Your usual reminder: the following is a summary of the debates we have had this week on our SCL discord server. These are an amalgamation of many viewpoints, and while Mark & Leo are probably the most active, there are other voices in here, too. This means that these views should not be attributed to one person, and indeed, the aim is to provide a balanced opinion (unless something is obviously a poor business on a high rating when we say so.) The aim of these summaries is to encourage knowledgeable investors to join in the debate and generate contrary viewpoints. So, if you disagree, great - come and join the debate on Discord. On with the news:

Creightons (CRL.L) - Half-year Report

After the recent trading update, we debated whether they were referring to exceptional in a past period or the current one. As it turns out, there are no exceptionals, and they deliver a beat at £1.7m (£1.700m, rather suspiciously, although we remind ourselves that when people make numbers up, they actually tend to avoid round numbers as a form of overcompensation!)

All they said previously is that it would be:

in excess of the full year operating profit before exceptionals of £1.5m for the year ended 31 March 2024.

If they'd simply said "in excess of £1.5m" we'd say this is a bit too much of a beat to report just two weeks later, but we think they gave themselves enough wriggle room and it was important to get a statement out.

Diluted EPS comes in at 1.61p for H1. Looking back, there is no clear H1-H2 bias, so it is a fair assumption without growth or further recovery is 3.2p for the full year. However, on the downside:

The Group calculates that the annual impact of the budget announcements will total £0.6m, with increased NI costs of £0.4m, and the increase in the national minimum wage of £0.2m. There will also be an additional impact on pay differentials that will need to be managed.

This is clearly highly material compared to £3.4m operating profits. The outlook reads like it is more about investing for future growth rather than a further recovery or reaping immediate rewards, so perhaps we should be expecting an EPS of 3p for FY3/2025. The big question is whether they can grow this further. So far, the improvement has come from reduced distribution and administration costs. The former was reduced:

as a result of the decision to exit the majority of third-party logistics providers and bringing picking and packing of finished goods in house.

The latter is by slashing costs at Emma Hardie, with marketing presumably being a big part of that. If they can’t take further costs out and the revenue doesn’t grow, the PE of around 11 looks expensive for this type of business. However, if this is the calm before the storm and revenue growth is about to kick off, then this will quickly look cheap.

The share price was down around 14% on the results, but that was more about the speculative froth of the last few days exiting (this is an illiquid stock and had been covered by some very enthusiastic high-profile investors in the run-up to these results) rather than a rational assessment of the pros and cons of ownership.

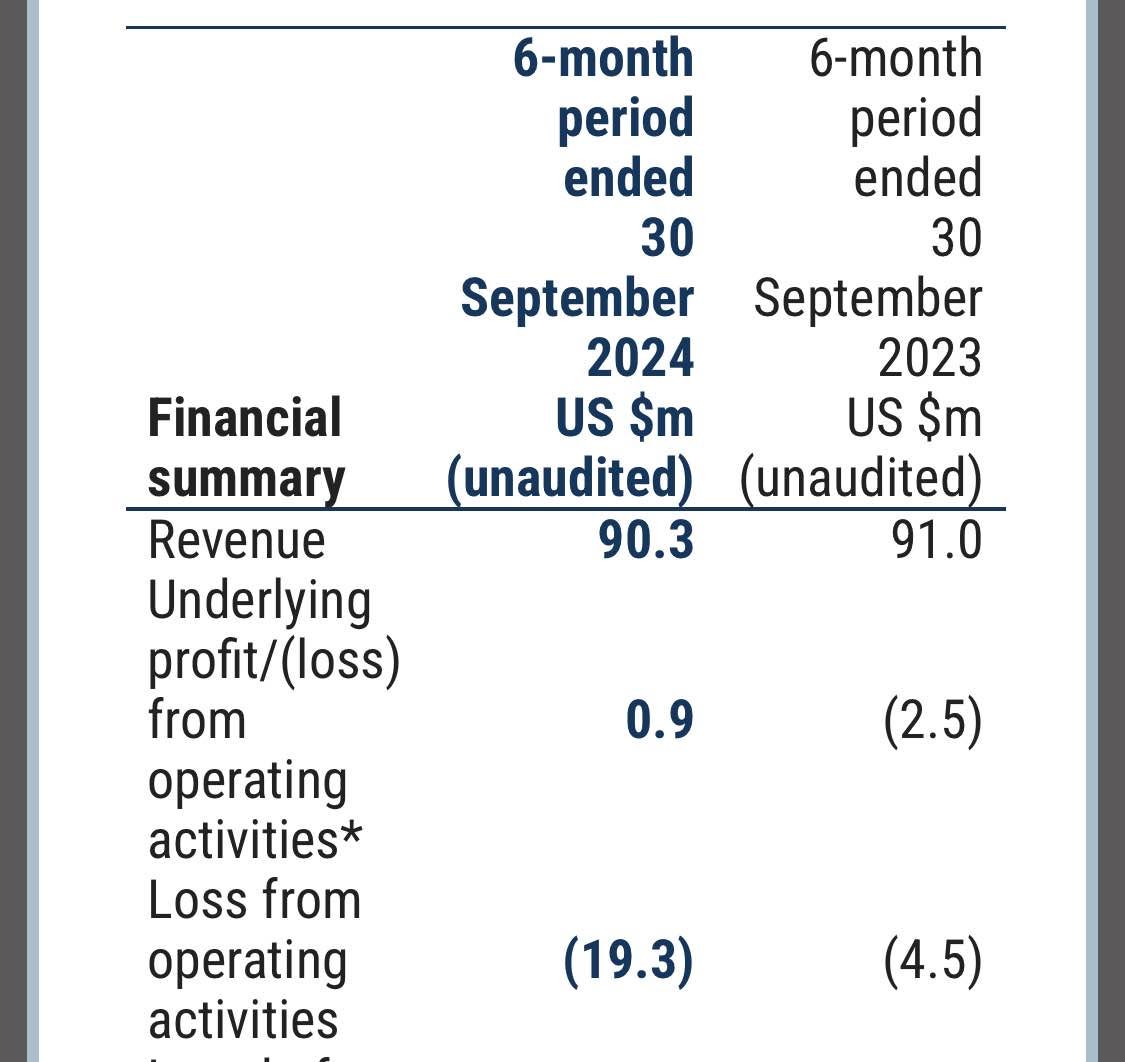

Dialight (DIA.L) - Half-year Report

It looks like they have got back to operating profitability:

Until you realise they are excluding the costs of firing the people to get to this:

Additional charge of US $3.1m recognised relating to transformation project.

Net debt improves, but this excludes what they owe from the legal case:

Positive net cash flows of US $5.6m generated from underlying operating activities after tax and interest with a further US $5.2m cash inflow from the gain on disposal of the Traffic business; net bank debt reduced to US $15.4m (31 March 2024: US $16.4m).

They’ve taken a $19.5m provision for this, but the going concern statement reveals that if they lose the appeal, they can’t afford to pay this:

At the balance sheet date the Group does not have sufficient liquidity to settle the [Sanmina] provision without taking mitigating actions or securing additional funding within the going concern period which may include seeking to agree a payment plan with Sanmina and/or new equity funding. The amount, timing, and receipt of any such funding is uncertain at the date of the approval of the interim financial statements.

On outlook:

Plan is beginning to show positive results and provides a solid foundation to achieve our medium-term ambitions. With this background, the Board is confident that further progress will be made in the second half of the year.

Pointedly, they are confident of progress but not meeting market expectations. Perhaps a more modest but realistic ambition should be to get the required deeply discounted placing away while they still can.

IG Design Group (IGR.L) - Interim Results

On the surface, these don’t look great:

And the market agreed, with the shares selling off 13% on the day. 11.2c vs 25c last year looks a particularly poor result, but this is the hope:

Business simplification, efficiency and cost-saving initiatives will drive profit recovery in H2 such that we expect to deliver a profit in that period, compared to a loss in that period last year

The reality is that all this was a known known from the recent trading update. Perhaps the outlook has done the damage:

This represents continued strong year-on-year improvement in both profit and cash flow compared to the prior financial year, albeit towards the lower end of the Board's profit expectations set at the start of the year.

But again, this isn’t materially different to what they said in their AGM statement. So it is strange that investors seem to be unable to convert profit to EPS, or the reality of how H1 looks in black and white has spooked the market. There is also a big gap between adjusted and statutory figures:

The China site closure accounts for $4.3m of total adjusting items, with $3.0m relating to staff costs and the remainder to asset write-downs and other closure costs. The ongoing business reorganisation at DGA accounted for the other $2.4m, with $2.2m relating to staff costs and $0.2m to a warehouse consolidation project.

But closing a site should be mostly a one-off. The PI World presentation revealed that these costs are largely complete, with just a few extra redundancies in North America due in H2. They also have specific reasons to think that H2 will be better than H1:

In DG International, $2.1m of profit was due to delayed orders that moved from H1 to H2. The lack of losses from China should also contribute to a $7.6m swing H1->H2.

In DG Americas, they have had initiatives to drive increased operating profit: cost reduction & simplification totalling $9.4m. On top of this, in Q4 last year they reduced deliveries to protect themselves from customers at risk of going into Ch11 and they don’t expect the same this year. All in all, they are confident that DG Americas will be profitable in H2.

The market is clearly calling BS on them hitting the FY25 forecasts, but even if it takes a bit longer to see a full recovery, they are trading on a P/TBV of around 0.5. The majority of this is inventories, so if these assets can be made productive again, the share price will be materially higher. At the end of the results presentation, they summarised the current situation:

The first half was tough, and the retail environment was tough. Consumers were under pressure. It will pass. The strength of relationships with major retailers remains.

Given that they now have net cash for almost all of the year, the risk of insolvency is negligible. Management are doing the right things to improve productivity, so it seems to be a case of simply waiting.

Strix (KETL.L) - Trading Update

This reads like the start of a profits warning:

As highlighted in the Group's interim results, the Kettle Controls division experienced relatively lower trading for parts of Q3 2024, and this has continued into Q4 2024, particularly in regulated markets.

This is the outcome:

As a result of the above, Strix now expects to report adjusted profit before tax for FY24 in the range of £18m to £19m (on a constant currency basis).

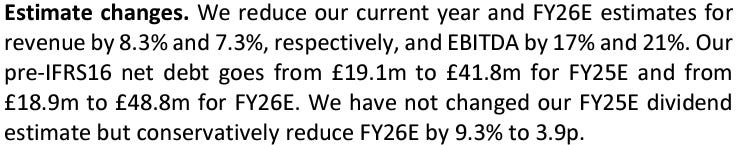

Annoyingly, they want to make us look up if that is in line with previous expectations for ourselves (which seems unlikely). Thankfully, Zeus comes to the rescue and say:

estimate reduces from £23.6m to £17.5m, a decline of 25.7%. Zeus factor in a c. £500k impact from currency as the statement indicates ccy pre tax profit will be in the range of £18.0m to £19.0m. In FY25 and FY26 pre tax profit reduces 27.8% to £18.2m and 23.3% to £21.6m respectively. Despite the reduction in estimates the business has headroom on its renegotiated covenants with Net Debt to EBITDA of c. 2.0x in FY24.

On the debt:

Strix's debt position has remained a priority for the management team, with latest reported net debt leverage at c. 2x. Reflecting management's confidence in the underlying business, it remains the intention to reinstate the FY24 final dividend for payment in 2025.

So that’s a bit vague; surely, just give us the current figure? Still, if banks aren’t blocking the possibility of a future dividend, it can’t be that bad, can it?

The shares were down around 10% in response. Due to the debt, this means the EV is only down 6% or so It seems far too light for a 25% cut in multiyear forecasts. There are no tangible assets providing support either. We simply don’t see the attraction at 16x 2025 earnings (adjusting for the debt).

Severfield (SFR.L) - Interim Results

These look decent results if you believe their adjustments:

Unfortunately, we don’t:

§ Results include non-underlying cost of £20.4m for bridge remedial works programme, excludes potential recoveries from third parties, assessment of any further remedial costs remains ongoing

This is probably a one-off, but the argument that we did something badly, so we only included the things we did well, is a little thin! And, of course, there is the risk that they did other things badly, too, and these have yet to come out of the steelwork. On top of this, there is now a profits warning:

§ Underlying profits for FY25 are now expected to be below our previous expectations

Due to:

…the predicted recovery in certain sectors has been slower than previously anticipated, and pricing has remained tighter for longer than expected.

Sounds like no easy fix:

In addition, a number of large project opportunities for FY25 and FY26 have been either delayed or cancelled and, given the current market backdrop, we remain vigilant to the increased risk of delay to expected orders in the short-term.

In the medium term, they are positive, as almost all companies in this situation claim to be. The market doesn’t seem to have anticipated this, either, as the share price has been strong recently. So, the reaction to this miss was also strong - down 40%. However, the forecast changes from progressive are nowhere near as big:

So it is possible this is a good buying opportunity. But the question is, why not just buy Billington (BILN.L) - it seems to be a better-run company, with a history of conservative forecasting, and can be bought for around half the rating of Severfield, even after this week’s huge drop in share price.

Sosander (SOS.L) - Interim Results

Results here are exactly what you’d expect from a company finding a new love of physical stores because their online business didn’t deliver:

…£0.7m pre-tax loss from £1.3m pre-tax loss in H1 FY24 as a result of margin enhancement and continued careful cost management

This caught our eye, though:

Presentations

Sosandar is hosting a webinar for retail investors at 13:00 today…

The Company is also hosting webinar for analysts at 09:00 tomorrow.

It is rare that retail investors get their presentation a day ahead of analysts. This perhaps shows where Sosander sees their next capital injection coming from!

Supreme (SUP.L) - Half-year Results

This company is performing well, with adjusted EPS up 37,% and now:

The Group has made a strong start to the second half of FY 2025 and expects trading for FY 2025 to be ahead of expectations, with revenue guidance of around £240 million and Adjusted EBITDA1 guidance of at least £40 million5.

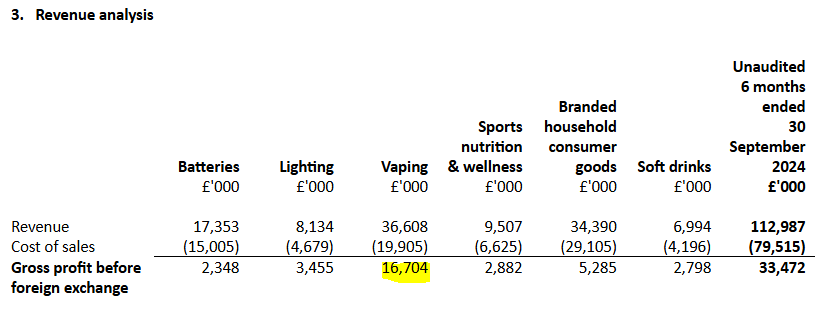

However, we never liked the vaping side of the business here due to both the regulatory risk and the moral position (for which each investor has to make up their own mind.) Hence, that half of the gross profit comes from vaping is a concern:

Within that, they claim:

They split out disposable because they are being banned from July 2025. But the reality may well be that "disposable" is about how the product is used, which is mostly about pricing rather than whether it is refillable/rechargeable. When they say:

Additionally, we have continued to invest in rechargeable pod system vaping devices

What they may mean is value engineering it to the extent that many will treat it as disposable, or the pod contains so much of the value that you are replacing much of the unit rather than meaningfully "refilling". Casual and illicit users certainly don't want to invest in a quality refillable.

As such, the biggest risk from government action is their distribution of the riskier vaping brands Elf Bar and (to a lesser extent) Lost Mary. In the above table, these are not categorised as vaping!

The Branded Distribution category delivered revenues of £34.4 million, up 12% (H1 2024: £30.6 million), and gross profit for the category experienced growth of 56%. Our distribution of vape brands ElfBar and Lost Mary contributed 92% of the division's revenue in H1 2025 (H1 2024: 86%)

Assuming there are no nicotine products under the "nutrition and wellness" category, that means they are 60% vaping by revenue and 64-65% by gross profit.

Potentially, their Perfectly Clear flavoured spring water brand could prove very valuable, although they are a bit coy about what is in it. Their "healthier future" page doesn't talk anything about health and rather ominously warns you:

Make sure you finish or empty out any liquid before throwing it in a recycling bin, as leftovers can ‘contaminate’ the rest of the recycling meaning the whole collection could go to waste!

This does beg the question: what is in there?!

Victoria Carpets (VCP.L) - Half-year Report

These sorts of figures look like rights issue territory:

However, this sort of thing buys them some time:

During the year the Company has completed the sale of a property in Belgium for €39.7 million and (post the H1 balance sheet date) realised €36.8 million from the sale of Graniser, which reduced leverage by 0.5 times.

Plus having a lot of bonds and preference shares instead of bank debt. However, bond repayment gives them a definite cliff edge, even if it is further in the future, not the ability of the banks to pretend and extend. We wouldn’t want to be a bondholder here, and if we wouldn't hold the bonds, then the equity is definitely a no-no.

Thats it for this week. Have a great weekend!