Since we have gained a few more new subscribers this week, we’ll repeat what we said last week: For those new to the SCL weekly summary, the following is a summary of the debates we have had this week on our SCL discord server. These are an amalgamation of many viewpoints, and while Mark & Leo are probably the most active, there are other voices in here, too. This means that these views should not be attributed to one person, and indeed, the aim is to provide a balanced opinion (unless something is obviously a poor business on a high rating when we say so.) The aim of these summaries is to encourage knowledgeable investors to join in the debate and generate contrary viewpoints. So, if you disagree, great - come and join the debate on Discord.

Plus, come to Mello Derby and meet up with fellow SCL contributors and hear Mark speak. He is either the headline act or has been given the graveyard slot, depending on how you look at it! We even have a discount code if you need something to sweeten the deal. Use code Simpson50 at https://melloevents.com/mello10tickets/

Creightons (CRL.L) - H1 Trading Update

Revenue is down, but the recent cost-cutting under the new CEO is starting to have a positive effect:

Despite a small reduction in revenue, the Groups' strategy of maintaining a tight control on costs, whilst aligning the overhead cost base with activity levels, has delivered a healthy operating profit for the interim period to 30 September 2024.

Meaning:

The operating profit for the interim period will be in excess of the full year operating profit before exceptionals of £1.5m for the year ended 31 March 2024.

It is unclear whether this half will feature further exceptional, such as redundancy costs or whether they are referring to the prior year. Anyway, there is probably about £150k of finance costs, which would give an (adjusted?) PAT of about £1m for the half year on normalised tax rates. Annualising this gives a 12x P/E, so it is no longer expensive. There is a chance of further gains in H2, but investors need to trust that they can grow the top line again to be worth considering further.

Jadestone (JSE.L) - Operational Update

Confirmation that there are no major problems. However, the Akatara production level has been variable. They say this is normal for new production. However, the market always fears the worst here after what happened at Montara:

During October 2024, average daily Group production was over 22,000 boe/d and for various periods reached a record in excess of c.24,000 boe/d as Akatara intermittently achieved its daily contract quantity rate of c.20mmscf/d. Intermittent production is not unusual for the early stages of a project of this nature as commissioning issues continue to be addressed.

We are not sure why they don’t just narrow the range. Perhaps they want to really lower expectations, and then everyone will be happy when they slightly exceed that. However, if that is the plan, it is not working well at the moment as the share price didn’t like the news.

The CEO bought another £107k of shares this week, having spent £150k a month ago, so he clearly thinks things are on track now.

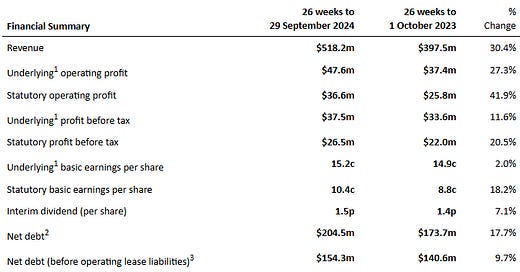

Marks Electrical (MRK.L) - Interim Results

It’s bad news:

significant operational headwinds brought about by changing our supply relationships and implementing our new ERP

However, customer satisfaction has been maintained, a new ERP system is now in place, and the transition away from Euronics has been completed. This partly explains the poor performance in pretty much every other respect. Here's the rest of the explanation:

During the Period we saw a significant reduction in average order values (-9%)

As the share price trend has been indicating, they are trading behind prior expectations in every respect and this is a major profits warning:

we now expect to achieve revenue in FY25 of circa £120.0m with EBITDA in excess of £4.0m.

Previous forecasts were £126m and £7m respectively. PBT was £5m so perhaps now is £2m, which probably excludes ERP costs. Cash also looks to be a major miss, with £4.2m burnt in 12 months. Again, much of this is likely related to the ERP system. Canaccord makes multi-year cuts to EPS - 2024 down from 3.5p to 1.5p, 2025 from 3.8p to 1.9p. Cash only recovers to FY3/2024 levels in FY2026, a miss of £5m.

So they have three problems:

1) ERP system replacement. We've never seen one of these go well, and so this has been a red flag ever since it was first announced; nonetheless, this should be categorised as my own goal. Some effects spillled over into October, but they imply it is working now. Cash will take a while to recover.

2) Departure from Euronics buying group. They claim they decided to leave of their own accord, and it isn't clear whether disruption was inevitable, so again an own goal.

3) Lower average order values. This is outside of their control, being more about the marketplace and possibly a function of growth, so much more of a concern.

The major ongoing problem they are left with is:

During the Period we saw a significant reduction in average order values (-9%) as demonstrated by our volume growth outstripping the pace of our revenue growth. Whilst this is positive from a customer acquisition and market share perspective, it means that distribution costs represent a higher proportion of revenue, which ultimately has a detrimental impact on profit margin and unit economics, given the relatively fixed cost of delivery.

And their proposed solution is:

Going forward, we will actively return to our historically successful premium focus in order to deliver an uplift in margin performance. We recognise this may have medium-term implications on the speed of our revenue growth, but our objective is to drive a sustainable margin recovery from the levels seen in H1-25.

So basically, the new cohort of customers gained in recent years is less affluent, they order lower-value items, and so, even on the same product margins, they are considerably less profitable. That does not mean that none of the new customers obtained in the last few years are desirable, though. They have significantly increased geographical reach (although whether the need to retrench slightly here is a good question) and public awareness since they came to market. Guidance is still for YoY revenue growth going forward (whether they would be better halting growth entirely is another question), it is "just" a matter of being more discriminating about which customers they target. Until recently, their direct online competitor had a deliberate policy of losing money on every sale, yet Marks still profitably grew.

There will be a limit to the market share they can obtain with their premium model, but I think ample runway remains and there is every reason to be optimistic of recovery on an 18 month view. However, with a 26x forward P/E, it seems that this is in the price and more.

We were surprised that this only fell 15% in response to this update; 50% would have seemed a more reasonable response.

S&U (SUS.L) - Update on Advantage Finance

Lots of uncertainty here:

S&U, the specialist motor and property financier, today notes the recent Court of Appeal decisions on Johnson and Wrench v Firstrand Bank Limited and Hopcraft v Close Brothers Limited, the implications of which it is considering. These decisions provide guidance for lower courts on the subject of commissions disclosure in the financial services industry. They unexpectedly overturned hitherto received judicial positions on the duties of motor dealers, credit brokers and lenders to disclose and obtain consent for the payment of commission. The Group also notes the intention of those companies to appeal those decisions to the UK Supreme Court.

While S&U never paid commissions linked to interest rates, whichis te initial complaint. They note:

In the meantime, S&U notes that these decisions do not specifically relate to 'difference in charges' models of commission (currently the subject of an FCA review) in which Advantage Finance has never been engaged.

This means that they may be drawn into having to pay compensation, even if they didn't use the interest-rate-based commission model that was the initial problem. S&U seem like the good guys in this sector, but it seems that the ruling is so wide it may well bring them in scope for compensation. This seems a major misstep for everyone involved, but as investors, we have to play the hand we are dealt, not the hand we’d like to have, and so far, it seems impossible to estimate either this size or the likelihood of any compensation claims that may end up here.

TT Electronics (TTG.L)/Volex (VLX.L) - Trading, Results & Offer for TT

Annoyingly for Mark, TT Electronics was next on his list for looking into in detail, having gradually worked its way up his watchlist as the price fell. Unsurprisingly, the shares are up between 30-40% on the news that Volex made two cash and shares offers to the board that were rejected.

Perhaps the sign that he should have paid more attention was that the share price went up on Thursday after a trading update that said:

As a result of continued subdued demand in the North American components market and the operational improvement plans only benefiting financial results from 2025, the Board expects FY24 adjusted operating profit to be at the lower end of our previously stated range of £37m-42m. FY24 leverage guidance is unchanged and is expected to be around or marginally above the top end of our stated target range of 1-2x.

And the CFO fell on his sword.

Volex is offering a decent premium, it seems, but far less than where TT were trading recently. This looks like a dead duck, as TT eventually said:

The TT Electronics Board also announces that it has recently received and rejected an all-cash indicative proposal from another party at a significantly higher value than the Volex Proposal. There are no ongoing discussions with this party.

Volex appeared to fall about 15% in response, which seems harsh given that the deal looks dead bit even if it wasn’t is a decent strategic deal. It may be that the market thinks they may be daft and up the offer, or simply it didn’t like the Results also released on Friday.

Revenue is up, but EPS far less so:

The outlook is strong:

· Trading in early H2 is encouraging, continuing H1's momentum, while recognising that second half comparatives are tougher

· Board reiterates confidence in the Group's ability to meet full-year expectations as well as achieve our five-year plan targets

And the stock seems reasonably priced given its history of growth via acquisition if you believe the forecasts. There seems a lot to do in H2 to hit these, though. Howevr, they have been investing strongly during this period so any organic sales growth will drop to the bottom line. In light of this, the drop seems a bit overdone.

Zytronic (ZYT.L) - Conclusion of Strategic Review

Having thoroughly evaluated the options set out in the Strategic Review Announcement in consultation with its shareholders, the Board of Zytronic will now seek a sale and / or wind down of the group assets (the "Process") to make a return to shareholders through a solvent liquidation of the Company. The appropriateness of this decision has been reinforced by continuing weakness in trading conditions with no material uplift in order intake.

Solvent liquidation always seemed the best option at this point. They are trying to sell the business as a trading entity. If it happens, it may well enhance returns, but it almost certainly would be at a big discount to NTAV. However, that is better than a slow wind-down of the business with the cost of job losses while still having to meet any contractual obligations for delivery or, we assume, pay penalty clauses.

In coming weeks, FRP Advisory will, as part of the Process, prepare an outcome report providing an estimate of realisable value available to shareholders.

It is not 100% clear whether that equates to, e.g., before or after Christmas and whether it will be published straight away. The risks then become the time value of the money and if any delisting is in the process, when that happens and if shareholders are able to hold or become forced sellers in the market, so it may be worth keeping an eye on this even if it is all over as a business.

That’s it for this week. Have a great weekend!