Driver Group (DRV.L) - Interim Results

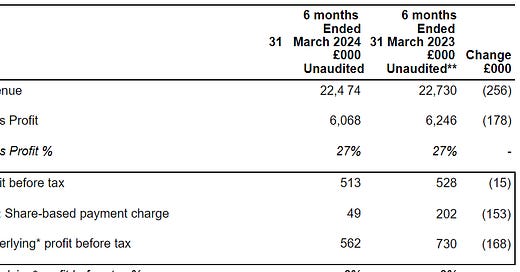

The results themselves are a bit meh, with no real change versus last year:

However, all regions have now returned to profitable trading, and the outlook is pretty good:

We have started H2 FY24 strongly, and we expect the business to generate further significant momentum as the benefits of our transformation strategy flow through to our clients and shareholders .

Plus, market attention may well focus on the buyback, which often moves the share price in such illiquid stocks:

However the Group will today commence an initial ordinary share buyback programme of £250k. Having identified surplus cash of £1m, a further amount of up to £750k will be allocated to the programme, dependent on progress with potential acquisition targets, in line with the transformation strategy.

Sounds like they have something specific in mind rather than a general acquisition strategy.

Cash flow is a bit of a concern:

Cash decreased by £2.3m from that reported at 30 September 2023 mainly due to dividend and tax payments and the timing of the planned cessation of a JV agreement in Canada and the Middle East.

Although £0.6m had flowed back as of 31 May, receivables remain high. There’s no unbilled revenue, so they consistently seem to attract customers who recognise that Driver has done work for them and pay late, if at all. When momentum turns with this sort of business, it can often mean multi-year periods of strong growth. Ultimately, future visibility is low, and this should be reflected in the price.

Paypoint (PAY.L) - Final Results

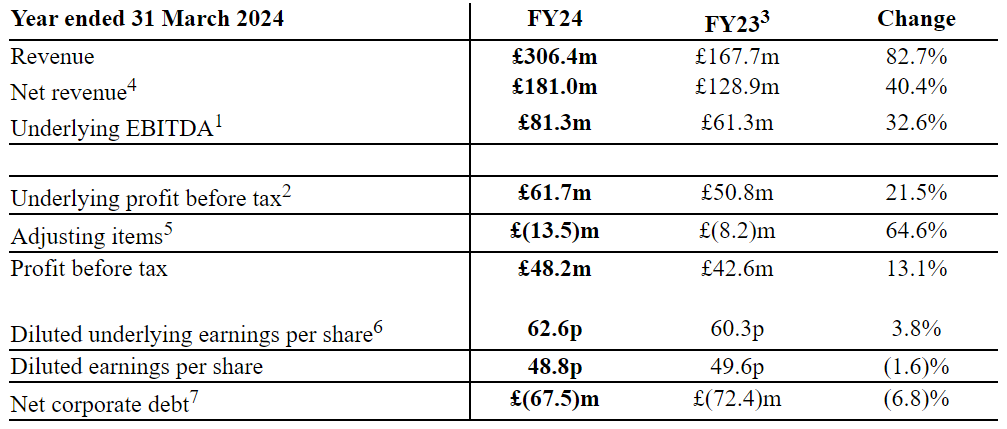

A great set of results:

Of course, these are not all like-for-like, as they acquired Appreciate for cash and shares in the period. We expect they would argue that they report this as a separate segment so shareholders are given the full picture. Still, it would be good to have these broken out in the headlines, too.

In addition they have announced a £20m a year buyback program. Interestingly, they announce this as a three-year program. Again, this is a sign of a management that is perhaps not as price-sensitive as we’d like with these things. They may be paying an inflated price in a huge bull market in three years’ time! And some of what they giveth in share buybacks, they taketh away in dividends (which were £27.3m in FY 2024) - this sounds like a strategic shift in distribution mechanism, albeit nothing dramatic:

we will continue to increase dividends at a nominal rate and grow our cover ratio from the current 1.5 to 2.0 times earnings range to over 2.0 times earnings by FY27

While the figures read fantastically well, the outlook is so-so:

In the current year, consumer behaviour across a number of our businesses remains subdued, reflecting continued tighter family budgets and a generally flat economy. Our expectation is that this consumer outlook will improve during the course of the year.

If forecasts build in these expectations for an improvement, then we have an H2 weighting and the risk of a profit warning. However:

We remain confident in delivering further progress in the current year and achieving our medium-term financial goals.

Which we believe refers to:

[we] made further progress towards delivering £100m EBITDA by the end of FY26

Given EBITDA rose from £61.3m to £81.3m against the headwind of fast-falling energy prices and the removal of the Energy Bills Support Scheme, that hardly seems a stretch. For a company that has been disrupted & lost its core business, these results are remarkable

One known negative with the company is that there is some legal action against them, which they go into more detail about today. The two cases appear to be about would-be energy supplier customers complaining about their dominant position in pre-payment energy cash payments. This hardly seems fruitful of the complainants' resources given it is in long-term decline, albeit not as fast as today's figures would suggest. The first complainant is Utilita, an Indian-owned energy supplier. Here is the filing.

Nothing has happened which wasn't already known about at the start of 2020 (e.g. movement away from cash in bill payments and top-ups), and indeed, they have successfully built a forward-looking strategy, so we don’t see why institutions wouldn’t bid it back to previous levels of over £10 if they continue to execute.

RWS Holdings (RWS.L) - Interim Results

These are not terrible results if you are willing to take the adjusted numbers:

That doesn’t sound like much of a commendation, but the market was clearly pricing terrible results, so it is easy to see why these actually caused a 20% rise in the share price.

On the surface, the move to net debt is a little worrying:

Although this is largely dividend payments and buybacks:

A small dividend increase is proposed:

The Directors have approved an interim dividend of 2.45p per share, reflecting a 2% increase over the 2.40p interim dividend in HY23. This reflects the Group's strong financial position, its cash generative business model and the Board's confidence in its future prospects.

The problem is that they were forecast to grow EPS, and a declining H1 doesn't look favourable to this. However, they do say:

…we are pleased that recent trading, including an encouraging start to H2, currently points to a performance in line with market expectations for the full year¹ and we remain confident in the multiple long-term growth drivers for our products and services.

Helpfully, they quantify these, given we can't read the notes:

The latest Group-compiled view of analysts' expectations for FY24 gives a range of £721.4m-£756.0m for revenue, with a consensus of £735.1m, and a range of £110.4m-£118.4m for adjusted profit before tax, with a consensus of £113.8m, and a range of 21.8p to 24.0p for adjusted EPS, with a consensus of 22.8p.

Hitting these has been helped by brokers continually reducing them during the year:

If there are no further major downgrades in response to these results, it feels like the bottom may be in here.

We are disappointed that there is no further buyback here. In general, funding these from debt is not something we like, but this is easily funded with their usual operating cash flow. In their analysts call they say that this would be a low point for cash and that they expect working capital to unwind going forward. It saves on tax, and it is exactly what Private Equity would do if they got their hands on it, so it would be better that shareholders get the benefit. In the last buyback, they shot their bolt too early and bought too high, so they may be reticent to do this for this reason. On the call, they said:

…we have a clear capital allocation policy which hasn't changed.

I think we'll always prioritise, first of all, organic investment in the business, our progressive dividend, which today we've continued to commit to with the announcement of our interim dividend, and then M&A. And I think it's only after all of those things have been taken into consideration that we would consider a further share buyback. And right now we are not anticipating a further share buyback.

We do look at them from time to time. That isn't to say we won't do one at some point in the future, but it's not something we're currently considering.

The focus on M&A above buybacks looks a little daft without any reference to valuation. Unless they can get an equally good business for less than an 8x multiple, then surely buybacks are better. It may be possible to get a bargain in the private markets, but it seems unlikely for a tech business, especially one with sufficient scale to move the needle for RWS. The days of them doing deals using their expensive paper look long gone.

That’s it for this week. Have a great weekend!