Camelia (CAM.L) - Trading Statement

Evidence that trading can get better as well as worse and that guidance builds in a reasonable degree of conservatism:

…announces an improvement to its forecast for the year to 31 December 2024 with trading now expected to be ahead of market expectations. Adjusted losses for 2024 are now forecast in the range of £7-9 million from a previous range of £10-12 million. This improvement is primarily the result of an improved outlook for our Indian operations.

Their trading always highlights the problem of being an agricultural producer - if they get favourable weather, they get good yields, but so does everyone else, so pricing is impacted:

Projected yields in North India are impacted by hot dry spells and heavy rainfall, resulting in lower production predicted, but similar to 2023. Pricing has improved significantly.

Of course, it acts the other way, too. So, results are never amazing or terrible. We don’t get any update on the BF&M transaction, which is the big catalyst for any re-rating here. Even if a portion of the initial $50m proceeds is spent on buybacks, the impact on an illiquid stock such as this will be significant. With the company trading at 0.4xTBV, any buybacks should also add shareholder value

Capital Limited (CAPD.L) - Q3 Trading Statement

The headline here is a retention of their revenue guidance:

Despite these challenges, we are retaining our Group revenue guidance of $355-375 million including contribution in Q4 from Capital Mining pertaining to typical demobilisation payments as well as early contract closure fees.

However, behind this, there is a lot going on. In a previous update, they were able to hold overall guidance only due to the extension of mining at Sukari (a double-edged sword as it delayed fleet realisation), and now it seems like they have missed again but saved by cancellation fees from Belinga. It's a bit of a surprise to see Belinga cancelled, and it highlights that their diversification into mining has not lived up to expectations, with the first contract failing to renew and the second one being cancelled early. Although they made sure they would still make money in this scenario, returns have been below reasonable shareholder expectations, and now they have two fleets for sale or redeployment at the same time, which must surely affect pricing.

That said, we never liked the mining side of the business as an economic activity. We get why they went for Sukari, as that protected their very lucrative drilling business from allowing a competitor onto the site. Less so with Belinga. At least they had the good sense to put in place break clause payments. Broker Tamesis put this at $3-5m, so it isn’t particularly high versus the cost involved. The good news is that those, plus selling the fleets, will materially reduce the debt when they happen.

Better news on the drilling side, where this has been a strong quarter. Normally Q3 would be weak due to the West African rainy season, and although their exposure here will be less than in previous years, it should still be there:

They warn that rig utilisation will reduce from here, but the step change in ARPOR should be maintained. It is a bit of a mystery as to why utilisation will go down as they add the rest of Nevada rigs, though, as these will surely go straight into use on the long-term contract; otherwise, why have they been bought?

They are also flagging a further delay with MSLABS in Nevada and have lowered MSLABS guidance. So this is another miss. Overall, Tamesis say:

We have had to downgrade our revenue forecast for 2025 (by 7.0%) and 2026 (by 6.8%) driven by FMG’s early termination of their mining contract at Belinga, and the delayed ramp up at MSALABS

However, the Tamesis sum-of-parts valuation still includes $64m of mining revenue, from which they derive a $60m valuation for the mining business. This is clearly nonsense; with no ongoing business, this should be valued at the market value of the equipment.

The share price dropped between 5% and 10%, depending on how you measure it, in response to this trading statement. This seems fair given the amount of bad news, offset by the fact that this remains fundamentally cheap, trading at 0.8xTBV. While the mining equipment turns out not to have been particularly productive, the drilling side remains a very high-quality business with a great return on capital.

Robert Walters (RWA.L) - Q3 Trading Update

Things are tough with most recruiters at the moment. About the best that could be said about these is that there is an improving trend in the second derivative:

They have an aim:

Though market conditions mean second half fee income is unlikely to exceed that seen during the first half, the programme of actions underway mean we continue to aim for a profitable full-year outcome.

They don’t sound particularly confident about achieving that aim, though. So, the mystery remains as to why the market is so forgiving here. While, every other cyclical company that keeps missing expectations is getting slaughtered, Robert Walters’ shareholders remain perfectly sanguine. Perhaps at this stage, they should give up fund management and run meditation retreats instead.

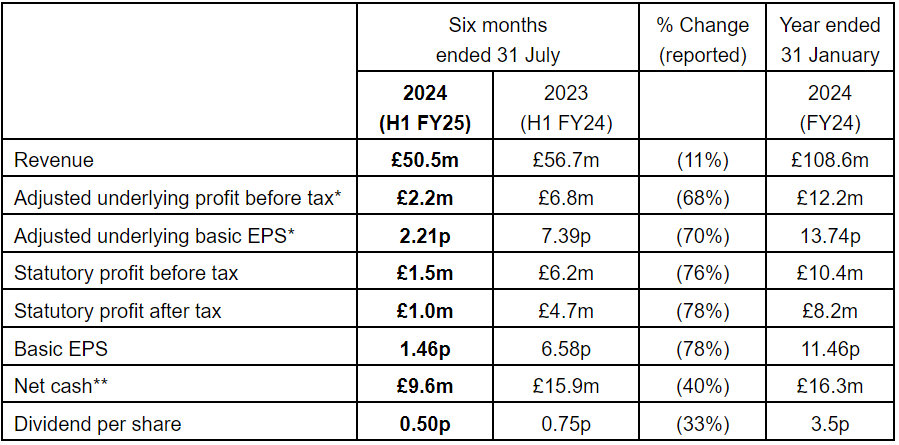

Sanderson Design Group (SDG.L) - Interim Results

These results look pretty poor:

UK brand sales doing most of the damage together with some strong operational gearing going against them. Licensing in H1 is down, but they guide this to be roughly the same as last year for the full year, as 23H1 was an exceptional figure.

Despite this, it sounds like another warning is on its way:

Trading conditions at the start of the second half have been more challenging than expected in almost all territories particularly in the UK and Northern Europe. Total brand product sales for the first eight months of the current financial year are -10%, which compares with -9% for the first 22 weeks of the financial year as announced on 27 June 2024. Delivery of the Board's expectations is reliant on a projected improvement in trading during the remainder of the financial year, which includes our important pre-Christmas selling period.

Unsurprisingly, with how weak UK consumer sentiment has been in the run-up to this budget. However, it does make us think that management has been a bit slow in cutting costs here on the branded manufacturing side. They must have expected a quick recovery, but given that hasn’t happened, they now look a little daft for carrying on regardless.

Broker Progressive cut EPS forecasts by 5%, which seems overly optimistic given the current trading. It is naïve to think that the price won't be hit further if that warning does eventually arrive. However, in the long term, this looks like good value. There isn't anything fundamentally broken about their business, just that their typical customer has the most to fear from the upcoming budget. The strength of the US and licensing show this is very UK-specific and, hence, cyclical phenomenon.

They currently trade on 0.8xTBV, and while those assets might not be the most productive, they have done work over the last few years reducing SKUs and inventory levels. While we are often sceptical about intangible assets, in this case, they clearly have significant value as they generate ongoing license sales.

Thruvision (THRU.L) - Trading Update

On the surface, this looks terrible:

Revenue is expected to be £1.9 million (H1 2024: £3.5 million). The current order backlog is £0.3 million and is forecast to be delivered during the second half of the year (H1 2024: £1.0 million). The sales pipeline contains significant tenders, some of which are expected to contribute to second half revenues.

That would be the worst six months since the six months to 30/9/2017, and that was only so low because it excluded non-continuing businesses following a strategy change. On the other hand, it isn't much worse than 2022H1, which they followed with £6.4m in H2, and there has been a strong H2 weighting for each of the past three years, albeit often driven by one-off orders. However:

The current order backlog is £0.3 million and is forecast to be delivered during the second half of the year (H1 2024: £1.0 million).

So, it is definitely not a case of things just slipping from H1 into H2; rather, reasonably secure (but still not guaranteed) revenues are £0.7m worse than last year. Their hope is:

The sales pipeline contains significant tenders, some of which are expected to contribute to second half revenues.

Some of which will be lost and/or may slip into next year. For example, in FY 3/2023, most of the period's revenue was recognised in the last month of the period, so it could easily have been missed. Something like £4-5m for the full year would appear to be a prudent forecast. That compares to Progressive's £10.9m before this update and £9.0m afterwards.

The only saving grace is that the profit protection part of the business is growing strongly:

...which doubled relative to the comparable period, and alongside healthy levels of repeat business, included orders from new customers John Lewis and DP World.

However, it seems highly disingenuous to claim this is down to a strategy:

In line with the Group's previously announced strategy, we now have approximately 85% of revenue in the period deriving from Retail Distribution sales...

The fact is that all the other revenue streams have collapsed. There are different ways of cutting the numbers, but they reported £1.15m in this sector in 2023H1, excluding support and development, so the claim of doubling also looks doubtful. Yes, it does look like an H1 record, but the company simply cannot survive to cash breakeven in its current form on profit protection revenues alone:

Cash at 30 September 2024 was £1.8 million (30 September 2023: £2.4 million) and trade receivables were £0.9 million (30 September 2023: £2.6 million).

This seems exceptionally bad in the context of them raising £3.2m in October 2023. The only saving grace could be if inventories are elevated, but then why would they be with such a weak order backlog, and why wouldn't they say so?

The logical conclusion is that they will need a further equity raise, and in the current market, it will be at a big discount to even this week’s fallen price. It is hard to raise money without a CEO, though:

Colin Evans , the Group's CEO, has informed the Board that he wishes to leave the Group to further his non-executive directorship portfoli o and, following discussion with the Board, he will leave the business at the end of October 2024 .

Two possibilities:

A) CEO Colin Evans has decided he's flogging dead horse and is taking the opportunity to ease into retirement, perhaps triggered by the offer of a more promising non-executive director role.

B) He's been sacked.

(A) is actually worse as it would mean he doesn't believe the business can be made to work in the near term. So, it is probably a positive that the short notice period implies he's been sacked. Of course, it could be somewhere in the middle, with Tom Black having a conversation with him about whether his heart was still in it, them agreeing he would look for interesting NED positions, and then something coming up. New management could come with new ideas, and perhaps founder, Chair and 8.2% shareholder Tom Black has already been making his views felt here with an increased emphasis on Entrance Security and sales partnerships:

particularly significant near-term opportunities in Entrance Security

our recently signed channel partnership with Sensormatic...We intend to sign additional major channel partners in the future...new sales partnerships

It all seems academic, though, until they raise enough money to get them through the short term.

Vertu Motors (VTU.L) - Interim Results

After a couple of minor profits warnings here recently, it looked like we were going to see a further one. And the face of it, this is yet another warning, with Progressive cutting EPS forecasts by 5.7% for the current year (FY 2/2025),. However, this appears to be caused by no longer excluding share-based payments. These are normally excluded because, although they recur, they are often volatile. However, in Vertu's case, they have risen in every 6-month period from 31/8/2020 onwards.

The current trading and outlook appears positive, in particular the key aftersales segment is showing no signs of slowdown or oversupply following significant investment. Caution on new vehicle profitability is fully warranted for well rehearsed reasons, hopefully this is reflected in forecasts. One area of risk is around used cars, where they repeat the chicken-counting language from the last update:

Profitability in H2 is expected to improve over prior year levels due to a stronger used car market and enhanced used vehicle trade values.

While we agree with the rationale for a stronger used market, there is an inherent lack of conservatism in assuming it will strengthen, and we assume this assumption is in the forecasts. In terms of growing via acquisition, Progressive say:

asking prices for small chains of dealerships have moderated

Perhaps there are near-term deals to be done, but at a cost:

any deals concluded between now and the end of the financial year may negatively impact near-term performance,

Regarding the achievability of forecasts, they need to more than double H2's PBT year-on-year, but last year, it was affected by falling used car prices, which won't be repeated. They also need to beat 2023H2 after falling short of 2023H1's figures, despite having significantly more sites. H2 revenue needs to match H1 despite H2 being the weaker half. Overall, the forecasts don't look particularly conservative.

More conservative (realistic?) assumptions would see an 8% revenue miss for H2 and 4% for the year. Due to the improved mix, this is only 2% of gross profits, but operational gearing leads to a 23% PBT miss. This suggests they rely on a jump in used car prices and volumes that may happen but are not yet in the bag to make the numbers.

While it'll be a stretch to reach it this year, a 7p nominal EPS should be achievable next year and grow ahead of inflation for several years to come, which, combined with 73p tangible assets (excluding the fake pension surplus), suggests that the shares should be worth around 70p. This is backed up by recent progress on property disposals after a hiatus:

Subsequent to 31 August 2024, the Group exchanged contracts for the sale of a former dealership, the sale, expected to be completed in the second half of FY25, will generate gross cash proceeds of £2.3m, in excess of the net book value of the property of £2.0m. In addition, a further surplus property was sold for £1.6m in October 2024, in excess of the net book value of £0.9m.

70p is still above the current price but perhaps not as high as the share price has been earlier this year.

Victoria Carpets (VCP.L) - HY Trading Update

While it is nice to know that management actions weren’t the cause of weaker H2 trading:

The Board expects H2 trading to be stronger as a result of the actions taken by management (outlined below) alongside a small improvement in demand, although earnings are likely to be below consensus expectations.

...this is still a profit warning. When this occurs in a heavily indebted business, it is a particular worry. So, although they say:

Group liquidity remains robust with cash on hand and undrawn credit lines providing more than £200 million of available liquidity.

Appointing debt advisors is only one step up from starting to talk about “stakeholders” instead of “shareholders”:

Following the Company's FY 2024 Results announcement in June, which noted that the Board was beginning to plan for the refinancing of the Company's Senior Secured Notes (the first tranche of which is due in August 2026), Lazard has recently been appointed as debt advisers, with Latham & Watkins continuing as legal advisers. The Board will continue to update the market as appropriate.

We are reliably informed that their 2026 bonds are now at 87 cents, and the 2028s are in the low 70s. This means that the bond market, which consists of the people who need to support any refinancing, is currently pricing the equity at approximately zero. Who are we to disagree with their assessment?

Zytronic (ZYT.L) - Trading Update & Strategic Review

The trading side shows that revenue increased in H2 vs H1, but there is no sign of any further improvement this year, so it is probably still loss-making. On top of this, or perhaps because of this, they have announced a strategic review.

The strategic review looks comprehensive and considers all options, but they all look pretty bad to us:

The transformation plan sees them spend most of the cash, stopping manufacturing and becoming an engineering and prototyping firm for other manufacturers. This seems risky, with no immediate return.

Liquidation of assets worth 127p/share, but we know they won’t get that by the time all redundancy, costs, insurance, etc., are taken into account.

Delisting may make sense for some shareholders, but it is not ideal.

Takeover as a trading entity is the best option, but so far, no one appears to have approached them despite being well-known in the industry and obviously keen to do a deal for the last few years.

Regarding asset values, any visit to the company revealed that the property was in a poor state of external decorative repair, in a fairly run-down industrial estate on the wrong side of a northern city. However, the buildings are in good structural condition, and this week, they report:

The Directors note that a recent third-party valuation report obtained by the Company concurs with the value of property assets as at the latest statement of financial position date.

However, of the £4.8m PP&E, only about £3.5m is freehold or long leasehold (30-50 years). Much of the rest would have minimal value. Last year they had 14 redundancies at a cost of £123k. £10k each for the remaining 48 at 30/9/2023 would be £500k.

Add £1m of accrued losses and £0.5m of legal and other liquidation costs and apply weightings to each line on the balance sheet, and we get a 61p liquidation value. This compares favourably to the current share price, but perhaps not with a significant margin of safety. From previous experience with liquidations, the big unknowns are:

how much insurance costs will be to ensure any cash realised can be returned to shareholders;

how much incentive management will require to stay with the business during the process;

whether they can get out of customer contracts without significant break fees; and

how long the whole process will take.

That’s it for this week. Have a great weekend!