After a couple of weeks off, Wayne was back with Large Caps Live - looking at a couple of macro trades that have been claimed to be the GOAT (Greatest of All Time)! We include one of them here. Check out the discord channel for the other.

In small caps land, the trends of the previous few weeks have held, with lots of significant results or trading updates early in the week and a quieter end to the week.

Large Caps Live Monday 11th October

Maroon Macro, on his / her substack, proposed the idea of short CNH, suggesting that one buys 10-delta USD / CNH calls for March 2022.

In short, the thesis is that the tightening of USD liquidity will lead to a shortage of dollars which will lead to the price of dollars rising in Renminbi terms. In addition, the Chinese economy is slowing/weakening. The PBOC / SAFE (China’s currency ‘regulator’) are desperately using the local banks to try to hold the currency up by buying the Chinese currency via swaps - with a forward arm that expires in 1 – 6 months time at which time the trade will reverse and weaken the currency.

The first part of the analysis is to understand the CNH vs the CNY. The Chinese currency is the Renminbi. The currency unit is the Yuan. This is kind of analogous to saying the British currency is Sterling and the units are pounds. CNY (ISO currency code 4217) is the onshore Renminbi (RMB) market. The CNY is NOT freely convertible. The offshore RMB is known as the CNH. The CNH can be used for all payments outside of China. So we dirty speculators have to trade the CNH vs the dollar.

So for our purposes the CNH and the CNY trade relatively close together. However, I would point out that there has been a spread at times between the two and that is important to recognise as it means the trade may not be as perfect as one likes.

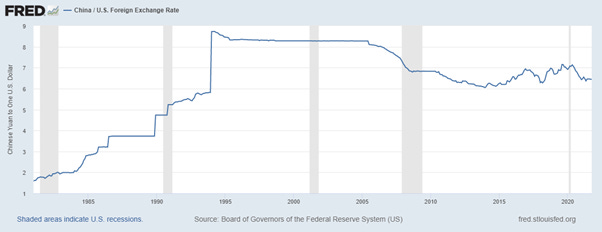

The key point to recognise in the USD / CNH exchange rate has stayed in a relatively tight range over an extended period of time:

The key point to bear in mind that is clear from the Fred chart is that the CNH has ranged between about 6.10 and 7.05 or something per dollar. So a ‘call’ on USD / CNY is a bet that the USD will strength against the CNH ie the line in the above chart will move up ie the CNH will WEAKEN.

As you can see short term it does look like the CNH could revert to say 7 or so IF the Fed tightens in Q4 and the Chinese do not respond. However, I think the big call is whether the CNH will break out the top of that range. (Remember CNH going up on that chart is CNH weakening / USD strengthening ). And Maroon Macro is suggesting a 10 delta option so that is really a bet on a range break.

So let's consider the 'inputs' into a 'regime change' that cause the CNH to break out of range:

On the following Fred chart I have plotted y-o-y growth of Chinese GDP

It is clear that the GDP has slowed down but I am not entirely sure, given how badly the rest of the world has fared that we should be too concerned by that if we are the Chinese govt. Also, a not insubstantial part of the Chinese economy was connecting to construction so I am not entirely sure whether the recent months of data is particularly surprising.

I am going to stick my neck out here and suggest that the weak job growth numbers in the US and the slowing of the ‘post-Covid’ recovery in Western countries might be more ‘reflective’ of the norm for GDP growth globally than people realise.

So the next thing to consider is the rate of credit growth in China, of growth of the monetary base and what the Chinese govt bodies can do about it.

This is the % change in the monetary base M2 in China:

It is pretty clear that the rate of growth of M2 has been declining.

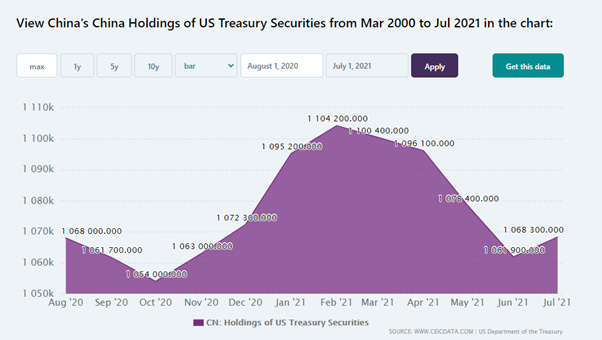

Several of the source articles at the beginning of this discussion suggest that falling reserves are an indication that China is going to have to devalue. However, I am not entirely sure the data proves a 'collapse' in Chinese reserves. For instance, the following chart:

However, if you look on a longer scale you see this:

Despite all the above, I do think it is possible to build a negative short on the Chinese currency on the following basis. However, in my view, it has a slightly different narrative:

(1) The key point to understand is that if you ‘soft’ peg your currency to another then you cannot adjust your exchange rate.

(2) In order to maintain interest rate flexibility (of some extent) you have to control capital flows

(3) However in a currency pegged economy, the availability of debt/credit is controlled by controlling the availability of credit. China does that by adjusting its RRR (reserve requirement ratio) for banks – ie how much they can lend.

I think if there is only one thing to take away from today it is that you can control the cost of debt/credit OR its availability. In the West, Central Banks control the cost; in China, to some extent, it is the availability.

So would I put on the trade?

(1) I said at the start that the trade is esoteric. It is. I could not find active quotes for the CNH / USD options chain last night.

(2) Maroon Macro suggested a 10 delta strike - as I could not find an active surface (ie prices) I could not work out exactly what strike he is referring to. I suspect he may be able to do it OTC as a market professional.

(3) For me - I am thinking that I would be looking at a 7 or 7.05 strike or even 7.10 but with the view that I am really in this for a breakout.

(4) I would only do it if the premium is cheap enough and it is 'throwaway' money on a high returns proposition ie 4x or 5x - but accepting it is a very very small part of my book.

(5) The suggestion was to put on the trade with a March 2022 expiry. I can see how if the Fed tightens starting in Q4 that that will benefit a long USD and short CNH trade. But I think it will take longer to work.

(6) Chinese New Year is 1 Feb 2022. Winter Olympics are 4 - 20 Feb 2022. Hence I would not want to bet until a few months after those dates as I suspect it will be hard to tell if the economy is weak or it is a one-off.

(7) So in my view, this is a trade idea to store away but wait for the RRR to be cut, and probably put on later.

(8) If you wanted to hedge your bets you could roll the trade but it is really really easy to burn through all your potential returns as a result.

Small Caps Live Wednesday 13th October

Equals (EQLS.L) – Trading Update

Equals released the following trading statement earlier this week:

The record start to Q3-2021 that the Company reported at the time of its Interim Results announcement issued on 14 September 2021 has been sustained throughout the remainder of the Period, generating revenues of £11.7m.

This marks a continued acceleration in Group trading and represents a 33% run-rate increase on the prior quarter (Q2-2021: £8.8m); a 62% increase on the prior year comparative period (Q3-2020 £7.2m); and a 47% increase on the pre-Covid comparative period (Q3-2019. £8.0m).

This reads well, with revenue above pre-covid levels. The problem is that pre-covid wasn’t particularly impressive with margin erosion over the last few years leading to losses in 2019 after a profitable 2018. And the trading statement says nothing about these margins or how they are trading in terms of market expectations. You have to assume, I guess, that they are in line. Canaccord are their broker so we can’t see the note but from Stockopedia they appear to have had a small upgrade prior to this trading statement.

But they are still on a forecast P/E of 30 which looks rich for a company with such a patchy record of profitability and with no sight on margins.

Argentex (AGFX.L) – Trading Statement

On the same day as Equals, fellow FX company, Argentex, also issued a trading statement. Weirdly, their revenue increase was identical (although they are reporting for a six-month period, not three):

Argentex expects to report a 33% increase in revenues for the six-month period to £15.7m (H1 2021: £11.8m) and a 67% growth in FX turnover to £8.3bn (H1 2021: £5bn).

The shares were down slightly on this update though, presumably because they represent a slight decrease on 21H2 revenues. Again, there is no mention of earnings or market expectations, but their broker Numis appears to have retained their previous estimates which are for 8.1p EPS, which is a forward P/E of 10.4.

Shares here have been weak this year since the co-CEO placed his shares at 80p having left (or been let go) after recovering from an illness. You can read this two ways - either he re-evaluated his life after the illness and wanted the cash to enjoy himself, or the company realised they could do without him and he sold his shares in disgust when he was let go. Either way, it is likely that he was a price-insensitive seller and probably didn't have material negative information specifically about the company.

With a much cheaper rating and a better record of revenue & profit growth (although not very long as a listed company) it is hard to see why anyone would prefer Equals to Argentex at the moment. However, since this announcement, the Argentex price has faced further weakness after a couple of high-profile investors who were previously bullish on the stock have announced their sales on Twitter. The logic given is that Argentex are likely to profit warn and Equals are likely to beat.

There are a few potential issues with this theory though. The first is that with the relative rating of the two companies, this appears to be already in the price. The second is that this strategy of picking the company that will beat expectations doesn’t appear to be a good one at the moment. We have seen large beats by companies such as ScS largely ignored by the market recently.

But perhaps, more importantly, it is likely that both companies will be facing the same margin pressures - just that we have had a bit more visibility of it in the Argentex trading statement given they quote the gross FX volume. Equals didn’t release this information.

Hummingbird Resources (HUM.L) - Kouroussa Update

Hummingbird has been one of the biggest risers in the last few days on the following update:

Hummingbird Resources plc (AIM: HUM) is pleased to provide an update on the development of the high-grade Kouroussa Gold Mine ("Kouroussa" or "the Project") in Guinea.

The Company has secured a group level financing package from Coris Bank International ("Coris Bank") to fully fund the Project into production, along with internal cash flows.

This was clearly unexpected since the share price had been very weak, even for the gold sector, prior to this update. The good news is that no equity funding is required:

The Project is fully funded through internal cash flows and a group financing facility from Coris Bank of US$100 million at a fixed interest rate of 8.5% over four years.

Development looks pretty quick too:

Commencement of construction is to begin this quarter, Q4 2021, with first gold pour scheduled for the end of Q2 2023.

Which helps the NPV:

Industry leading project economics at today's gold price of $1,750 per oz*:

o IRR 71%

o NPV US$210 million

o Cumulative free cash of US$314 million

Capex payback period of approximately two years post commencement of production.

Of course, we are sceptical of anything that is using a 10% discount rate for a project in West Africa. But the current market cap of Hummingbird is only $115m and they have an existing mine in Mali that generated over $40m in FCF last year.

Operationally, their existing mine has not been without its challenges and a lot of investors don't rate the management here. However, a new operational team seems to be getting a handle on things. But with these sorts of figures compared to the market cap, you can see why the market reacted so strongly to this update.

Of course, mining or developing only one or two resources is highly risky and miners like this tend to be incredibly volatile in their outcomes and share prices. This is why we prefer mining services companies as the way to play this booming sector, such as, Hummingbird supplier….

Capital Limited (CAPD.L) - Q3 Trading Statement

Hot on the heels of a very positive investment update, Capital Limited produced the following Q3 trading statement this week:

• Revenue of $61.6 million represents a new quarterly revenue record for the Group, up 12.6% on Q2 2021 ($54.7 million) and 74.5% up on Q3 2020 ($35.3 million);

This is an incredibly strong performance given that Q3 is seasonally weak due to being the rainy season in West Africa so a lot of exploration drilling stops due to access issues. All areas of the business contributed to the strong growth:

• Non-drilling revenue contribution of 26% to total revenue, up from 17% in Q2 and 12% in Q3 2020, driven by mining services and MSALABS;

• Average monthly revenue per operating rig ("ARPOR") up marginally (1.1%) on Q2 2021 at US$182,000, but up 6.4% on Q3 2020 (US$171,000);

This has led to upgraded revenue guidance:

Increasing 2021 Revenue Guidance: After a strong first three quarters of 2021 with better than anticipated drilling utilisation rates, and Sukari mining operations delivering ahead of contract targets, the Group is increasing guidance on anticipated revenues for 2021 to $220-225 million (up from $200-210 million guided at our Q2 2021 trading update and up from $185-195 million originally guided at the FY20 results).

We have consistently said that brokers have been behind the curve on this one, with Tamesis forecasting just $39m for FY non-drilling revenue prior to today’s update (vs over $20m deliver in H1) and a revenue estimate at the bottom end of previous guidance. Q3 mining services revenue was $15.5m by my calculation so that is $35.7m for the first 9 months.

In Q4 you also have additional revenue coming through to the rapidly expanding MSALABS with the Chrysos unit commissioned at Bulyanhulu and…

MSALABS commissioning of Thor Explorations mine site laboratory is complete and the first analyses have commenced;

Tamesis have upgraded their revenue and gross profit significantly, but have also caught up with the fact that they were underestimating the admin costs given the additional scale of the business.

The net effect is an EBITDA estimate of $63.2m for 2021. They have increased their 22E EBITDA slightly to $71m and retained their price target of 140p but add “with conviction” to the end. Sounds like they didn't really believe their own PT until today!

I believe Peel Hunt and Berenberg were more optimistic than Tamesis on everything but costs and their price targets, but all brokers will have to go for a significant upgrade to 2021 estimates following this update.

Vertu Motors (VTU.L) – Half Year Results

As we've covered recently Vertu has issued multiple profit upgrades recently, and since their last update pretty much all of their competitors have also upgraded. So the second news today should not be a massive surprise:

The Board now anticipates that the Group's adjusted profit before tax for FY22 will be at least £65m, previously £50m to £55m

They have previously attributed great performance in August (last month of the period) to super-normal used car margins. However, over these 6 months, this just equates to an increase of 1 percentage point to 10.2%. On the used-cars side it is as much higher revenues that have led to this outperformance:

A lot of this is catch-up, with New Car revenues also ahead versus 2 years prior, despite supply issues. Of course, a 29% overall increase in gross profit makes a massive difference to the bottom line, with EPS basically double two years prior.

Looking forward, H1 is generally the stronger half for Vertu, despite having one plate change in each half. Revenue weighting was 52.3% H1 for FY2019, 53.7% in for FY2020. Profits have however been around 75%/25% split and it is difficult to tell if these are one-off factors.

So, on a simple calculation, you might expect £75m underlying profit before tax for the full year. But, we have the new car supply issues on the vital September plate change month (first month of H2). But, but, we have ongoing super-normal margins on both new and used. But, but, but, we have the lingering risk of possible further lockdowns. So a lot of uncertainty.

New car sales are down just 18% LFL versus 25% for the market as a whole. This means that every franchise dealer that has reported has now outperformed the market!

Most importantly is that £20m trading profit in September. We understand this to mean operating profit, i.e. after admin costs, but before finance costs and tax. Not surprisingly this is a record and twice the entire operating profit in H2 2019 or 2020. Given the H1/H2 split, I suspect the October - February is pretty weak and probably loss-making in a typical year, but, in the commentary on new sales:

Consumers are increasingly accepting of long lead times, with order bank levels very high and pricing benefits to margin for Manufacturers and retailers alike.

We can also expect higher than expected new margins to continue so there is a lot of potential upside on the upgraded guidance. 15p or above EPS looks far from impossible. Zeus forecast 13.6p today. Liberum go for 14.1p saying "our numbers look cautiously set"

But there are a few short-term downsides. The dividend looks miserly compared to the EPS, and the buyback program is resumed but not enlarged.

The reason for the lack of an extension is pretty clear even from the summary outlook:

Increasingly visible acquisition pipeline

And the word acquisition appears no less than 43 times in the results. For example:

The Group has a strategic objective to grow its scale of operations and therefore, allocation of capital to acquisitions and organic growth opportunities is vital.

This sort of thing tends to frighten investors who know they are currently on a sure thing if they would just return the excess cash. But actually, there could be a longer-term story here. Vertu were formed to consolidate the franchised dealership sector 15 years ago and frankly hasn’t performed very well on a share price basis:

But behind the scenes a lot has been going on that has not been reflected in the share price - scale has been gained, a culture formed and cash/assets accumulated. But the real transformation has been in the last few years culminating in the pandemic where the opportunities for centralisation, data mining and digitisation have been met with significant investment, e.g. with 40 FTE developers currently working on their systems. Scale is now a much bigger advantage than it was 2 years ago, let alone 15.

What they now have is a genuine scalable “platform” that enables them to buy subscale franchise groups and add very considerable value to them. These could be profitable groups that could be run more efficiently (instantly earnings enhancing, even if bought with equity), or run-down groups that need 2-3 years to turn around.

That means from a notional balance sheet perspective there are hidden intangible assets, and from an earnings perspective, this is now a potential growth share. Considerable cash reserves should get them off to a great start with acquisitions (they claim nearly 50% of their market cap in firepower) before hopefully, the share price starts revaluing.

The short-term outlook remains cautious given the uncertainties that abound:

The Board remains cautious on the outlook for the remainder of the financial year and beyond. In light of the trading performance delivered for the year to date, the Board now anticipates that the Group's adjusted profit before tax for the year ending 28 February 2022 will be no less than £65m.

But then, they have always been quite conservative on their forecasting in the last year.

Small Caps Live Friday 15th October

Marshall Motor Holding (MMH.L) - Acquisition of Motorline

Marshall Motor Holdings Plc…announces the strategic acquisition of the entire issued share capital of Motorline…for a cash consideration of £64.5m funded from the Group's existing cash resources . The net assets on acquisition include c.£20m of cash and c.£10m of debt.

That seems a rather strange way of saying they'll be paying £54.5m for it.

The Group has also separately acquired a related freehold property for £2.9m and has the option to acquire two additional strategic freehold properties for £24.9m.

Looking at the accounts of this company I can see that they did a sale and leaseback to a related party mostly in 2019, with some more recently. So this company looks like it has been prepared for sale and Marshalls are not getting the freehold property as part of the deal.

Motorline's consolidated shareholder funds at completion are c.£30m, including c.£20m of cash and c.£10m of debt.

So that's £10m of net non-cash assets. On the last balance sheet date, there was £13m of tangibles and no intangibles. So I think you can assume that those shareholder funds are at least all tangible. But of course, since they are paying £64.4m for £30m of net tangible assets, there will be £34.4m of intangibles recognised as part of the purchase. This looks expensive compared to Vertu who trade at Tangible Book Value.

On an EV/EBITDA basis, Marshalls are paying 7-8x. This compares with a valuation for Vertu of 2.4x. Both figures are normalised for the effects of covid. Vertu has freeholds, which means higher EV and higher profitability.

Marshalls must clearly think they can improve the margins & profitability of Motorline. If they can bring the operating margin from 0.5% to 1% then you might, crudely, say that EBITDA would double, leaving a valuation of 3.5-4x. But presumably, this would take capital and this doesn't seem to be a group that has been run down.

Vertu, who remain our pick in this sector, mention acquisitions many times in their results. Perhaps when Vertu CEO, Robert Forrester, was talking in various interviews saying that he wouldn't overpay, he was referring directly to this acquisition. Based on their recent history, Vertu are probably looking for pretty much the polar opposite of this deal - slightly run-down, perhaps even loss-making, groups of 3-10 sites that own some of the freeholds.

So on this basis, there indeed seems a risk that Vertu would overpay if they did a similar deal BUT that the implication is that Vertu is massively undervalued in comparison.

Newmarket Security (NWT.L) – Trading Update

We last looked at Newmarket Security on 10th September following their Final Results. We didn’t like the cash outflow and commented that the risk very much looked to the downside given the supply issues they faced, concluding:

With severe short-term issues, and little credibility for long term growth story, this remains uninvestable for us.

Today’s trading update does nothing to change our minds:

The worsening supply chain issues facing multiple sectors and businesses of all sizes have been well documented in recent weeks and, unfortunately, Newmark has not been immune to these challenges. These issues include material increases in freight costs and shipping timeframes, as well as increasing component costs and reduced availability…

This increased working capital outlay, coupled with the significantly higher freight costs and increased component costs, has negatively impacted gross margins and cashflows in the first four months of the year ending 30 April 2022.

They also announce a capital re-organisation. Often these are used to enable companies with retained losses to pay dividends. However, in this case, it seems to be designed to enable them to consolidate the shares without having a very high nominal share price (below which they can’t issue shares.)

The stated aim is:

• improve the liquidity of the Company's shares and increase trading volumes;

• improve investor perception of the Company; and

• improve marketability of the Company's shares.

Essentially a share price of 45p looks better than 0.9p and could fool some people into investing in it. It doesn’t change the fundamental value of the company though.

Kenmare Resources (KMR.L) – Q3 Production Report

Q3 production has been solid, although down slightly on Q2:

Unlike fellow Heavy Mineral Sands producer, Base Resources, who should report quarterly production next week, Kenmare doesn’t give cost & price received details to allow you to model their profitability. However, they do say:

Demand for Kenmare’s products remained robust in Q3 2021, supporting strong sales volumes and further price increases.

One of the reasons stocks in this sector had dipped a month or so back was concern over China and Kenmare specifically address this concern, saying:

The outlook for Q4 2021 remains positive, with a strong order book in place. The Company continues to monitor the impact of power disruption to downstream industries in China, and the potential effect on demand related to the uncertainty in the Chinese real estate market. However, demand remains strong from our customers in China, and elsewhere, into Q4 and global feedstock inventories remain at low levels.

Even more pleasingly, Zircon pricing is now on the rise again:

Demand for zircon improved in Q3 2021, as major economies continued the recovery from COVID-19 restrictions being lifted. Demand from the ceramics and foundry industries has recovered particularly quickly. In China, Kenmare’s zircon concentrate benefited from a tight spot market. Coupled with supply disruptions, the strong demand has resulted in an undersupplied market and prices for zircon are expected to increase again in Q4 following increases in Q2 and Q3.

Zircon commands higher pricing per tonne and Base Resources produces a higher proportion of Zircon than Kenmare so even though Kenmare looks cheap, Base remains Mark’s pick in this sector.

That’s all for this week, have a great weekend!