And they also say:

There has been an increase in inventory value on site which has been driven by a good supply of material from our current customer base and healthy stock levels before the transition started. Through investment in plant capacity and changes at our operations, we believe these levels should normalise over the next quarter.

Assuming by next quarter they mean the one just ended, that suggests a good Q3 to come in Ghana. Most of that should turn into cash, given the now reduced pipeline between production and sales. Offset by ongoing capex to increase capacity:

We expect to spend a further £250,000 over the next 6 months. This investment is required to increase plant capacity and to increase the recovery of gold from concentrate on site.

Broker forecasts are maintained, making it close to the cheapest stock on the UK market on earnings multiples, we just need to finally see those shareholder returns that keep being promised.

Getbusy (GETB.L) - 2024 Results

As is usually and ironically the case, Getbusy haven't been very busy:

And are spending money to stand still:

Their vain search for some productivity software that may improve their performance continues…

Journeo (JNEO.L) - Final Results

These look like decent results, and as is often the case, we turn to the brokers to see if these match expectations, in this case, Cavendish.

Before:

After:

So, it is a slight miss on revenue, slight beat on EPS, and FY25 estimates are held, which are basically for no growth. Net cash is a slight beat at £14.1m vs £13m forecast, and here, FY25 has been upgraded to £17.6m from £16.3m. Cavendish say:

Valuation: Journeo looks compelling on an FY25E adj P/E of 10.6x (7.3x ex-cash P/E) vs peers on 17.9x, with further upside being seen if the substantial £14.1m net cash balances (c.35% of market cap) are deployed on additional organic or acquisition opportunities leading to earnings accretion.

Which we would probably agree with if we assume they will continue growing. However, a cash-adjusted P/E of around 7 is probably about right for Cavendish's forecasts for no growth. There are no FY26 forecasts introduced at this stage, so the investment case really comes down to whether you believe that Cavendish have been guided unnecessarily cautiously.

Management have forecasted very conservatively here in the past, so on the balance of probabilities, they are likely to beat and are just being conservative. In their presentation, they did quantify the sales pipeline at >£75m versus last year’s £60m. (Of course, we shouldn’t have to wait for a presentation for this information.) They are targeting £100m revenue within 3 years, assisted by acquisitions, and there should be operational gearing and improved margins as they grow.

While its still better than missing expectations, we’re not sure the conservative approach is doing them any favours in the current market as the drip-drip of sellers just takes the share price lower, as they don't look cheap if they are not growing, and then the jump from any beat happens off a low base, which is then sold into again.

Luceco (LUCE.L) - FY Results

Look decent results on first reading with EPS of 12.5p vs 11.9p consensus on Stockopedia, although on an adjusted basis. However, Longspur's forecasts were stale and so may have polluted the consensus: After the January trading update, they maintained revenue forecasts at £234.6m despite explicit guidance of £240m, maintained EBITDA, and actually cut PBT & EPS without explanation and in contradiction to their P&L model. In a scenario with 2x12.5p forecasts plus Longspur's 10.9p EPS, the consensus would be 11.9p, and the results merely in line.

For the very little it is worth, Longspur have upgraded future EPS forecasts by around 0.2p on these results, seeing lighting slightly ahead. Without adjustments, the EPS is down, and there is a lack of the usual operational gearing.

Adjustments:

· Amortisation of acquired intangibles: £2.3m and acquisition-related costs of £3.8m

Excluding the amortisation of intangibles is normal, but we have to question the validity of excluding acquisition costs when this is fully part of their strategy. They don’t exclude the revenue or profits from acquisitions as exceptional!

Here’s the outlook:

Trading in early 2025 has started well, although consumer confidence remains relatively subdued, we are beginning to see green shoots of recovery within our markets. Whilst the macroeconomic outlook for 2025 remains difficult to judge, I am encouraged by our continued underlying trading momentum which leaves us well positioned to make further progress in the year ahead.

This isn’t cheap, but then probably shouldn’t be, given the quality of the execution and that we are closer to trough than peak trading conditions

In terms of risks, the Americas are less than 10% of sales, and they explicitly mention South America as a market. So we think the USA is around 5% of sales. So the risk is from secondary USA effects, including pressure on the UK to tax Chinese imports, rather than a direct impact.

National World (NWOR.L) - Response to media speculation

With the 23p takeover here delayed a little due to needing Irish government approval, it seems another bidder is interested in stepping into the fray:

The Company has received confirmation that EMH is considering making a proposal to acquire the entire issued and to be issued share capital the Company

However, details are sparse:

…to date no details of any such proposal has been received by the National World Board (including as to its possible terms, timing or process for implementation)

EMH is controlled by Todd Boehly, and separately, Sky News has reported that Exec Chair Montgomery and Boehly are progressing talks for a bid for The Telegraph. So it seems that Monty may not have given up the fight here, despite the sale to Media Concierge being approved by shareholders.

If there are now really two very serious bidders who know the company well, then it seems that the 23p offer may not be the end of the matter.

Real Estate Investors (RLE.L) - Final Results

For a fund in wind down, the Post Year End Activity can be as important as the numbers:

· Additional £1.6 million of completed and contracted sales since year end (an aggregate uplift, pre-costs, of 7.47% above December 2023 valuations)

· Sale agreed on Kingston House at £2.7 million, dependent upon planning permission which was granted on 13 March 2025, with expected completion by end of Q2 2025, which will materially reduce holding costs

· Further £1 million of debt repaid since year end, resulting in reduced debt of £38.2 million

· Healthy pipeline of new income to the portfolio of £230,110 p.a in legals

· In March 2025, the Group extended the £12.6 million facility with Lloyds Banking Group Plc for a further 12 months to 29 May 2026 and the £24 million facility with National Westminster Bank Plc for a further 12 months to 1 June 2026. As with the previous refinancing in 2024, the facilities have each been extended on a short term basis to reflect the Group's intention to repay debt as a priority using disposal proceeds

Of course, the most marketable properties are the ones that get sold first, and these are most likely to have the uplift, but this still bodes well. The loan facility was never in doubt at this level of leverage. However, while valuations may be conservative, they're still going down:

Loss before tax of £2.4 million (FY 2023: loss of £9.4 million), primarily as a result of a revaluation deficit of £6.3 million on investment properties (FY 2023: £13.2 million revaluation deficit) (non-cash item)

And that's largely the news this week - adjustments for interest rate moves. EPRA NTA (a NAV measure) is 51.3p versus a price to sell of around 28.3p, so that's a 45% discount to assets. If values keep falling at 2024's rate, then this might be 43% in a year’s time before any adjustment for dividends. Loan to value net of cash is just 26.4% now versus 32.4% last year so there's not that much risk. Occupancy is slightly down due to emptying properties for disposals, and has recovered since due to sales. Lease length to break (WAULT) improved over the year and has only come back slightly since, less than the time that has passed.

Whilst Q1 2025 has seen the continuation of weak market sentiment from 2024...We remain optimistic about H2 2025 and expect some investors that have been absent to return to the market as conditions slowly improve.

So it is true to say that liquidation has been put off another 6 months, and this is reflected in the share price. They must be close to selling smaller properties of interest to smaller entities and owner-occupiers and increasingly dependent on institutional-type investors returning to the market. Looking at their tenants, there is some exposure to Poundland and the housing of asylum seekers, both in the news recently, but the properties concerned are well-located and conservatively valued, respectively.

Total fully covered dividend for 2024 of 1.9p per share (FY 2023: 2.5p) reflecting a yield of 6.7% based on a mid-market opening price of 28.5p on 24 March 2025.

That looks a little misleading given:

The first three quarterly dividend payments in respect of 2024 were paid at a level of 0.5p per share and were fully covered. Due to the level of disposals, the final dividend in respect of 2024 is confirmed at 0.4p per share

So a reasonable dividend forecast might be 0.4 + 0.4 + 0.4 + 0.3 = 1.5p, a yield of 5.3%. If things (i.e. disposals) go well, it will be lower. If they go badly, then it could be higher, maybe a 0.5p final at most.

Xaar (XAR.L) - Final Results

As usual, there is a huge gap between how the company describe their prospects:

The Group enters 2025 with renewed optimism as several, potentially significant, market opportunities start to gain momentum. Over the medium term, these opportunities should deliver meaningful revenue at attractive margins, and we see these as major drivers of shareholder value growth over the medium to long term.

And the accounting figures:

The company could probably have skipped the verbiage and simply posted the following meme as their results:

Shareholders seem to be familiar with the sound of (their cash) burning, as inexplicably the shares have risen almost 50% on the news. Perhaps in the current markets it is better not to make a profit, as shareholders can focus purely on the story, and companies who want to see their shares soar should actively try to lose money.

That’s it for this week. Have a great weekend!

Love the this is fine meme, it could be user for soooo many companies and how the world feels every time Trump or Elon go to Twitter/X or basically when they open their mouth 🔥🔥🔥🔥

A wry and entertainig look at the way companies interpret their unimpressive results! Volumes in share dealings seem to be dropping alarmingly across the board. Is this a harbinger of price falls ahead or a combination of the Trees effect (Trump and Reeves). Thanks for posting.