SCL Weekly Summary readers often suggest that they’d be willing to pay for additional substack content. However, our aim here is not to create a subscription model. Instead, the best support you can give is by joining in the discussions on Discord. The real value of SCL is the diversity of opinion. While we don’t always achieve it perfectly, the aim is to cultivate diverse, well-informed opinions, since this is the real value of SCL to us - sharing detailed analysis on UK small and mid-cap shares while avoiding groupthink.

Another way to support us is to buy Mark’s book, Excellent Investing:

The book is packed full of wisdom and tackles topics such as investing styles, overcoming behavioural biases and portfolio construction in a practical and easy-to-read way. It would make an excellent Christmas present for yourself, or you could give it to a friend or enemy. If you have already got a copy, please leave a review.

Alternatively, Leo has a referral link for one of the services we regularly use to analyse stocks: Research Tree. So, if you are considering signing up for this service too, doing so via this link will give you a 10% annual discount and Leo a free month.

Here’s what we’ve been looking at this month:

Biome Technologies (BIOM.L) - Trading Update & Board Change

Perhaps unsurprisingly, a further profits warning here:

As a result of the matters set out above, the Board has adjusted its expectations for revenues in 2024, which are now expected to be materially below current market expectations with a consequential impact on profitability.

So these are materially below already profit-warned figures in the only bit of the business that actually generates cash. (Apart from the employee who fills in the grant funding application forms.) Consequently, the Chair falls on his sword. However, it seems that the CEO intends to draw his generous salary all the way to the inevitable end.

Camelia (CAM.L) - Disposal

This is good news, as many of us were not sure this deal would actually complete:

…announces that the sale of its shares in BF&M Limited to Bermuda Life Insurance Company Limited, a subsidiary of Argus Group Holdings Limited, for a gross consideration of US$100 million completed on 5 December and all funds have been received. The transaction will crystalise a net profit of c.£10.7 million including accumulated exchange gains and losses.

They get all the cash now, too; previously, half was going to be a loan note. This is a bit disappointing, though:

The majority of the proceeds are expected to be used to grow the business and improve profitability by investing in the Company's existing businesses and through other value accretive growth opportunities over the medium term.

Only £9m has been allocated to a buyback, and they have limited themselves to 5% of the share count, which, at the current share price, is under £6.6m. This is quite illiquid, so this amount may still have a material impact on a share price they have previously described as “significantly undervalued”. They may well have a great acquisition lined up, but given that they trade on around 0.4x TBV with half of that value now in cash, we’d have hoped they would have had more faith in the value of their existing assets and been more aggressive with the buyback.

Goldplat (GDP.L) - Results Update

Two bits of good news. The first shouldn’t be news, but it is - it looks like they will get accounts out before the deadline. The second is that these results will be ahead of expectations. This is mainly around the timing of revenue recognition. It seems Goldplat have been too conservative on this in the past:

Due to adjustments identified as part of the year end audit process, some revenue recognised in Q1 FY25 has been brought forward to Q4 FY24, as final assays received in Q1 FY25 relating to provisional revenue recognised in Q4 FY24 were adjusted for.

The result is:

…we expect reported profit before tax for the year ended 30 June 2024 to be in the region of GBP6m.

Zeus previously had £4.8m for PBT for this period, so this is a material upgrade. However, with a £13m market cap, even after a rise this week, trading on 2.7x or 2.2x PBT probably doesn’t matter that much. Either way, it is likely to be one of the cheapest stocks in the UK market, and investors view it as an obvious bargain or cheap for good reason.

Diales (DIAL.L) - Preliminary Results

Research provider Equity Development describes these results as ahead of expectations:

The company is finally willing to give enough guidance for ED to make future forecasts, too. (Previously, they were only willing to forecast a year that had already ended!)

However, this means they are still on a historical P/E of 19 with flat EPS. This comes down a bit if we exclude the cash balance, but we already know that they use a significant portion of this to manage their large working capital flows.

They say they reviewed several acquisitions in the period, but these are not like other companies’ acquisitions. Instead, they are paying golden hellos to teams of professionals. This may be a good deal, but perhaps not the same sort of deal as a company with synergies, etc. If they can’t do any “deals” it looks like this may make its way back as buybacks instead, which is probably what shareholders will prefer, although buying back at 19x earnings isn’t immediately a great capital allocation.

However, small changes at this level impact results. Adjusted PBT was up because a slight £0.2m improvement in gross profit was met with flat costs. If they can improve utilisation on the existing staff that generated £43m of revenue by billing 72.6% of their time, they could do much better and look cheap. Unfortunately, we’d hoped they would be able to do this for many years, and there doesn’t seem to be much sign that they can actually do it.

It is also worth noting that they only make a profit at all by excluding the failed parts of the business, and the results are generally confusing and, in places, confused, e.g.:

…planned cessation of a JV agreement in Canada and the Middle East...

There was a loss from discontinued operations of £1.0m (2023: £0.4m) relating mainly to the USA (£0.5m), Oman (£0.2m), Kuwait (£0.3m)

This means they have massively increased their exposure to UAE. Their problems of actually getting paid on time and in full for the work they do remain. We struggle to see a commercial business here.

Premier Miton (PMI.L) - Full Year Results

Shareholders probably had a heart attack when Premier Miton began their RNS with the dreaded R-Word:

Resilient performance

But actually, things don’t seem as bad as the headline suggests:

· £10.7 billion closing Assets under Management 3 ('AuM') (2023: £9.8 billion), an increase of 9% for the year

· £10.9 billion closing AuM at 30 November 2024 4

· Net outflows of £318 million for the year (2023: £1,147 million outflow)

· Adjusted profit before tax 1,3 of £12.2 million (2023: £15.7 million)

· Adjusted earnings per share 2,3 of 6.3 pence (2023: 8.8 pence)

The dividend is held and just covered by adjusted earnings. Cash is flat, as you’d expect from a company that pays only a just-covered dividend. Sometimes small cap investors can look at the performance of things we know Miton’s micorcap trust and think it’s performance is poor. However, the average fund here is much better than that:

Strong investment performance with 68% of funds in the first or second quartile of their respective sectors since launch or fund manager tenure

This should do well when UK markets finally recover.

Quiz (QUIZ.L) - Trading and Cash Position Update

Further profits warning here:

Similar to many retailers, revenues generated across November and December are key to the performance of the business across the year. Consequently, further to the notable decline in traffic and footfall in November, sales for the eight months 30 November 2024 were behind management expectations at £52.2m, an 8.6% reduction from £57.1m in the previous year.

If this didn’t look all over before, it does now:

As at 5 December 2024, the Group had net borrowings of £2.8 million and total liquidity headroom of £1.2 million.

It seems that the founder and largest shareholder may agree with this assessment since an agreed-in-principle shareholder loan remains outstanding:

The Group previously announced, on 29 August 2024, that Tarak Ramzan, the Company's founder and largest shareholder, has offered to provide a £1.0 million loan facility to provide additional liquidity headroom for working capital purposes (the "Majority Shareholder Loan"). The agreement in relation to the Majority Shareholder Loan remains outstanding and is subject to approval from the provider of the Company's banking facilities.

Treatt (TET.L) - Full Year Results

Here are the key figures:

This appears to be a slight revenue miss and a slight EPS beat. They claim they are “poised for growth,” but on a P/E of 17.6, they surely need to do better than +4% revenue and +7% EPS. At least there are very few adjustments this time. To their credit, they've spent a lot upgrading and expanding their site, and they have almost got back to net cash. However, a build-it-and-they-come strategy rarely works out for those who build significant excess capacity ahead of demand. Shareholders have to hope they have something more concrete than “poise” in the pipeline.

XP Factory (XPF.L) - Interim Results

Figures here look reasonable with Boom growing strongly:

Boom Battle Bar ("Boom") owner operated revenue increased 56% to £17.6m (H1 2023: £11.3m)

Until you realise these don’t add up:

Free cash generation3 of £2.1m (H1 2023: £2.2m)

£3.6m invested in growth capex, and £0.3m in maintenance capex

Cash balance at 30 September 2024 of £1.9m (31 March 2024 £3.9m)

Net debt at 30 September 2024 of £1.3m (31 March 2024: £0.0m)

Their definition of free cash flow isn’t free cash flow at all, but operating cash flow. So, they can grow rapidly if they open sites and spend on capex. However, without this their figures are rather lacklstre:

· Continued underlying positive like-for-like growth in both brands ahead of the industry and against strong comparators in the prior year.

o Boom: up 4.4% in the 26 weeks to 29 September 2024 (5.6% excluding the two weeks of riots)

o Escape Hunt : up 3.0% in the 26 weeks to 29 September 2024 (5.7% excluding the weeks of the Euros and the riots)

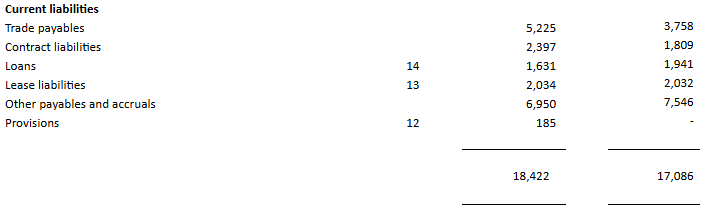

Current trading is 2% LFL growth. They talk about reorganising the balance sheet to pay dividends but the balance sheet has deteriorated, with current assets down and current liabilities up:

While the banks may be willing to let debt increase in order to find site growth, we are not sure how pleased the banks will be to be funding shareholder payments from debt.

That’s it for this week. Have a great weekend!