Apologies for the shorter summaries this week, winter holidays are taking priority this week. Here’s a selection of what we discussed on the SCL discord server. Anyone needing more is welcome to join the discussions there (which is, of course, the aim of these summaries).

Angling Direct (ANG.L) - Trading Update

It’s good news here, with revenue and EBITDA said to be “slightly ahead”. UK online continues to be the weak spot, although it is growing:

However, it is worth noting these are not organic growth rates as the drop in net cash shows. The problem is that it is not particularly cheap at around 20 times earnings. When there was more than 50% of the market cap in cash then it was easy to argue that this looked good value. However, with this diminishing as a proportion due to a share price rise and spending the cash, this no longer looks the case. The other argument is that the results would look a lot better without the loss-making European operations, and this gives option value. However, it is getting to the stage where they need to decide what to do with this, close it or make it profitable.

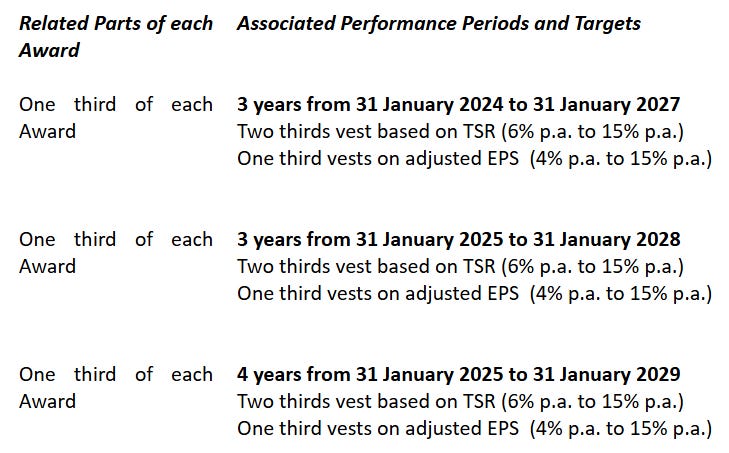

We also get a new options package, giving management up to about 1% of the company each year. Here are the targets:

The upper end of that may be considered challenging, but the lower end they can surely just achieve by using the cash to buy branches, and do buybacks.

Arcontech (ARC.L) - Interim Results

Revenue is up 4%, and underlying PBT is down 7% due to increased costs. Cash up to £7.2m, although this is largely flat on the last final results and is partially due to being paid upfront.

It’s hard to get excited about these sorts of growth rates when the shares traded above 100p. The large cash balance means that small changes in share price have an oversized impact on valuation. There has been quite a bit of froth in the share price here due to being highly illiquid and regularly tipped in the IC. However, even the usual bullish article this week doesn’t seem to have overcome the disappointment of those who read the results. However. with the shares approaching 80p, it wouldn’t take much more of a fall to start to look interesting again (at least to the type of value investor who likes illiquid, non-growing stocks!)

City of London Investment Group (CLIG) - Interim Results

Despite the continued outflows, the EPS has increased 13% (diluted, underlying basis) over the last 12 months. This means that the dividend cover is projected to improve:

Since this is a popular income stock this is one of the most important figures.

The reality of fund management is that, in the long run, investors are usually better invested in the fund manager than the funds, but perhaps not this time for this company:

Our OV team at CLIM delivered strong absolute returns and outperformed their indices by between 6% and 16%. Exceptional KIM performance deserves to be highlighted as well, particularly the team's Taxable Fixed Income and Tax-Sensitive strategies, comprising c.26% of Group FuM. These products outperformed their indices by 6.2% and 7.7% in 2024, a staggering feat in fixed income. The vast majority of our CLIM and KIM-managed International mandates nicely outperformed their various indices by between 1% and 3%. Similarly, most of our EM mandates outperformed their indices in a range of 0.2% and 1.7%. And our LPE strategies performed strongly, with the composite delivering 20.9% on an absolute basis net of fees, outperforming their hurdle rate by 12.9% points.

Surely, this bodes well for future inflows, where there is plenty of capacity and scope for future positive performance:

Discounts in US-listed CEFs that invest in non-US equities remain wide due to the ongoing outperformance of assets offering US exposure, despite a strong year of relative and absolute performance. Discounts in UK-listed investment trusts also remain wide as the expansion of passive options in the UK marketplace provide competition to the c.150-year-old investment trust industry.

So this may be finally poised to grow again after many years of malaise. In other news, they say:

CLIG remains committed to the UK market and our UK listing

...before detailing why they might move in future.

Empresaria (EMR.L) - Strategic Update

We plan to continue to exit from those operations that are not aligned with this strategy, creating a more cohesive and streamlined Group consisting of:

· Core operations in the UK (IT and Professional)

· Core operations in the US (IT, Professional and Healthcare)

· Offshore Services based in India

Given that they plan to sell the rest of their operations over the next few years rather than close them down, this reads a lot like selling off what they can to keep the lights on at the rest. This underlines the wise don't run a recruiter with net debt.

Jadestone (JSE.L) - Trading Update

Production is in line with revised guidance. However, Mark was a bit disappointed with the production guidance here, which is below what they were producing in October last year without Akatara running at full contract volume.

· Production: 19,000 - 22,500 boe/d.

· Operating costs: US$250-300 million.

· Capital expenditures: US$75-95 million.

· Unlevered free cash generation[2]: US$270-360 million (2025 - 2027).

Best guess is it is a new conservatism from the changed management combined with cautious maintenance assumptions, but without any more details, we have to take them at their (disappointing) word. So, we can see why the share price is down in response. However, the independent report highlights the value disparity with a NPV10 of existing reserves of over £1:

The 2P reserves are valued by ERCE at US$799 million, or an implied per share value of 102 GBp after deducting the Group's year-end 2024 net debt position of US$104.8 million.

I'd argue against a 10% discount rate here, but not that this remains fundamentally undervalued on a DCF basis.

ME Group (MEGP.L) - Final Results

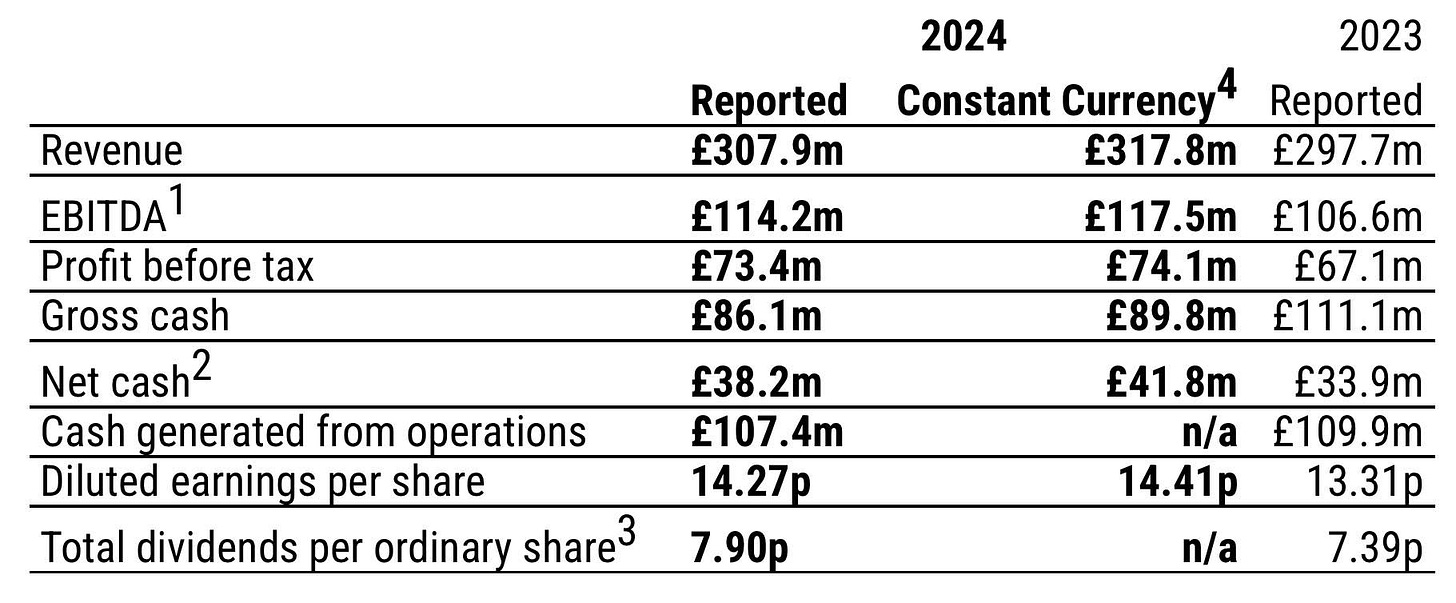

Lots of words at the start of the RNS. Oh dear. Table with no percentages:

Oh dear. Given that start, we were expecting the worst here, but it doesn’t look too bad overall. However, there is no escaping that, having made us get the calculator out, these results are only 3% revenue growth and 7% EBITDA growth. It is hard to tell without brokers’ notes, but based on Stockopedia numbers, this is a miss on revenue but in line on EPS, with the miss mainly due to currency effects. At the end of the day, these growth rates just look unimpressive for a company trading on a 16x P/E.

National World (NWOR.L) - Acquisition delay

Bad news for investors with too many share ideas and not enough cash:

The timetable for implementation of the Acquisition has been impacted by a delay relating to the consideration of the Acquisition by the Republic of Ireland Competition and Consumer Protection Commission (the "CCPC").

This is strange because the company doesn’t disclose any titles in the Republic of Ireland or any Euro revenue, but hopefully this means it will be approved at the first stage.

The bad news is a likely delay of six weeks, and 0.2-0.3p off the share price for those that can’t wait.

Nexteq (NXQ.L) - CMD

We get updated notes following Nexteq’s Capital Markets Day. Canaccord say:

we believe current market valuation unfairly reflects both recent cyclical headwinds and a lack of visibility on strategic direction after an unexpected transition in senior leadership.

Just in case anybody believed that everybody leaving at once constituted a planned transition.

Cavendish introduces FY2027 forecasts, which show the company to be trading on a P/E of around 10. This looks overvalued in today's UK small cap equity markets, but they dangle a significant upside outside of the forecast window. In their base case, cash is retained, so either this is an oversight, or the 3-year plan does not involve the level of investment that we would have thought necessary.

Ultimate Products (ULTP.L) - Buyback scaled back

The share price of Ultimate Products continues to be very volatile, down 15% in a few days to four-year lows after the rate of buybacks slowed from 25,000 shares a day to around 9,000.

There is history here - previous buybacks at much higher prices were slowed and the share price fell when (as management subsequently reported) working capital demands became elevated due to seasonal factors and ongoing shipping disruption. A subsequent profits warning led to a further 25% intraday fall, but this was followed by a rapid recovery of around 15%, perhaps helped by the current buyback initially being executed in line with the maximum mandate.

It is very hard to be sure of either correlation or motivation, but the initial theory that buybacks slowed due to lower market volumes does not appear to be supported by data. One contributor pointed out that broker forecasts assumed half of the buyback would be done for EPS purposes. Another didn’t think there was anything to be read into slower buybacks. Leo concluded that the most likely explanation was that they required the Red Sea to reopen to continue at the full rate and this has not happened as they hoped.

While varying buyback levels do appear to drive short-term price movements, may structurally increase volatility, could imply debt / working capital levels and might possibly indicate the strength of current trading, the main takeaway is the massive effect the closure of the Red Sea has on companies like Ultimate, and the opportunities if/when it reopens.

Zytronic (ZYT.L) - Outcome Statement & Delisting

Here’s the rub:

The Board can advise that shareholders can expect to receive an estimated return of 46 pence per share held in Zytronic in a conservative scenario, increasing to 60 pence per ordinary share ("Outcome Range"), should prevailing asset valuations hold through the Wind-Down period.

This is in line with what we expected, but perhaps not giving sufficient upside from the current price to cover the time value of receiving the payout. Also, it shouldn’t be a surprise that they propose to delist. This can cause problems for those who own in taxable accounts, so we could see some upcoming price dislocation. This may be an opportunity for those willing to hold unlisted shares.