Here is some of what we discussed this week:

BS25

This week saw the release of Simon Thompson’s Bargain Shares 2025 picks. While we doubt that the realisable returns achievable by investors are anywhere close to the performance figures given in the article, there is no doubt that this article moves the price of the chosen stocks.

However, when the picks were announced, we were a little disappointed. For what claims to be picks based on Ben Graham’s principles, none appeared to actually trade at a discount to Net Current Asset Value (the key claimed bargain metric), and only Crystal Amber was even at a discount to tangible book value. Instead, there appears to be a heavy reliance on intangible assets to justify valuation, something that would be anathema to Graham.

Perhaps this style shift indicates a form of capitulation. After a poor couple of years of performance, the temptation to shift to more story-led stock-picking may be too much. However, what usually happens when an investor capitulates is that the original strategy comes roaring back. Perhaps this year is the one where buying companies trading at significant discounts to their net assets really works.

Avation (AVAP.L) - Financing

This doesn’t seem out of the ordinary:

…it has signed a Term Loan A-style US$85 million expandable portfolio financing facility

But this bit is:

Once fully drawn, this facility has the potential to improve the Company's cash flow by up to US$400,000 per month.

The maths seems to suggest this is over 5% cheaper on interest rate than their unsecured finance. Their broker, Zeus, doesn’t change their forecasts, citing upcoming results, but the $4.8m saving should drop straight through to the bottom line after tax adjustment. Bearing in mind the current PBT forecast for FY26 from Zeus is $8.1m, this could add more than 50% to the EPS forecast. It Still doesn’t make it that cheap on earnings, but it is a step in the right direction.

Checkit (CKT.L) & Crimson Tide (TIDE.L) - Recommended All-share Merger

Last time this combination was proposed we said it made strategic sense. However, the Crimson Tide board were less convinced, saying that the 7 Checkit shares for each Crimson Tide share:

The Board noted the potential commercial and strategic logic to such a combination but considered that the terms of this proposal were neither adequate nor attractive.

So here’s Checkit back with an improved offer that is now recommended:

For each Crimson Tide Share: 6 Checkit Shares

LOL. What actually seems to have happened is that CT is trading badly:

…the Crimson Tide Board believes that in the current economic climate client buying behaviour is unlikely to improve in the short term, with sales cycles only likely to become more protracted, however well invested the mpro5 platform may be. With that in mind the Crimson Tide Board sees little scope to make top-line progress during the current financial year, with any growth not now anticipated until FY26.

Hence, they are now willing to fold to the lower offer. If anyone knows where the Crimson Tide board play poker, do let us know. We’d love to get in that game!

Both companies have seen their share price fall in response. The biggest loss, though, is that we will no longer be able to refer to Crimson Tide as “maker of nuclear submarines”!

Gattaca (GATC.L) - Trading Update

Given the recent share price trajectory, and that it traded at net cash at the last balance sheet date, the market was clearly expecting a warning here. Perhaps unsurprisingly, given that many peers were reporting double-digit declines in Net Fee Income. However, they seem to be significantly outperforming their market:

Group Net Fee Income1 ("NFI") expected to be £18.8m (H1 242 £19.4m), a decrease of 3% year-on-year ("YoY").

Which, combined with the usual sector cost-cutting, means:

Group guidance for FY25 adjusted profit before tax remains at £3m.

The market was clearly wrong to assume a terrible outcome here. However, the shares are still trading below where they were at the start of the year. One downside is that cash has declined:

The Group expects to report statutory net cash as at 31 January 2025 of £16.7m (31 January 2024: net cash of £22.3m). Days sales outstanding (DSO) remains in line with recent reported trends, the decrease in net cash is primarily a reduction in trade creditors.

However, this seems to just be part of the normal working capital cycle and it still remains a significant proportion of the current market cap.

Overall, this still seems far too cheap, especially given that there are several signs that a recovery may be underway in their markets.

Goldplat (GDP.L) - Q2 Operating Results

On the surface, this is a weak quarter, given the high gold price :

…a combined profit before tax excluding listing and head office costs for Q2 of £834,000 (FY Q2 2024 - £716,000).

However, the issue appears to have been that:

[Security concerns] resulted in doré bars produced during the latter half of December in Ghana only being exported in January which had an impact on revenue of circa £2 million in December.

Given these were already in bars, the cost will have already been incurred, which means the £2m of missing revenue would likely have flowed through to the bottom line, turning a poor quarter into a great one. Barring other unforeseen circumstances, the PBT from these sales will benefit Q3.

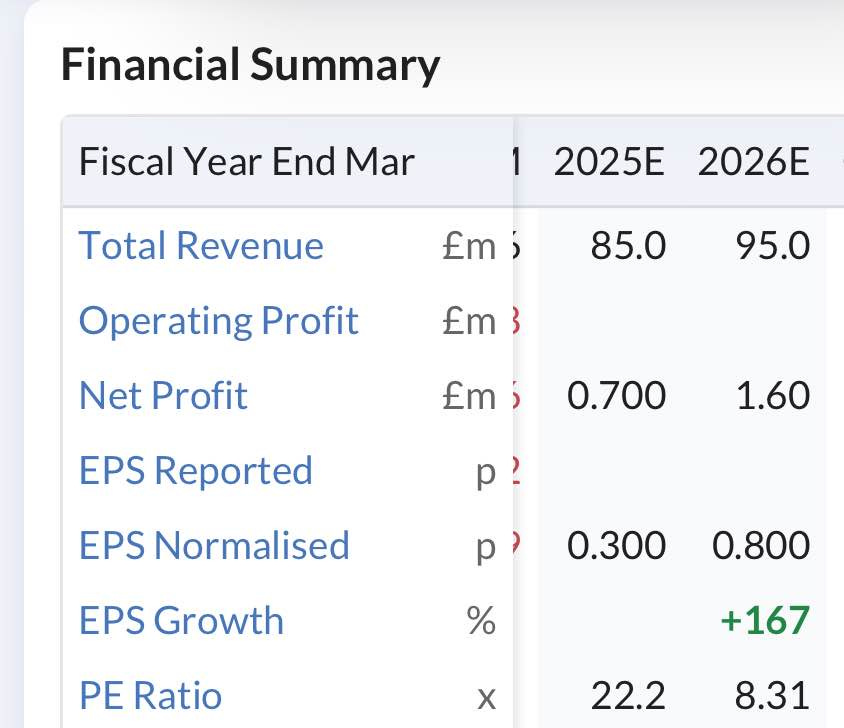

Totally (TLY.L) - Outlook Update

A Friday update called “Outlook Update” is rarely good news, and this is no exception:

Based on the current revenue run rate of the Company, new contract wins and the current new business pipeline the Board now expects the financial performance of FY26 to be at a similar level to that which is expected to be reported for FY25.

So another 0.3p EPS year instead of 0.8p means a 63% miss!

While their business model seems to normally include negative working capital, any miss when the current ratio is 0.5 is bound to put further stress on the balance sheet.

That’s it for this week! Have a great weekend.