Another bonkers week. With equity falls accelerating and possibly starting to spill over into the bond market, Trump appears to have blinked, at least for 90 days, but not before he managed to tell his friends to buy stocks. 90 days is long enough for the market to have a brief recovery and then start to worry about the upcoming cliff edge. And, of course, China isn’t forgiven, so this pretty much embeds inflation assumptions into the US economy and delays any interest cuts into the incoming recession (why invest in hiring or a new factory at the moment when policies will change multiple times before the factory is built?).

With all this going on, it is no wonder that UK small caps have been affected, too. However, with so much uncertainty around the impact, individual investors seemed to have reduced their response to piling into panic selling the most popular PI stocks (whether they suffer from tariff impacts or not) on the down days for the indices and piling back into the same set of stocks on the up days. We are not sure whether selling low and buying high is a great strategy for the long-term compounding of wealth, but it must make them feel better that they are doing something.

This is a selection of the news we looked at this week:

Beeks Financial Cloud (BKS.L) - Contract Win

The contract, worth c.$2 million over four years, is for the deployment of the Beeks high performance, dedicated and client-owned trading environment across the client's core FX platform, with revenue recognition set to commence in H2 FY25, further supporting current Board expectations.

$500k pa really should have been an RNS Reach given it is 1% of forecast revenue and already in forecasts. But with the share price falling due to the current weak wider markets and with the level of share-based payments, they were probably desperate to RNS something….anything…to try to stop the fall.

Brave Bison (BBSN.L) - Final Results & Acquisition

Sky News trailed the acquisition but made it sound grander than it was:

If completed, the transaction would involve Brave Bison acquiring The Fifth with a combination of cash and shares that would result in News UK becoming one of its largest shareholders.

The purchase price is said to be in the region of £8m.

This is the reality:

On completion of the Acquisition, News UK will be issued with 40 million new Brave Bison ordinary shares (the "Consideration Shares"), worth £1 million at an issue price of 2.5 pence per ordinary share, and will receive cash consideration of £0.575 million. News UK will also receive 25% of profits generated by The Fifth over the next three years, capped at £6 million (the "Contingent Consideration").

As has been the case recently, Brave Bison have structured this deal very favourably as the contingent consideration gets paid out of profits from the acquisition itself.

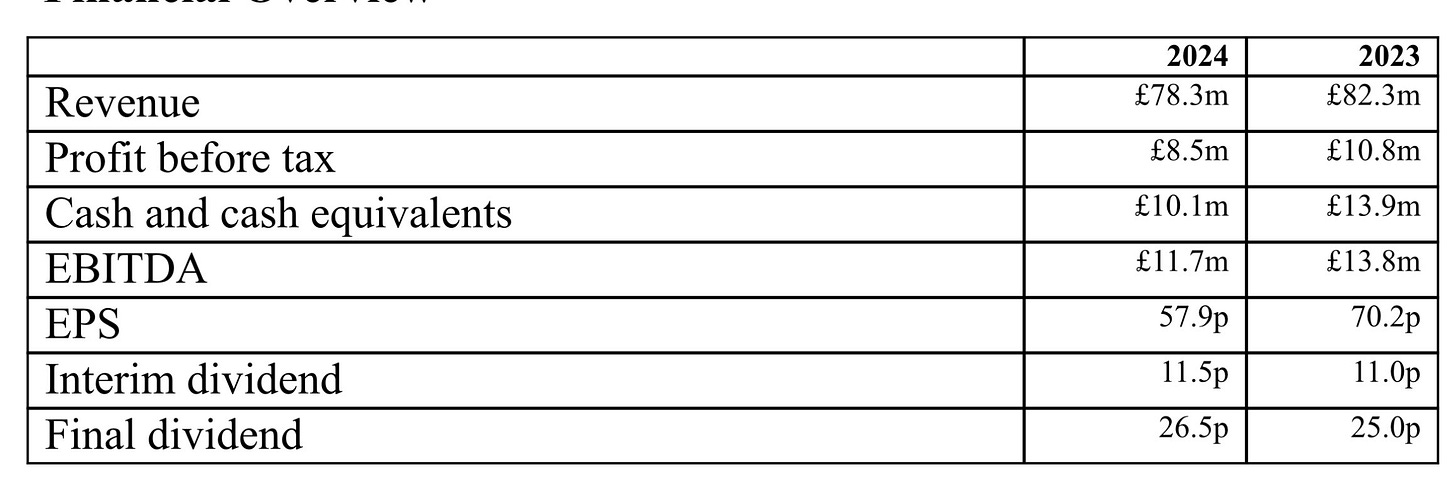

In terms of the results themselves, they are a bit flat, given all the corporate activity:

What stands out most is that the exceptional costs are anything but exceptional, given their business model of acquiring businesses and restructuring them. Management also restrict their pay and take options. While this aligns them to shareholders, this also means SBP should be taken into account for any valuation.

Their broker, Cavendish, say:

Following the recent acquisitions of Engage, Builtvisible and The Fifth, we are confident in raising our net revenue forecasts by 18% to £25.5m, and nudge up adj PBT by £0.1m to £3.9m. The acquisitions are likely to contribute positively to profits in the first year, but are partially offset by National Insurance rises from April 2025. Net cash reduces by £4.7m, but remains healthy at £5.3m.

Which, again, is a bit meh after all the acquisitions. Cavendish also claims:

Brave Bison’s valuation looks highly compelling given it trades on an FY1 adj P/E of just 8.1x versus peers on 9.3x, whilst retaining significant net cash and growing net revenues by 20% in FY25E.

Which sounds daft, that kind of discount isn’t large at all, and if one makes more sensible adjustments this trades at a premium to the sector. This may be justified given the deal-making quality, but it certainly isn’t compelling.

Character (CCT.L) - Trading Update

It's the first one of these that I've seen, where the tariff uncertainty is causing the withdrawal of forecasts, but it is unlikely to be the last:

The recent unilateral imposition by the USA of trade tariffs on imports, particularly from China, and the escalating retaliatory measures being adopted have greatly impacted global economic stability in a very short space of time.

The Board's visibility for forecasting sales to USA (which were c.20% of Group turnover in the last financial year) and its ability to assess the financial implications for the Group have been considerably obscured by these events. Consequently, the effect of the imposition of the trade tariffs will be felt in the second half by the Group and, as a result, the Company is withdrawing the market guidance for the year ending 31 August 2025. Despite this, the Board remains confident that the Group will be profitable for the current financial year as a whole.

There is an obligation to update the market where the outturn is likely to be materially different from market expectations. In this case, that means we can expect profits to miss by more than 10%, but that they cannot estimate what they will be to within 10% with any reasonable level of certainty. So, somewhere between 10% and 90% profits hit? The key problem is that they don’t know how large price increases will impact demand. In contrast, other companies that have reported have said that they don’t necessarily expect lower demand due to greater price elasticity. If every toy is double the price, do Americans buy half the number or do they cut their flag/assault rifle/meth consumption to keep their toy volume constant? We just don’t know, and neither does Character.

In reality, the worst case would be a total loss of US sales, which Leo calculates would lead to around 13p EPS.

The Company continues to have a strong balance sheet...

Indeed, arguably, this is a property company with a sideline in toys

...and the Board is confident that it can ride out this storm. As we gain a clearer picture of the global economic landscape emerging, we will update shareholders further.

It would have been nice to get an update on Vietnam. Not announced, but disclosed to anybody that asks (e.g. at the AGM) is that they have been working with the owner of their Chinese Goo Jit Zu factory to set up in Vietnam. It is now not clear whether they pressed the button early enough on this. Today's statement was made when the following was already known:

a) 10% on Vietnam for at least 90 days

b) 145% on China indefinitely (though maybe this is a mistake and it is 125%)

c) A relaxation for goods on the water before 5th April reduces this from 0% and 10% from Vietnam and China respectively:

The market has been remarkably sangune about this miss. It may mean that other investors have spotted the hidden property value, too.

Churchill China (CHH.L) - Final Results

These don’t seem too bad, given market conditions:

This is the outlook:

The Company continues to deliver differentiated performance products that are highly regarded in the marketplace. We continue to have a business that has a strong installed customer base leading to healthy replacement business which we expect to continue through 2025. The area that is currently more uncertain is the number of new installations however, as always, with our market leading delivery times and stock levels we are always well placed to service new installations rapidly.

A more robust hospitality market is required for a step forward in our market penetration and profitability. We will continue to focus on improving efficiencies within the business and invest strategically to ensure we are in the best position to capitalise on future opportunities, as underlying macro conditions and consumer sentiment improves.

Obviously, the UK hospitality industry is in a terrible state. However, the one advantage Churchill have is that their product is breakable!

Gulf Marine Services (GMS.L) - Final Results

Revenue is up, but on lower gross margins and lower utilisation, meaning lower profits:

Utilisation guidance is up for 2025, and net debt is down, including a refinancing on lower interest rates, which should see an improvement going forward. The forward EV/IBITDA of 4 from Zeus isn’t an obvious bargain, given the highly cyclical nature of the industry, but it isn’t bonkers either.

They talk about their progressive dividend policy, but no dividend is declared or forecast by Zeus, which won’t please the dividend-loving PI who has been the core buyer here recently.

At the end of June, the not inconsiderable number of warrants will expire and will presumably be exercised unless the price collapses. This may mean another period of persistent selling on top of the one we have had from the Seafox distribution.

The short-term weakness here is more likely due to weaker oil prices, and this likely means that their medium-term outlook has soured somewhat. However, construction cycles are long in both shipping and oil, so the reality may be that the NPV impact is slight. We doubt many are investing based on NPVs here, though.

Treatt (TET.L) - Trading Update

The combined impact of several factors means we now expect Revenue of between £146m and £153m for the full year, and PBTE between £16m and £18m.

We've consistently argued this was overvalued, and there was little sign they would be able to use their extended capacity. The failure of the new CEO to get ahead of the numbers (aka "kitchen sink") has led to at least two further downgrades, and the suspicion is that this may not be the last. They clearly signalled they don't want private investors onboard after removing our access to broker coverage over a year ago, but the shares fell over 30% on this update, and they now trade below Tangible Book Value, so it has got our attention.

They are guiding £16-18m for the full year, but H1 £3.6m PBTE is down from £7.6m. H2 last year was £11.5m, so they are expecting a big improvement in H2. This looks very optimistic, given the recent performance.

The big risks are a) that they make highly processed and "quite" processed ingredients for highly processed foods and drinks, and b) whether their unproductive assets will come good or need to be written down.

Given the scale of the fall, we wonder if some funds are dumping because it is now too small for them. They better start courting those PIs again.

Volex (VLX.L) - FY Trading Update

Nat must have loved writing (or telling an underling to write) this, given recent market moves here:

operating profit of at least $100 million, well ahead of the top end of market estimates1.

Organic CCY revenue growth 8% and margins at upper end of the range have delivered the result. And unlike a lot of companies, they’ve bust the billion without going bust!

"For the first time in Volex's history, revenue and profits have exceeded $1 billion and $100 million respectively. This is a direct result of our continued investment in advanced manufacturing capabilities, coupled with our strategic focus on key growth sectors, whilst simultaneously maintaining strong returns on capital employed.

Most importantly, tariff costs are to be passed on to customers:

The majority of Volex's products represent essential components within complex supply chains. In many instances, Volex is either the sole provider or one of very few qualified manufacturers capable of meeting demanding technical and operational requirements, fostering strong customer reliance. Incremental costs arising from tariff changes are expected to be passed through to customers, underscoring the robustness of Volex's competitive positioning.

Looks like the market fears here have been seriously overdone.

That’s it for this week. Have a great weekend!

Finding your write-ups very useful to provide a counterbalance to the permabulls.

Your scepticism helped me dodge the dogshit that is Treatt- much obliged!

As usual, Small Caps Live Weekly tells the story behind the story. A fascinating read. Thanks as always.