Here’s some of what we discussed this week:

Brave Bison (BBSN.L) - Trading Update

Good to see another ahead here. They said when they presented at Mello in Derby that they tend to be conservative in their guidance, and this has proven to be the case again. The absolute beat is relatively minor:

· Group Net Revenue of not less than £21.3m (FY23: £20.9m), growth of 2% year-on-year and marginally ahead of market expectations. Excluding net revenue of £0.2m from US operations which were mothballed during the period, net revenue growth was 8% year-on-year

· Adj. EBITDA of not less than £4.5m (FY23: £4.3m), growth of 5% year-on-year and ahead of recently upgraded forecasts (6)

· Adj. Profit Before Tax of not less than £3.9m (FY23: £3.6m), growth of 8% year-on-year and ahead of recently upgraded forecasts (6)

versus:

Market expectations as at the date of this announcement of Net Revenue of £21.0m, Adjusted EBITDA of £4.4m and Adjusted Profit Before Tax of £3.7m

But its the momentum that matters here most, when the shares are on a cash-adjusted P/E of less than 6.

However, there still seems to be a seller about, as the initial markup was sold into. Perhaps because Cavendish haven't upgraded 2025. The real 2025 outcome here probably depends on how quickly they can stem the losses from the recent acquisition, plus their tendency towards conservative forecasting. So, a flat EPS forecast perhaps shouldn’t be worrying at this stage. After all, Cavendish forecasts them to generate £2.5m FCF before any further acquisitions, which puts them on a forward EV/FCF of less than 8. Management doesn't start to get paid any real money unless the share price is consistently above 3p, so there is still a lot to like here, even if it's not often a great sector to be invested in.

CT Automotive (CTA.L) - Trading Statement

It is rare that a profit warning generates a rise in share price, but CT Automotive managed it. This is this week’s update:

no less than $117m, adjusted PBT no less than $8.6m, broadly in line with market expectations

Helpfully, they quantity the miss versus broker forecasts:

Immediately prior to this announcement, Singers Capital Markets estimates for FY2024 were Sales $119.1m and Adj PBT $9.3m)

We can only surmise that the market was actually expecting much worse! after all, being a small supplier to the automotive industry at the moment is generally a terrible place to be. Presumably, the reality was that this was all in the price. They have a number of new contracts starting from FY26 and are on a low single-digit P/E. Debt is not excessive either. This may be another company where Trump tariffs present a big risk. They support NA OEMs via a plant in Mexico and have recently invested to add extra capacity. Conversely, if tariffs are not applied to Mexico but to Chinese imports, they could benefit from near-shoring.

DigitalBox (DBOX.L) - End of Strategic Review

As expected, the strategic review concluded with no sale. Basically, the non-exec put in by Downing because they weren’t happy with the share price concludes that management is doing a great job!

And it makes sense not to sell at this juncture. As well as announcing the end of the review, they report a slight upgrade to revenue forecasts - £3.6m vs £3.5m previously. If they are trading this well and beating expectations in very difficult digital advertising markets, but the share price is not reflecting this, why sell out to someone who knows that they are being forced to sell and will offer a modest premium, at best.

Maintel (MAI.L) - Trading Update

This is a minor profits warning, although they have done well to increase EBITDA on declining revenue:

The Company expects to report total revenue of £97.9 million (2023: £101.3 million)…

Broadly in line with expectations, adjusted EBITDA* is expected to be £10.5 million…

Despite some progress, debt levels remain significant:

Net Cash Debt** at the end of the period decreased by 8.2% to £16.7m (31 December 2023: £18.2m),

The impact in the year just gone is slightly compared to the changes their broker Cavendish have made to FY25 estimates. They have cut EBITDA by 26% and added £5.1m to the net debt forecast. This makes the 13% fall in share price this week look nowhere near enough to be up with events. Especially as it only just reverses recent unfounded optimism in the share price.

Paypoint (PAY.L) - Trading Update

Paypoint hasn’t done us any favours here. They’ve gone for an endless stream of text to start the RNS, where a simple table would have been much better. It makes it very hard to work out what is going on! Thankfully Leo has been doing a bit of deciphering.

Leo had hoped for a small upgrade, but it sounds like any conservatism has been absorbed by "lower consumer spending":

In Cards, lower consumer spending during the quarter and the continuing challenging environment for UK consumers have impacted processed volume and value.

Panmure Liberum reveal an interesting snippet here:

At Love2Shop, management has shortened the card expiry dates so breakage income can be recognised quicker.

That's a great way to harvest short-term profits at the risk of your brand and regulatory intervention.

They are in partnership with Royal Mail, which may gain a new lease of life with their upcoming ownership change, but in competition with the Post Office, which continues to be largely unprofitable and moribund. Despite WH Smith's claims, some of their in-store Post Office branches are at further increased risk.

In E-Commerce, we have delivered a record quarter, with volumes up 36.8% against the peak quarter of FY24

Unfortunately, revenue per parcel has been reducing, and the Christmas Q3 failed to match Q1 in revenue terms.

Ultimately this is in line, and the small dividend increase probably gives the best signal. The business is performing well but in difficult end markets.

RBG Holdings (RBGP.L) - Suspension

As was probably the central outcome, and the £1m market cap suggested, insolvency is the result here. Given that this is a people business with no assets beyond highly uncertain case outcomes, I’d expect lenders to get nothing, let alone shareholders.

This is followed up by a board resignation:

The Board of RBG Holdings plc (AIM: RBGP), the legal services group, announces the resignation effective from 30th January 2025, of its Non-Executive Director, Patsy Baker.

She presumably didn’t want to be the board patsy anymore.

Somero (SOM.L) - Trading Update

They say revenue is in line which is good news:

It expects the Company to report 2024 revenue of US$ 109.2m, in line with previous guidance and market expectations, with H2 revenues improving by 10.8% to $57.4m

However, according to broker Cavendish, this is a small miss on profits:

In 2024, parts and service revenue declined 11% on 2023 to US$ 16.8m, with most of the decline in North America, Australia, and China, commensurate with the overall volume declines in those regions.

2024 North America revenues were US$ 82.2m (2023: US$ 88.4m).

Revenues in Europe, the Company's second largest market, remained consistent during H2 2024 reporting full year revenue at US$ 14.6m (2023: US$ 15.1m)

Australia reported a revenue decline of 33% to US$ 6.6m

Rest of World segment...sales declined to US$ 5.8m (2023: US$ 7.3m).

But the H2 weighting bodes suggests we might see some recovery in FY2025:

H2 revenues improving by 10.8% to $57.4m

Accordingly, newly introduced forecasts for FY 2025 of revenue up 4% look conservative, but unfortunately, lower margins mean that EPS is expected to be flat YoY, although they do contradict themselves a bit.

In summary, this is an ex-growth company that continues to lose market share. They remain the defacto standard in the US, but we don't see why anyone would pay a premium for their relatively crude equipment in Europe. The forecasts always looked a stretch so perhaps some will be relieved that EPS only missed by 6%, but the time to guide down was 20th December, not post year end.

On the plus side, there's the strong dollar and scope for the US market to prove stronger than expected this year. There is always the chance that some of their innovations start to gain traction, too. It is also cheap for a US company, which, combined with founder / founder-like board members leaving, may encourage a takeover bid.

Tribal (TRB.L) - Trading Update

Rare that you get such a positive upgrade:

Tribal expects to deliver a positive trading performance in FY24 with adjusted EBITDA1 substantially ahead and revenue ahead of current market expectations2.

Here’s the figures:

In so far as the Board is aware, as 30 January 2025, consensus market expectations for FY24 were Revenue of £85.6m, adjusted EBITDA of £14.4m, and Net Debt of £9.4m.

But there’s a sting in the tail, huge adjustments:

Adjusted EBITDA is stated before Exceptional items of £6m, reflecting NTU settlement, TDE impairment and redundancy costs.

There’s news of intangible write-downs and the usual risks for 2025, but the 10x forward P/E perhaps covers this. The market clearly didn’t expect this ahead statement:

Which made for an interesting morning as the market caught up. However, in the cold light of day, FY25 forecasts are unchanged by this update, and a legacy contract unwinding means EPS is set to shrink next year. This means that the gains this week will probably be short-lived.

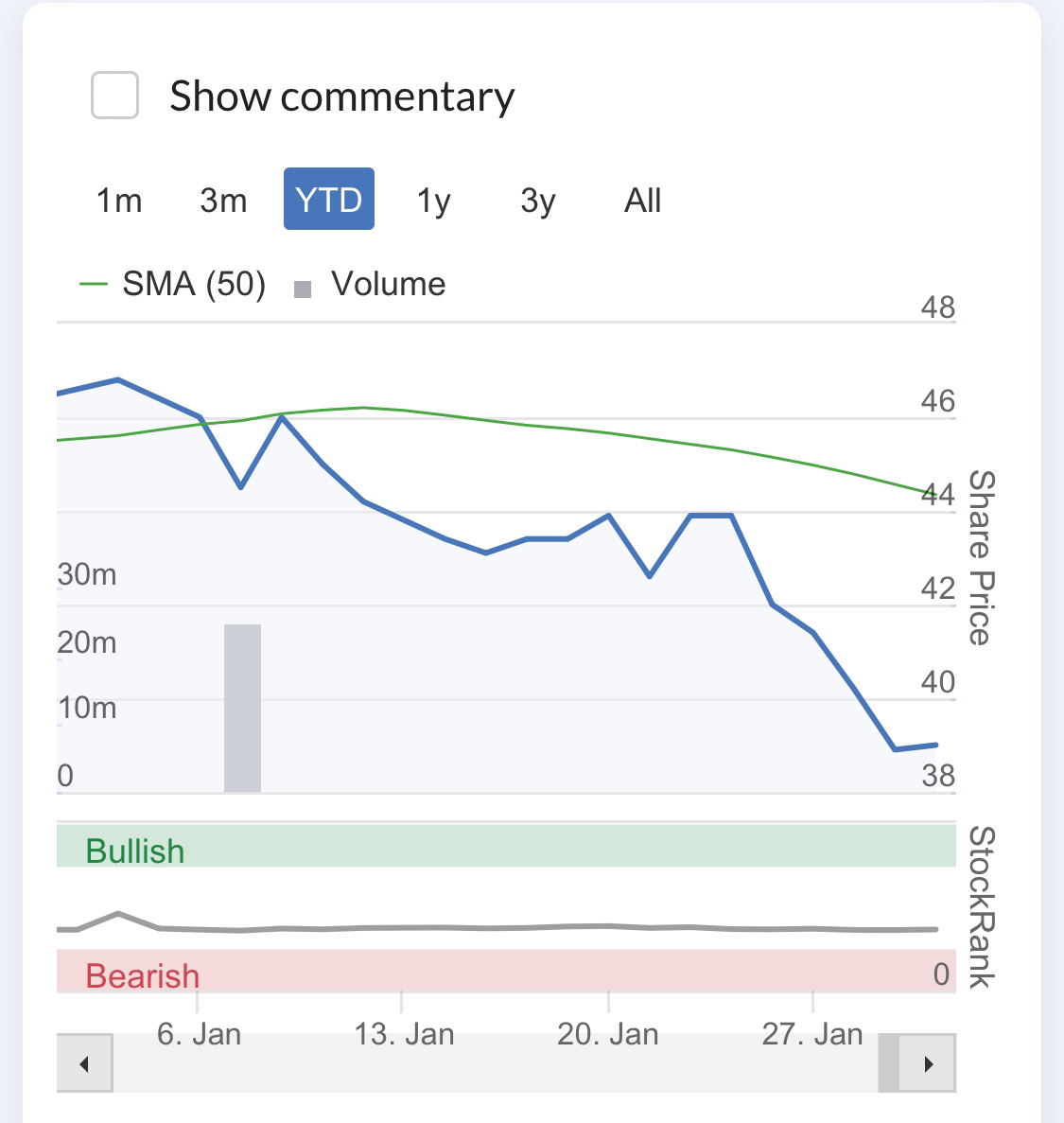

Volex (VLX.L) - Trading Update

The organic growth rate of around 10% seems pretty good, although Q3 is only up 2% on Q2. Overall, this is said to be in line:

The Group's underlying operating profit2 expectations for the full year remain unchanged and are in line with market forecasts3. Positive customer interactions underpin confidence in sustaining high single-digit organic growth for the full year, as well as maintaining margins in the target corridor of 9%-10%.

Net debt is $151m after paying deferred consideration and making a small profit from selling their TT Electronics shares. However, there is no mention of the impact of Trump's tariffs, which is perhaps one of the market worries here. In a recent webinar, the company mentioned that they benefited last time around but without fully explaining why. It may be stockpiling by customers ahead of tariffs, but this would be a one-off effect. Overall, it seems harsh that this is down 20% due to the aborted takeover of TT Electronics, when they made a profit on the shares they bought, and are trading in line.

That's it for this week. Have a great weekend!