Just a few short comments this week, as most regular commentators have been preparing for, attending and then recovering from, the Mello investment conference. This was another enjoyable event, and nice to be back in Derby, where it all began. It is just a shame that there were not more companies presenting. Although market conditions can make these types of things hard to sell to the board, they will get an audience of knowledgeable investors who may never join an online presentation.

For example, Mark was impressed with Brave Bison (BBSN.L). He had not seen them present before as it is a sector he isn’t usually a fan of. However, they are a growing company unlike many of their sector peers at the moment, on a P/E of 6 with forecasts of £9m in cash at the year end. Some of their adjustments look a little aggressive, but there was a lot to like, too. The brothers, who are Exec Chairman and CEO, cap their salaries at £125k and pay no cash bonus. The rest of their remuneration is in options at 3p versus a current share price of c2p. Many won’t like the dilution, but at least you can’t say they aren’t aligned with shareholders at the moment. Other snippets are that they are conservative in their forecasting, hence the ahead statement at the half-year, and that they are getting good deals coming across their desks for potential acquisitions, given the current weak advertising climate.

Leo was impressed with Fitronic (FTC.L). Despite recent strong performance and a high rating, the upside is still large here if they hit their targets.#

The other highlight is getting to discuss stocks with fund managers, such as Richard Stavely from Rockwood Strategic (RKW.L) and John Goold of Kelso (KLSO.L). They usually have insight we don’t as individual investors, plus activists with larger holdings can often drive change in businesses that we can’t. It is great that they very kindly give their time to talk stocks with the likes of us!

Here is the rest of the news:

Calnex (CLX.L) - Interim Results

These results are as bad as you would expect from a company that brings out the dreaded R-word as the first word in the RNS:

Resilient trading in challenging telecoms market

That means they have had £5m of cash outflow in the last year. Bad but probably not fatal as they say:

Cash increased to £10.3m at the end of October, driven predominantly by a £1.1m corporation tax refund and R&D tax credit receipt.

On outlook:

The Board expects to close the year in line with current market expectations, although uncertainties in the wider economic environment persist.

So that’s not the warning, but it is definitely the pre-warning. How on earth this continues to defy gravity in a terrible small cap market, we don’t know.

National World (NWOR.L) - Request for Engagement

It seems behind this rather tame headline is the possibility of a bid:

Under the terms of the Possible Offer, Media Concierge proposes that National World shareholders would receive:

21 pence per share, in cash.

The Possible Offer values National World's entire issued, and to be issued, ordinary share capital at approximately £56.2 million, and implies an enterprise value of approximately £43.2 million.

To be clear, this is not an offer, and there is a clear obstacle to it proceeding with the current conditions:

Media Concierge is ready to move promptly towards making a Rule 2.7 offer subject only to the following pre-conditions: · the recommendation of the National World Board; · the completion of limited, confirmatory due diligence, details of which have been provided to National World's advisers; and · the receipt of irrevocable undertakings from the directors of National World in respect of their shareholdings in the Company, in a form acceptable to Media Concierge.

National World appear to have largely ignored this:

Since the proposal was submitted to the National World Board 22 days ago on 31 October 2024, Media Concierge has made every effort to engage privately with National World and its advisers, but has had no substantive engagement to date.

There is the usual argument that this bid is good value:

The Possible Offer represents an enterprise value multiple of 7.2x statutory EBITDA and 3.8x adjusted EBITDA for the twelve-month period ended 29 June 2024.

The implied multiple is:

· at the high end compared to multiples paid in recent relevant precedent transactions in the UK regional newspaper sector; and

· at a significant premium to trading multiples for both National World and Reach PLC, a larger, UK-listed, UK regional newspaper competitor, which currently trade at 2.4x and 2.3x adjusted EBITDA for the twelve-month period ended June 2024, respectively as at 21 November 2024.

However, the Reach comparison ignores that half the operating cash flow there goes to the pension fund and probably will for the foreseeable future so the underlying rating there is double the headline. Plus National World is doing ok in terrible advertising markets so you could consider that multiple to be on trough cycle earnings. We agree that the adjustments are a bit aggressive, but we think some of them are reasonable. One should probably go for somewhere around 2.7p EPS versus the 3.0p forecast.

This will never be particularly highly rated given the industry, but surely the board can’t recommend a 7x(adjusted)P/E while they sit on £13m cash. It would just make them look daft. And the plot thickens as to why MediaConcierge may want to try to get this out of the public eye. In their response, National World make several accusations that have not come to light before:

On 1 October 2024, prior to the approach by Media Concierge, the Company was made aware of a potentially systemic pattern of historical invoicing irregularities in relation to the activities of entities affiliated with Media Concierge. The Company commenced an investigation of these matters on 2 October 2024 (the "Investigation").

In addition, entities affiliated with Media Concierge are currently inappropriately withholding revenues due to the Company totaling £4.4 million.

The Company has requested access to historical records to facilitate the Investigation and enable the Possible Offer to be fully evaluated. A forensic auditor is on standby to assist with the Investigation.

Looks like this is already getting heated, and it seems clear that there has been a pretty major bust-up behind the scenes. While it has the scope to cause all sorts of disruption, it also shows that this is worth fighting for. All parties here know this is worth more than 21p; the question is, can independent shareholders get anyone to pay it? Helping the cause are Harwood, holding just over 5%, and Aberforth, close to 20%. Even if the outcome of this is no offer, but significantly improved governance and shareholder engagement the shares could easily trade above 21p.

Norcross (NXR.L) - Interim Results

Resilient trading and market share gains in a challenging demand environment

Oh dear, that R-word again. These don’t seem too bad, though:

Disposals and closures cut revenue, but adjusted profitswere not affected too badly as they mostly got rid of the bad stuff. Massive gap between adjusted & statutory, though:

The reported operating loss was £8.6m (2023: profit of £15.3m) after deducting acquisition and disposal related costs of £25.5m (2023: £3.9m), exceptional operating items of £2.1m (2023: £1.4m) and IAS 19R administration expenses of £0.7m (2023: £0.8m).

Acquisition and disposal related costs included the previously communicated non-cash loss on disposal of £21.4m relating to the disposal of Johnson Tiles UK in May 2024. Other acquisition and disposal related costs represent amortisation of acquired intangibles of £3.3m (2023: £3.3m) and advisory fees of £0.8m (2023: £0.1m). Exceptional operating items predominantly relate to the cash costs of investment in consolidating the warehousing and distribution sites at Grant Westfield.

We’re not sure if advisory fees or costs of combining a warehouse or pension admin should be considered exceptional here. So we’d add this back in. That’s £3.6m, making PBT of around £14m. Annualising this gives c10x EV/EBIT, so it is not expensive but not exactly cheap in the current market for this type of business.

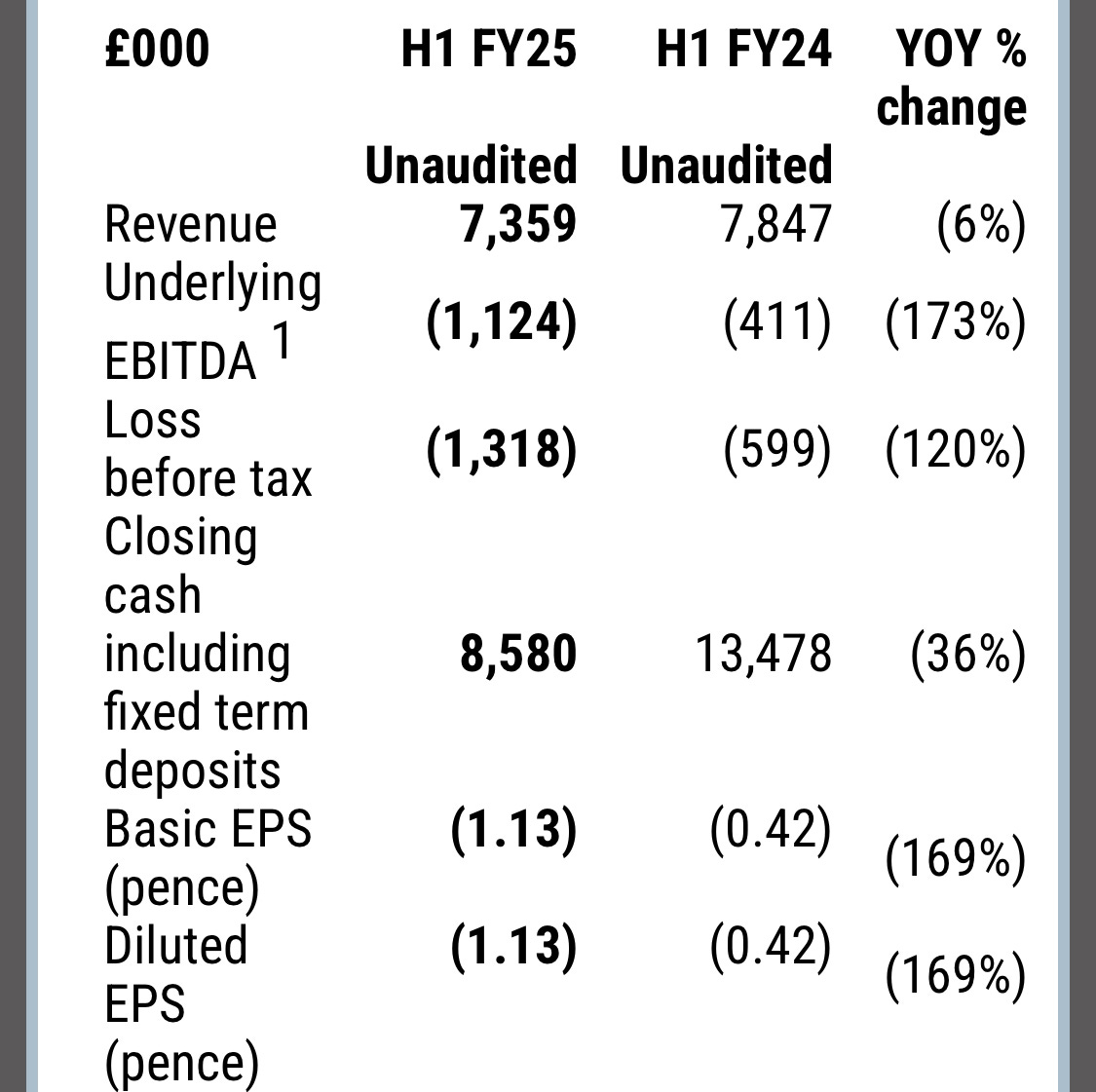

Speedy Hire (SDY.L) - Interim Results

Speedy have a habit of losing things. Last time, it was half their non-itemised assets. This time, it is their profits:

Unsurprisingly, they bring out the R-word:

Commenting on the results Dan Evans, Chief Executive, said:

"We have delivered resilient results for the first half of FY2025…”

Yes Dan, we agree, they are crap.

That’s it for this week. Have a great weekend!