Market events have rather been overshadowed by political events in the UK this week. WayneJ takes a look at the impact for government debt financing and the gilt market.

While small cap markets remain depressed, there is some good news. A physical Mello will be back in November:

All of us intend to be there as this is the ideal opportunity to see companies, attend interesting talks plus get to know like-minded investors over a drink or two. It is well worth making the effort to join us.

Large Caps Live

Can I show you all something:

And that is the DMO plan for debt issuance by gilts in 2022-2023. It was published in March 2022. CGNCR = Central Govt Net Cash Requirement - so that is the estimate for the cash the UK govt would require - you can see it was £94bn. That is the number before Network Rail, Bradford and Bingley and NRAM. So we can say that basically there was £125bn of gilts expected to be issued. Add in £80bn of QT. And maybe £80bn in 2023 for the energy cap. And maybe £40bn due to losses on QT. So you get maybe £320bn of issuance rather than £125bn.

So you can see why there could be an issue for the UK gilt market - which means gilt investors would demand more return/interest.

(1) So what I am thinking is that the result of this is that we are going to get higher rates for longer.

(2) The Truss madness is firmly back in the box

(3) But I just cannot see how the numbers add up without drastic cuts

(4) Remember I have not counted the Truss tax cuts in the above - except for the energy cap

(5) I can't see how the BoE can sell its bonds in that situation, so I think we see very limited BoE selling - or maybe swapping duration with the market (e.g. the BoE might sell some long-duration bonds if there is demand and take some short duration issuance).

It is also worth remembering the above DMO report, and the last OBR report were before a spike in inflation. Just back of the envelope, I think matching inflation will cost the public sector £50bn (based on a govt budget of circa £1.1 Trillion) and a 5% across-the-board rise. It is hard to pin the exact number as I am not sure what was Covid related and what was Boris's largesse. But here is a quote from the OBR that would raise some eyebrows:

In 2021-22, we expect the public sector’s income to amount to £987.5 billion, equivalent to £35,000 per household or 39.3 per cent of national income. This income is called ‘public sector current receipts’ in the official statistics and comes from many sources.

I want to come to a bugbear of mine - the cost of moving from QE to QT for the UK:

(1) Specifically - the Treasury has indemnified the Bank of England and is meant to pay the BoE to cover any QT losses as they occur

(2) The above OBR document specifically excludes any BoE debt in their forecasts

(3) So, if I am right, the shift to selling bonds causes the recognition of losses which leads to £30-40bn PER YEAR of transfer payments from the Treasury to the BoE - and this is different from other central banks

And remember, we also have about 1/4 of the UK debt of circa £2.2 trillion, so about £550bn which is index-linked - so that probably means another £16 - 20bn of interest payments there.

As you all know, I have been bullish on and off banks. After all the above settles down, I think that banks, insurers, and pension funds will benefit because we will start getting a return ON capital. However, given the state of the govt debt, I think that there are likely to be more windfall taxes. In the case of banks, the implication of Hunt's corporation tax reversals is that the bank surcharge of 5% is not going away. I expect that as the proverbial hits the fan though that there will be a discussion on further taxes. And ditto for a lot of other sectors (O&G, pension managers etc.)

I also suspect that there may be a raid on pension funds - not sure how but would not surprise me if the govt either forces them to invest in infrastructure or looks at ways of taxing them.

I think the area of govt that will be hit the hardest is the local govt sector, and so local councils will try to raise rates as much as they can to balance books. I think that will hit shops/retail - leading to the abandonment of more shops. I had lunch with someone who runs a couple of retail shops at the weekend - the cost of rates/utilities and rent is now making the businesses totally unviable. She would love to sell but, frankly, will not get more than a nominal sum for her businesses which have taken years to set up. I suspect that many are in a similar position.

Small Caps

Capital Limited (CAPD.L) - Q3 2022 Trading Update

Here are the headlines:

Compared to Q2, the number of utilised rigs is down, but the average revenue per rig is up. The reasons given were as expected for this time of year:

Fleet Utilisation of 77% in Q3 2022 was up 1.3% on Q3 2021 and down 9.4% on Q2 2022, due to typical seasonal weakness, particularly the wet season in West Africa, and also increased asset mobilisation as the group begun repositioning the contract portfolio as outlined at our H1 22 results. Repositioning of rigs is continuing in Q4 2022 along with some refurbishments on the newly acquired rigs at Fekola;

The overall effect is a small beat on drilling revenue and either a small beat on mining or MSALABS (they don’t break this out) versus Mark’s Q3 expectations. A similar story from Broker Tamesis, who say:

Revenue remains high and on track to meet guidance. The company achieved Q3 revenues of US$73.1 million which is just above the previous quarter which is impressive given the usual seasonal weakness (wet season in West Africa). The company continues to edge up growth in non-drilling revenue contribution (29% of total vs 26% in Q3 2021) driven by strong quarter for mining services and continued growth of the MSALABS business. The average ARPOR of $182,000 was flat YoY but up 6.4% QoQ which is a positive surprise to our modelling. We expect this high ARPOR to come off slightly (we model $175,000 going forward) compensated by the increased fleet size. After this strong quarter the company remains on track to meet its US$280-290 million revenue guidance for 2022.

Given the closing size of the rig fleet, a Q4 performance of 80% utilisation and $175k ARPOR would give the upper end of that revenue range.

There is a couple of new contract announcements:

§ A multi-rig exploration drilling contract (including reverse circulation, diamond and air core drilling) with Perseus Mining at its Block 14 Gold Project in Sudan; and

§ A reverse circulation drilling contract with Evolution Energy Minerals at its Chilalo graphite project in Tanzania.

These, together with the B2Gold contract already announced and the continued growth of MSALABS, mean that 2023 should see further profitable growth.

Perhaps the biggest disappointment is the lack of any new share buyback announcement. With a forward EV/EBITDA of less than two versus peers who trade on approximately 4x, their own shares remain a better capital investment than almost all the other possible capital investments they could make at this time. Earlier in the year, they were buying back shares at 97p. Since then, brokers’ EPS forecasts have risen by around 40% in sterling terms, yet the share price is some 15% lower. Surely this makes a further buyback a no-brainer?

Revolution Bars (RBG.L) - Acquisition & Final Results

The results here were delayed while they finalised the acquisition of Peach Pubs:

Revolution, a leading operator of 69 premium bars is pleased to announce that it has completed the acquisition of the entire issued share capital of Peach ("the Acquisition"), the operator of a collection of 21 award winning, premium food-led pubs from its founders for a cash consideration of £16.5m, on a debt and cash free basis, of which £0.5m is contingent upon the future performance of the business.

£16.5m for £1.5m EBITDA does not look particularly cheap, although they say that synergies will take it to £3m going forward. The acquisition is completely debt funded:

Revolution's net cash position prior to the Acquisition and strong trading performance following the pandemic, together with the compelling strategic rationale for the acquisition of Peach, has allowed it to fund the entire consideration for the transaction from its banking facilities. Net cash, pre-acquisition, on 17 October 2022 was £0.7m. Following the Acquisition, the Group will have headroom on its bank facilities of more than £15 million, and will target a return to net bank debt / EBITDA (IAS17) of 1x in the short to medium term.

So £15.3m net debt, now. The results have details of the debt:

The total facility was refinanced on 10 October 2022, through which a new RCF was committed at a total facility level of £30.0 million expiring October 2025. The RCF was sought with the purposes of repaying all other indebtedness, general working capital requirements, and for future acquisitions. Therefore, all outstanding CLBILS term loans were repaid on 13 October 2022, with just the RCF making up total facilities going forwards. Interest is charged on the utilised RCF at a margin determined by leveraging plus SONIA, with unutilised RCF values having interest charged at 40% of margin.

So the new RCF repays the CBILS loan. In addition to traditional debt, trade payables and short-term provisions exceed receivables and inventories by £19.7m. While this is a business that always trades with negative working capital, any slowdown in trading will see the debt increase significantly.

Their adjusted EBITDA is given as £10.2m under IAS17, and Peach Pubs adds £3m pa after integration and cost synergies are implemented. However, interest costs going forward must be at least £2m, and they need to spend £3-4m on fixtures and fittings to keep trading from dropping off.

So potentially, £7-8m cash flow vs £40m EV looks good value, but the debt & negative working capital make this look a mighty risky move. Any real downturn in trading could see them in serious financial trouble (again)! And with a consumer recession on the horizon, they would have been much better off funding this kind of deal mainly through equity. Perhaps they intend to raise money when the markets are looking perkier. However, this can be a dangerous strategy.

finnCap (FCAP.L) - Response to offer speculation

The Board of finnCap notes recent speculation and confirms that it has received indicative non-binding proposals from Panmure Gordon Group Limited ("Panmure Gordon") regarding a possible combination of the two companies structured as the acquisition for cash of finnCap by Panmure Gordon with the alternative for electing shareholders to receive partial consideration in Panmure Gordon securities.

This was the article they were responding to:

Sky News has learnt that Panmure Gordon, in which Mr Diamond's Atlas Merchant Capital took a majority stake in 2017, has approached FinnCap Group about a potential tie-up.

These sorts of things can just be a cheap way for some companies to gain a listing, so it is good to see that real cash appears to be on offer here.

The consolidated turnover for Panmure Gordon Group was £38m in 2020 and £48m in 2021. Finncap £48m and £52m, respectively. Especially when you consider profitability, finnCap is the more valuable entity here, so it will require financial backing from Mr Diamond for Panmure Gordon to make an acceptable offer.

The share price responded positively on the day, up around 30%. However, that only really reverses the recent decline. As a fairly illiquid stock, any forced selling in difficult markets can easily see the share price drop. However, this seems to be at odds with recent trading. This certainly isn’t at the boom levels of last year, but a search of the RNSs of the last couple of months shows that they continue to be able to raise money for clients, and M&A still seems to be strong.

The other side of illiquidity means that, as a tightly held share, Panmure will have to pay what the larger shareholders want. Ex CEO, Sam Smith, holds around 10% and bought shares in the market last year at 31p. So psychologically, this may be some kind of target price. The larger shareholders may want to retain equity in the expanded business, so the absolute cash levels required to do the deal may be smaller.

Having built the business on the idea of a unique corporate culture of always doing the right thing, Sam Smith may be reluctant to let it go, even if she remains a shareholder in the larger business. However, you can’t resign as CEO with the share price at all-time lows and expect that your successor doesn’t consider all options for the market to better reflect the real value of the underlying business.

Carclo (CAR.L) - Trading Update

In line, with sales marginally ahead of last year and operating profit marginally behind, and that is with the benefit of FX:

As a result, underlying Operating Profit for the Group is in line with the Board's expectation and marginally below the prior year, supported by favourable exchange rate movements, particularly the movement of sterling against the US dollar.

Pension deficit slight benefit:

The Group pension scheme IAS 19 accounting deficit has reduced slightly since March 2022, with both asset and liability values reducing significantly during recent high volatility in equity and bond markets.

But this is still a significant proportion of the capital structure, as is debt, which is rising even further:

Increases in borrowing costs are expected in the second half driven by increases in both the level of debt and interest rates.

Gross Debt on 31st March was £44.8m. They paid £2.5m interest, so assuming that the y/e debt is similar to the whole year, then this is 5.6%. So this could easily be £50m and 7.6% this year, which would be £3.8m interest paid. With the operating profit dropping, the PAT could be down quite significantly.

The market cap is only £11m, though, so small changes in valuation can have big effects on the equity value. With interest rates and debt going up, this gearing effect seems to be going the wrong way for equity holders here.

Smiths News (SNWS.L) - Contract Renewals

Smiths News have announced two contract renewals recently that have been well received by the market:

The new agreements reached with Frontline (the UK's largest magazine distributor) and Seymour (part of the Frontline Group and the UK's largest independent magazine distributor) secure all of Smiths News' current distribution territories in the UK from 2025 through to 2030 with Frontline and Seymour, representing revenues of c.£180m p.a. at current market values. Combined, the Frontline and Seymour portfolios account for over 50% of the UK magazine market and include titles such as 'Radio Times', 'Take A Break' and 'TV Choice'.

And:

Smiths News is pleased to announce that it has successfully secured a new long-term contract with Associated Newspapers Limited, publisher of the 'Daily Mail', 'The Mail on Sunday' and the 'i' newspaper.

…The new agreement with Associated Newspapers is for all of Smiths News' current distribution territories in the UK through to 2029, representing revenues of c.£155m p.a. at current market values.

The question is - did anyone really expect these contracts not to be renewed? The reality is that Smiths has a geographic monopoly on newspaper and magazine distribution. With declining physical circulation, no one is going to start a new operation, and it is not in the interest of either geographic monopoly to start a price war to expand their territory.

While contract values are given, the key information is not - are they getting paid more than previous contracts after accounting for inflation? You’d expect if they were, they would have said so.

So while it’s good to know these contracts are renewed, there really was never any doubt that they would be, and the investment case here is unchanged by this news.

Luceco (LUCE.L) - Q3 2022 Trading Update

Starts off well:

The Group has traded in line with expectations in Q3 2022 and generated strong cash flow.

But quickly goes downhill:

However, our order book now suggests our distributor customers will destock faster in Q4 than we originally expected, resulting in Adjusted Operating Profit for 2022 in the range of £20-22m, below previous estimates.

Their adjusted operating profit for H1 was £11.5m. So the range is now £8.5-10.5m for H2. Adjusted PAT was £9m for H1, so we can perhaps expect £6-8m PAT. H1 adjusted EPS was 5.8p, so a simple pro-rata suggests that we can perhaps expect 3.9p - 5.2p H2 EPS, and so 9.7p - 11p FY EPS.

Stockopedia has a 12.1p consensus, so this is 10-20% below. However, their broker, Liberum, has cut their estimate to 9.1p, which is more severe.

However, this de-stocking is a one-off effect, and they say:

Our estimate of total destocking for 2022 and 2023 combined remains unchanged.

We now have good visibility of orders due for shipment to these customers in Q4. This confirms they plan to reduce their inventory by more than we had originally expected in 2022, leaving less to do in 2023.

And there is positive news on costs:

Our estimate of the total impact of cost inflation emerging from the pandemic has reduced materially in recent weeks as key cost drivers such as sea container and currency rates have moved rapidly in our favour. At current prices, this would lead to a reduction in our annual cost base between 2022 and 2024 once existing inventory has been sold through and current hedging arrangements mature.

Overall, the guidance for 2023:

If pressure on residential RMI activity from reduced household disposable income and fewer housing transactions continues as expected, this is likely to lead to profits in 2023 being similar to 2022, with performance underpinned by tailwinds from reduced customer destocking, growth in EV charger sales and input cost deflation.

Stockopedia forecasts were for EPS to grow in 2023 but are now clearly out of date. Liberum now has an 8.3p forecast for this year. Perhaps those higher tax rates and interest payments are having an impact? Still, it seems a little aggressive given the company guidance, perhaps reflecting the level of uncertainty for the year. So this is a forward P/E of 8, which surely must be on trough earnings?

One of the worries here, and perhaps why the market has given this such a low rating, is the presence of debt going into these difficult times. However, there is some good news on this front:

The Group generated free cash flow of £11m in Q3 2022, which included the benefit of ongoing inventory reduction. Pre-IFRS 16 net debt at 30 September 2022 of £43.5m (30 June 2022: £53.9m) equalled 1.3x LTM Adjusted EBITDA (30 June 2022: 1.4x).

We are on track to deliver H2 2022 free cash flow margin of at least 10% and an inventory reduction of c.£10m. We expect year-end net debt leverage to be similar to Q3 2022.

Mark was clearly wrong to call this a buy above £1, and those forecasts have come down quite a bit in response to macro conditions. However, this company is trading better than it did pre-covid and is a very well-run business that traded between £1-2/share pre-covid. The £4-5/share and 30x P/E it traded in 2021 was clearly bonkers. But 8x P/E on trough earnings for a company that typically generates 20-30% ROCE looks low. The proof will be how well they navigate 2023 and if they return to growth with better market conditions in 2024.

Gear4Music (G4M.L) - Half-Year Trading Update

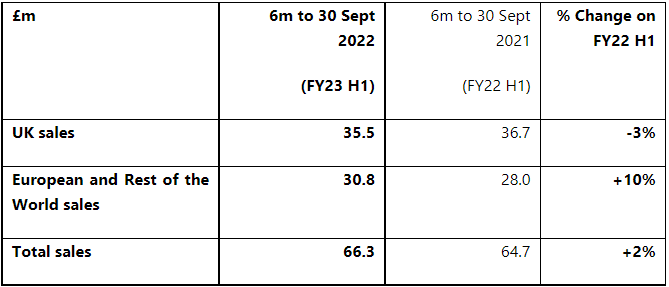

So sales flat, but a gross margin decline means gross profit is down:

- FY23 H1 gross margin expected to be 26.3% (FY22 H1: 28.0%), reflecting targeted stock reductions

- Gross profit expected to be £17.4m (FY22 H1: £18.1m)

Overall, they say:

- Full-year outlook in-line with recently updated consensus market expectations**

And helpfully give us the figures:

Gear4music believes that current consensus market expectations for the year ending 31 March 2023 are revenue of £155.1 million, EBITDA of £8.9 million and profit before tax of £1.1 million.

Assuming normal tax rates, this would be a PAT of c.£0.9m and an EPS of c4.1p. So this is on a forward P/E of around 27 on flat revenue. It seems strange that the market has bid this up slightly on these figures, especially in this market.

On top of this, they still have debt around their current market cap, although it has reduced slightly:

Net debt reduced by £2.4m over the period to £21.8 million at the end of September, comfortably within our £35m facility. We expect net debt will reduce further by the end of the current financial year following our peak trading period.

Progressive forecast this to be down to £17.9m at year-end. Progressive, and by extension anyone invested here, are betting on a massive recovery in sales, increasing margins and flat admin costs going forward. If all of this goes right, then they will be at 11.3p EPS in 2024 and a P/E of 10. Although that would be quite a lot higher on a net-debt-adjusted basis.

This seems a brave bet. Paying a high price today for an uncertain recovery in the future is often folly. As Luceco has shown, you can execute well, but if the macro is still against you, then it is more of a mitigation exercise than anything else. Buying Gear4Music today seems the epitome of a reward-free risk.

Distil (DIS.L) - H1 Results

Last week they issued their H1 results, which is quite impressive as the period only ended two weeks before. But of course, producing results is easier for nano-caps like this. The biggest news is:

Major move from UK Distributor to a new business model.

Relationship with major UK retail customers taken under direct control.

Significant reduction in UK market stock cover associated with removal of distributor.

Which they had previously announced in July:

Distil will be entering a new distribution agreement with Marussia Beverages UK, following the decision to withdraw its portfolio of spirits from long-term UK distributor, Hi-Spirits.

Also, they were taking direct control of major customers with the help of a newly appointed commercial director. They will be using the above distributor mainly for pubs and other hospitality.

A change of go-to-market strategy usually comes about for one of three main reasons: 1) They have outgrown previous arrangements, 2) They wish to enter new markets or 3) They are unsatisfied with the previous performance.

Clearly, (1) is not the case here. (3) often applies because of fundamental problems getting traction in the marketplace, which new distribution arrangements will not solve. It could be argued that their push into pubs etc., could constitute a new market, and so (2) applies, but they did sell to the on-trade before, just not very successfully, so it is more a question of (3) I suspect. So how is this switch going?

Turnover decreased by 68% to £0.46 million (2021: £1.44 million)

Oh dear. But, although they never mentioned inventory reductions as part of the original rationale for cutting out the middle man in supermarket sales, this is now a major advantage in the operational highlights:

Significant reduction in UK market stock cover associated with removal of distributor

Reductions in inventory are, of course, good because less working capital is tied up, but this was inventory from Distil's perspective; it was sold goods. To ensure a smooth supply, the stock has to be held somewhere, so it is not surprising that Distil's inventory has increased; in other words, this change of strategy has increased working capital. And sales have collapsed because the distributor was working through their stocks. But did they really hold £1m of stocks (over 4m of sales), or is this noise a cover for something worse? And can they now manage with less than £1m in cash?

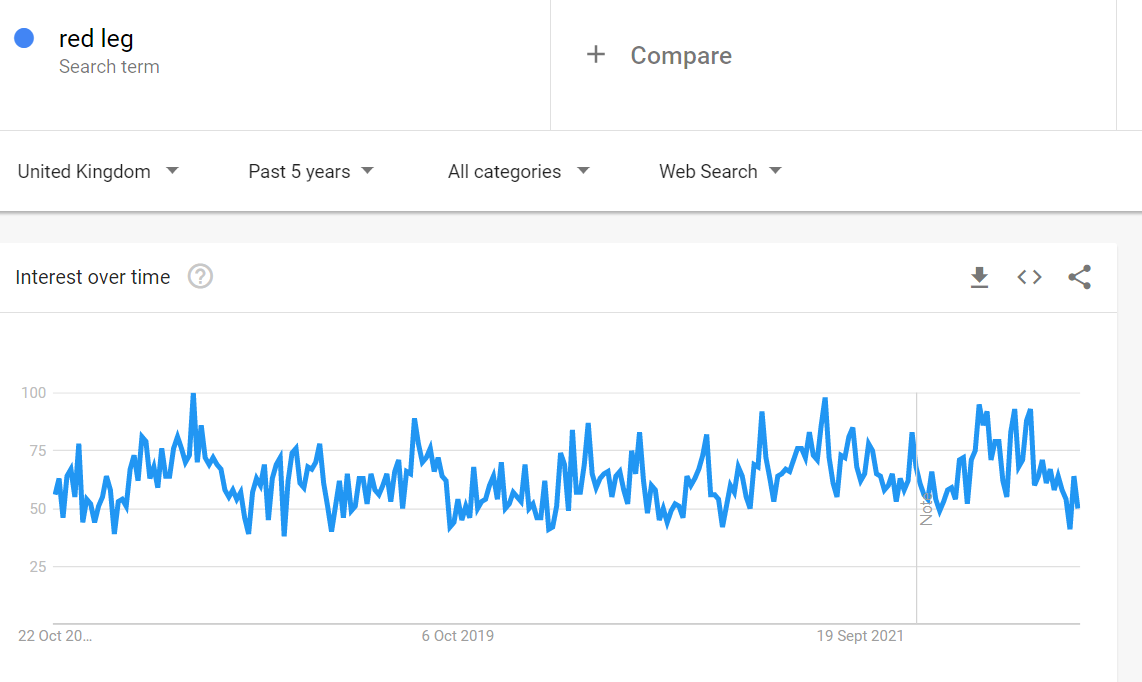

They don't break down on/off trade sales, but supermarket sales of RedLeg have latterly been the most important. The risk is that they may have lost a listing and not told us. Since Leo’s last check on 18/5/2019, Asda, Waitrose and Majestic have delisted it. Tesco has switched to the vanilla flavour, which was supposed to be a range extension. So there does seem to be a serious problem there.

And potentially, an increase in competition. They do not declare the split between on- and off-licenced sales or even mention the word supermarket in the last annual report or recent statements, but we know that supermarkets were the main sales channel during covid. And there are no signs of them gaining traction:

So, the evidence is that their flagship product has peaked in a very crowded market on supermarket shelves and is now starting to be delisted. Spending £500k (before discounts) on advertising made no apparent impact. Realising there was a problem, they blamed the distributor for this and not getting them into the off-trade quicker. They are hoping for a strong H2 from Christmas, but with no current retail sales figures to back that up. Money has been wasted on advertising spending and on the abandoned Ardgowan Distillery project. Intangible asset writedowns look a certainty, with difficulties over the going concern statement quite likely at the time of the next annual report in June 2023.

Hummingbird Resources (HUM.L) - Q3 2022 Operational, Finance and Trading Update

Hummingbird CEO Dan Betts appears to be auditioning for the next Conservative leader by presiding over his own coalition of chaos. Having had a poor Q1, producing just 15.5koz, the company promised that an underperforming contractor would be forced to upgrade ageing machinery to improve production. Their efforts yielded some improvements, and they managed 20.5koz in Q2. However, in order to hit the mid-point of their 87-97koz production target, they would need to do 28koz for Q3 & Q4. So what did they achieve:

§ Quarter production: Q3 2022 production of 16,827 ounces ("oz") of gold (Q2 2022: 20,013 oz)

Oh, dear. A performance that only Liz Truss would have been proud of. They are still trying to fix it:

- The replacement of the mining contractor's production and grade control rigs by third party contractors. These rigs are now on site, commissioned and in production in the Komana East deposit which has historically been our highest grade and best performing source of ore giving confidence in an immediate improvement in output

- Ongoing external support in the form of equipment, management expertise and funding for the contract miner

- Assisting in the restructure of the contract miner through an expansion of the group's relationship with Corica Mining Services ("Corica") and the injection of capacity to ensure it can perform its contractual obligations

- Changes to the leadership team of the mine.

Tl;dr - they appointed a mining contractor who can't do the job.

the year end 2022 production guidance range being conservatively lowered to between 77,000 - 87,000 oz

So they think they will do between 24-34koz in Q4. That doesn't seem conservative, given their history of missing every production target they have set over the last few years. The only good news is that Coris bank still seems to be supportive:

The Company has agreed in principle with its partner, Coris Bank International, additional financing facilities of up to, in aggregate, US$35m to support the Group's liquidity whilst it brings the Kouroussa Project into production. This includes a one year loan facility of CFA10bn (approximately US$15m) which has already been made available on similar terms to existing facilities the Company has in place with Coris Bank International. The structure and terms of the balance of US$20m are expected to be confirmed during the current quarter. This additional liquidity is expected to see the Company through to the commencement of production at Kouroussa.

Debt is now most of the capital structure:

Net debt position c.US$85 million end of Q3 2022 (c.US$81 million including gold inventory value), with c.US$37 million debt remaining available from Coris Bank International (including the $20m balance of the facility currently being finalised) and is expected to be drawn during Q4 2022 for the Kouroussa construction purposes.

So the future very much hangs on Kouroussa being brought into production on time (which seems likely) and profitably (the jury's very much out, given the issues they have had at Yanfolila). With a market cap of £21m, if they can get to two profitable mines producing their original plan of 200koz of gold pa, this would be the cheapest gold stock around. They look a long way from that today, and with the Q3 production numbers, the target moved even further away.

Wickes (WIX.L) - Q3 Trading Update

This is in line overall:

Following this stable third quarter performance we continue to expect full year adjusted PBT to be in the range of £72-82m.

Interestingly, inflation seems to be abating in some areas:

Aided by reductions in the cost of timber, there has been some moderation in the rate of retail price inflation since the first half.

Although, there is some uncertainty over the impact of energy prices in the future:

Looking further ahead, uncertainties remain regarding consumer confidence and operating cost inflation. In particular, our costs will be impacted by rising energy prices once our energy contract ends in March 2023. If energy costs were to remain at the current price cap for businesses, then our FY2023 energy costs would be c£7.5m higher than FY2022.

This may be weighing on the mind of some investors - hence the share price is down 7%. Seems a little harsh, though, for a business that has confirmed that it is in line with forecasts that put it on a forward P/E of 5 with a third of its market cap in net cash (ex-IFRS16).

That’s all for this week. Have a great weekend!